– by New Deal democrat We finished housing data for the month with this morning’s report on new single family home sales and prices. As I usually point out, new home sales are the most leading of the housing construction metrics, but they are noisy and heavily revised. That was true again in May. Sales (blue in the second graph below) declined -11.3% m/m to 619,000 annualized, after April was revised sharply higher by +64,000 to 698,000. As usual: very noisy, big revision. Two months ago I wrote that “because mortgage rates have risen somewhat in the past few months (from 6.67% to 7.10%, I expect this range in new home sales to continue, with a slight downward bias in the immediate months ahead.” That is what happened in both April a May.

Topics:

NewDealdemocrat considers the following as important: Homes, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

– by New Deal democrat

We finished housing data for the month with this morning’s report on new single family home sales and prices. As I usually point out, new home sales are the most leading of the housing construction metrics, but they are noisy and heavily revised.

That was true again in May. Sales (blue in the second graph below) declined -11.3% m/m to 619,000 annualized, after April was revised sharply higher by +64,000 to 698,000. As usual: very noisy, big revision.

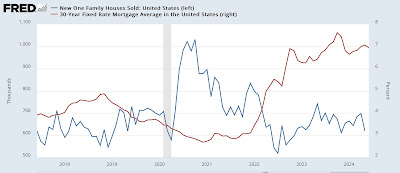

Two months ago I wrote that “because mortgage rates have risen somewhat in the past few months (from 6.67% to 7.10%, I expect this range in new home sales to continue, with a slight downward bias in the immediate months ahead.” That is what happened in both April a May. Mortgage rates (red in the graph below, right scale) remain elevated compared with earlier this year, so downward pressure will continue to be placed on new home sales and construction:

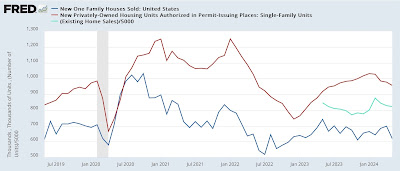

As the five year graph below shows, beginning in 2023 sales have stabilized in the 650,000 +/-50,000 range, but with a slight downward bias. For comparison I also include the much less noisy, but slightly less leading single family housing permits (red), which as anticipated have started to follow sales down from their peak, and the last year of existing home sales (light blue; all that FRED is allowed to reference), which have followed a similar trajectory:

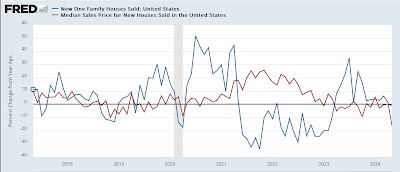

As I always point out, prices follow sales, and that has continued to be the case as well. The median price of a new home in May was $417,400, near the bottom end the range it has established since at least February 2023:

For the past half year, YoY prices have been within unchanged +/-1.0%. Taking into account inflation, this is about what we would expect from the downward YoY sales record of 2022. If anything, I would expect YoY prices to increase over the next few months.

Finally, let’s wrap this into my overall worldview of the US economy in 2023, in which I am watching for signs of any simultaneous downturn in manufacturing and construction, which would be the short term harbinger that a recession rather than a soft landing is in the works.

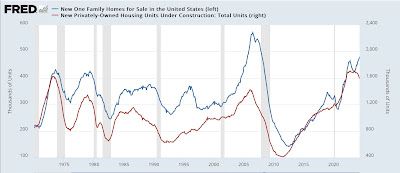

Although I’ll spare your the graph this month, in addition to new home *sales*, this report also includes the metric of “new homes for sale;” and the former has always led the latter. Further, last month I noted that, with only one exception (the 1981 “double-dip” recession), housing units under construction have always led new homes for sale, by varying time frames but most usually the peak in the former has led the peak in the latter by about 6 months. And new homes for sale have *always* also turned down before a recession, at least by 3 months (1970 and 1973) but usually by a significantly longer period of time.

In fact, with the exception of the 1970 recession, they have always turned negative YoY shortly before a recession has begun (again, I’ll spare you the graph).

Well, in May, new homes for sale (blue in the graph below) increased to a new 15 year high of 481,000:

While building units under construction (red) have turned down decisively, new homes for sale most definitely have not. This is evidence that no recession is in the offing in the immediate future.

New home sales and YoY prices change little; expect sideways trend to follow similar recent trend in mortgage rates, Angry Bear, by New Deal democrat