– by New Deal democrat The monthly personal income and spending report is now the most important report of all, except for jobs. That’s becuase it tells us so much about the state of the consumer economy. It is the raw material for several important coincident indicators that the NBER looks at, as well as several leading indicators on the spending side. To the numbers: in July nominal personal income rose 0.3%, and spending rose 0.5%. Since PCE inflation rose 0.2%, real income rounded to an increase of 0.2% and real spending to 0.4%: Since spending on services tends to rise even during recessions, the more important component to focus on is real spending on goods. This rose 0.7% to a new all-time high. Real spending on services also

Topics:

NewDealdemocrat considers the following as important: personal income and spending, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

– by New Deal democrat

The monthly personal income and spending report is now the most important report of all, except for jobs. That’s becuase it tells us so much about the state of the consumer economy. It is the raw material for several important coincident indicators that the NBER looks at, as well as several leading indicators on the spending side.

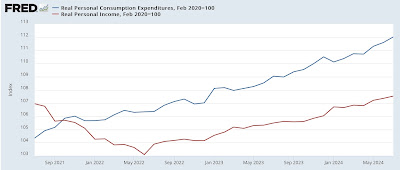

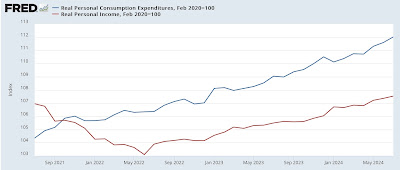

To the numbers: in July nominal personal income rose 0.3%, and spending rose 0.5%. Since PCE inflation rose 0.2%, real income rounded to an increase of 0.2% and real spending to 0.4%:

Since spending on services tends to rise even during recessions, the more important component to focus on is real spending on goods. This rose 0.7% to a new all-time high. Real spending on services also increased 0.2% to an all-time high as well:

Prof. Edward Leamer’s business cycle model indicates that spending on durable goods tends to peak first, before nondurable or consumer goods. In fact both rose in real terms, by 1.7% and 0.2% for the month, respectively:

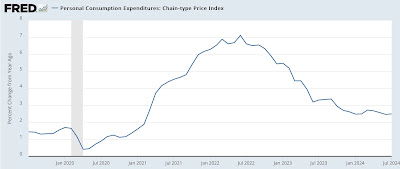

As indicated above, PCE inflation was relatively tame, at +0.2%. On a YoY basis, PCE inflation is 2.5%:

While this measure appears to have stopped declining YoY, it has been stable only slightly higher than the Fed’s target.

If there is a fly in the ointment, it is that the personal saving rate declined another 0.2%, to 2.9%. This is the lowest post-pandemic rate of saving except for the month of June 2022, and is lower than at any other point since the turn of the Millennium except for the 2005-07 timeframe, as shown in the below graph which norms the current rate to zero:

The positive of this number is that it indicates increasing consumer confidence. The negative of this number is that consumers are very vulnerable to any adverse shock.

Finally, as indicated above this report goes into the calculation of two important coincident indicators. The first is real personal income less government transfer payments. This rose 0.2% to another all-time record:

Second, with the usual one month delay, real manufacturing and trade sales rose sharply, by 0.4%, also to their highest level ever excluding last December:

In short, this was an excellent report, with all of the important leading and coincident metrics increasing to records or near-records. It is indicative of a healthy economy both now and for the immediate future. As indicated above, the only fly in the ointment is that the very low savings rate is leaving consumers vulnerable to any future financial shock (of which there is no present sign).