– by New Deal democrat As usual, the month starts out with important data on manufacturing and construction. There was bad news and good news. The bad news is that both were negative. The relatively good news is that they were so slightly negative as to be essentially flat. First, the ISM report on manufacturing declined very slightly – by -0.2 – further to 48.5. This is the third month in a row that this index has been under the equipoise point of 50. On the other hand, the more leading new orders subindex recovered by 3.9 from last month’s dismal 45.4 to 49.3: While this is a mildly negative report, manufacturing has not been nearly so important in the Millennium as it was in the post-WW2 period, so negative readings, unless *very*

Topics:

NewDealdemocrat considers the following as important: US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

– by New Deal democrat

As usual, the month starts out with important data on manufacturing and construction. There was bad news and good news. The bad news is that both were negative. The relatively good news is that they were so slightly negative as to be essentially flat.

First, the ISM report on manufacturing declined very slightly – by -0.2 – further to 48.5. This is the third month in a row that this index has been under the equipoise point of 50. On the other hand, the more leading new orders subindex recovered by 3.9 from last month’s dismal 45.4 to 49.3:

While this is a mildly negative report, manufacturing has not been nearly so important in the Millennium as it was in the post-WW2 period, so negative readings, unless *very* poor, normally have still not meant recession. For the last 20 years the weighted average of the manufacturing (at 25%) and non-manufacturing (at 75%) indexes have been much better correlated with expansion vs. contraction. Last month the ISM non-manufacturing index came in at 53.8, and its new orders component at 54.1. Similar readings for June would mean continued overall expansion.

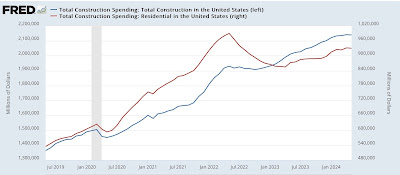

Turning to construction, total nominal spending declined -0.1% in May, but is higher 6.4% YoY. The more leading residential sector also showed a -0.2% decline, and is higher by 6.6% YoY:

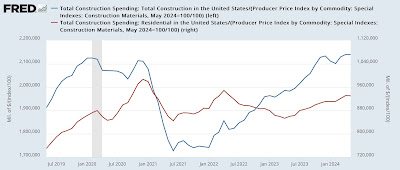

Since producer prices for construction materials declined -0.1% in May and are down -1.4% YoY, the “real” residential construction numbers are unchanged for total construction and less than -0.1% negative for residential construction spending:

Finally, the Inflation Reduction Act, which conferred favorable tax benefits for “restoring,” led to a sharp increase in manufacturing construction spending, which rose another 1.3% for the month to another new record, and accelerated to 20.3% higher YoY:

To reiterate my big theme for this year: I am especially concentrating on these two leading sectors to tell us whether we are having a continued “soft landing” or not. That both sectors are now tilting to negative (construction had been holding up until recently) is definitely not good. But the negative numbers are so slight that they do not even merit a yellow caution flag yet.

May new manufacturing orders slide, truck sales rise, construction spending close to unchanged, Angry Bear by New Deal Democrat