– by New Deal democrat I figured this month I would report on new and existing home sales at the same time, since they have been reported only one day apart. I have been looking for a rebalancing of the market between the two, which means *relatively* more existing vs. new home sales, firming in new home vs. existing home prices, and more inventory growth in existing homes vs. new homes. To cut to the chase, it looks like that rebalancing is beginning to happen. With that in mind, let’s check the data. Let me start by reiterating the big picture: mortgage rates lead sales, which in turn lead prices. Further, new home sales are the most leading of all housing metrics, but they are noisy and heavily revised. The much less noisy single family

Topics:

NewDealdemocrat considers the following as important: Home Sales, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

– by New Deal democrat

I figured this month I would report on new and existing home sales at the same time, since they have been reported only one day apart. I have been looking for a rebalancing of the market between the two, which means *relatively* more existing vs. new home sales, firming in new home vs. existing home prices, and more inventory growth in existing homes vs. new homes.

To cut to the chase, it looks like that rebalancing is beginning to happen. With that in mind, let’s check the data.

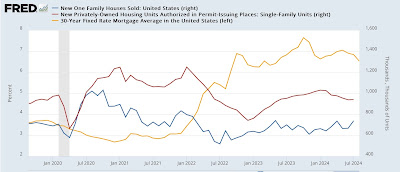

Let me start by reiterating the big picture: mortgage rates lead sales, which in turn lead prices. Further, new home sales are the most leading of all housing metrics, but they are noisy and heavily revised. The much less noisy single family permits lag them slightly.

Mortgage rates declined to near 12 month lows in July (gold in the graph below), and unsurprisingly, new home sales (blue) increased. In fact they increased to the highest level in 2.5 years with the exception of one month. If this holds up after revisions, it bodes well for an increase in single family permits (red), which are much less noisy, but typically slightly lag sales, in the next few months as well:

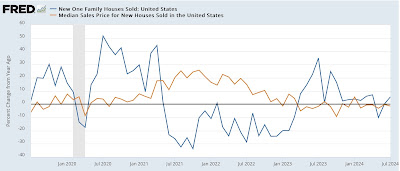

Meanwhile prices (brown in the graph below), which are not seasonally adjusted, were increased 3.1% m/m, but more importantly declined -1.4% YoY. Prices of new homes have been behaving well recently, being down YoY in all but 3 of the last 15 months (vs. sales, blue, YoY):

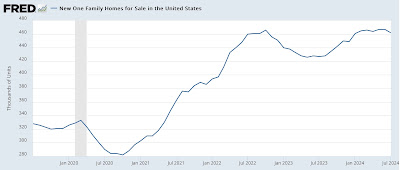

And inventory has very likely peaked, as it has been generally flat for the past half a year, and was down 1% in July:

In short, for new home sales, lower mortgage rates have worked their typical magic, increasing sales and putting a lid on inventory, while prices have slowly moderating from their extreme levels of several years ago.

Turning to existing home sales, which are about 90% of the total market, yesterday they too increased slightly, and remain within the range they have been in for the past 18 months. Lower mortgage rates will likely cause further increases in this metric in the next month or two:

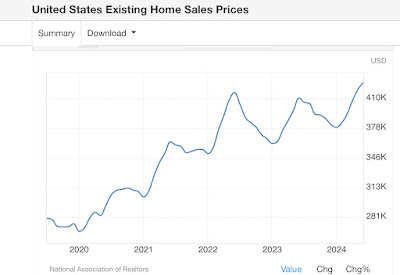

Prices here have also moderated, relatively speaking. They were higher YoY by 4.2%, but down from their peak of 5.4% in April. Here’s what their non-seasonally adjusted trajectory looks like for the past five years:

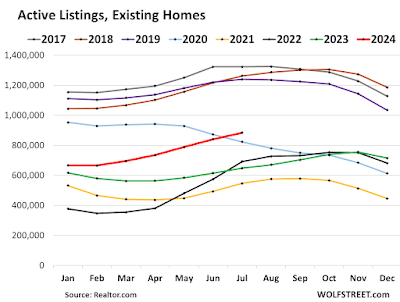

Meanwhile, inventory has made substantial progress towards normalization in the last several months, as shown in this graph cribbed from WolfStreet:

Last month II summed up new home sales by writing that “I expect existing home inventory to continue to rise sharply until prices stop rising faster than prices for new homes. Meanwhile sales for both will continue their existing flat to slowly decreasing trend until mortgage rates are significantly lower.”

And for existing home sales I wrote, “What we are looking for is rebalancing in the housing market. For that to happen, we want the inventory of existing homes to increase, prices to stabilize, and sales to gradually pick up.”

In July, with lower mortgage rates, the trend in new home sales broke, and existing home sales will likely shortly follow. Inventory of existing homes has indeed continued to rise significantly, especially in comparison to flat to slightly declining inventory of new homes. Price increases in existing homes have moderated somewhat, but need to go much further before the normal balance with new home sales is restored.

We still have a long way to go, but the rebalancing is underway.

The Bonddad Blog

Repeat home sales were benign in May, forecast continued downtrend in shelter CPI in months ahead, Angry Bear, by New Deal democrat