WEDNESDAY, FEBRUARY 21, 2024 Perceptions of inflation vs. wage growth: why the divergence? – by New Deal democrat My recent travels included visits to cousins and their children on both sides of my family. Without any prompting from me, inevitably the table talk turned to the state of the economy. Rather than Bigfoot the opinions of my relatives, I decided to sit back and listen until they were all done before I weighed in. The most important thing I learned by far is that inflation remains the #1 topic across the board. Nobody seemed to think that incomes were keeping up. There was skepticism even after I pointed to the relative better performance of average hourly wages in the past three years vs. inflation, and even after comparing

Topics:

NewDealdemocrat considers the following as important: February 2024, inflation vs. wage growth, Journalism, politics, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

WEDNESDAY, FEBRUARY 21, 2024

Perceptions of inflation vs. wage growth: why the divergence?

– by New Deal democrat

My recent travels included visits to cousins and their children on both sides of my family. Without any prompting from me, inevitably the table talk turned to the state of the economy.

Rather than Bigfoot the opinions of my relatives, I decided to sit back and listen until they were all done before I weighed in.

The most important thing I learned by far is that inflation remains the #1 topic across the board. Nobody seemed to think that incomes were keeping up. There was skepticism even after I pointed to the relative better performance of average hourly wages in the past three years vs. inflation, and even after comparing their best guesses for things like eggs with the actual data.

Although we’ve seen improvement recently across measures of consumer confidence, I suspect there are two reasons for the persistence in the beliefs that inflation has made people in general worse off.

The first goes back to a principle of psychology: to be more effective, reinforcement has to be more frequent and more recent. When it comes to prices and incomes, prices of things like gas and groceries encounters are almost every day. Thus, there is constant reinforcement of that data. But paychecks (and social security payments for retired people) are typically only received biweekly or even monthly, and they typically don’t increase except for once a year. Thus, the reinforcement of the price data is far more powerful than the reinforcement of income data. There’s also the fact that “job switchers” have received much bigger pay increases than “job stayers.” For people in stable careers – who are much more likely to be job stayers – it’s entirely likely that a large minority at least have not received pay increases that have equaled inflation over the past three years.

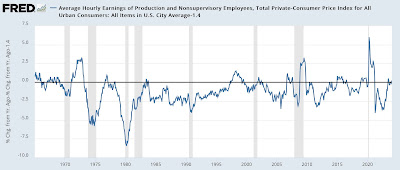

The second issue is that real median household income might not have followed the positive trajectory of real hourly wages. The former have averaged being up 1.4% YoY for the past half a year, which historically is very good improvement (note: graph subtracts -1.4% from values to show current average at the zero line for easier comparison):

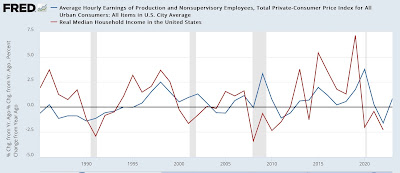

But here is the comparison of the annual changes in real average hourly wages (blue) with real median household income (red):

Through 2022, hourly wages (annually) and median income were both significantly below their pre-pandemic levels. Partly this is due to the fact that, even with better wages, the number of jobs still had not recovered to their pre-pandemic level until the middle of 2022. It is only when we measure more currently – only available in the wage series until this coming September- that we see an increase.

In my opinion, the very delayed, and only annual update, in real median household income is one of the biggest shortfalls in the official government data. As shown above, real median household income for 2022 was only reported five months ago, and we’re already in 2024!

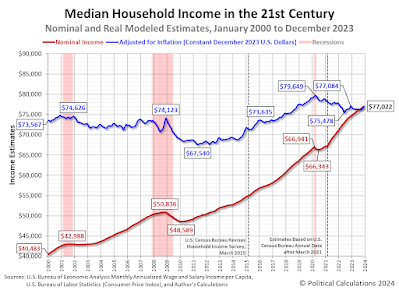

Over the years there have been several private economic firms who have used data from the monthly Household survey to provide estimates of monthly changes in real household income. For example, Ironman at the Political Calculations blog has done this for more than 15 years. Here’s his most recent update:

But while annual real median household income, as measured officially, rose over 14% between 2007 and 2019, Ironman’s calculations only show an increase of less than 5% for the same period.

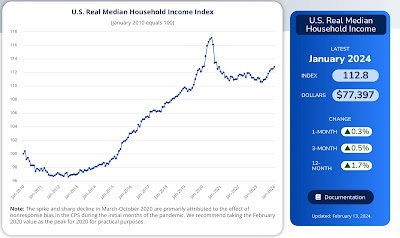

Recently, he has begun linking to another estimate by Motio Research, which appears to track the official government series far more closely, but is also updated monthly. Here’s their data through January 2024:

Note that until the middle of last year, real median household income had fallen back to 2019 levels. It is only in the past 6 months that it has risen sharply again, better than all levels except for those months during the pandemic where income included government stimulus payments.

If real median household income’s recent gains remain intact, or even improve further, I would expect the popular impressions of the relative impacts of wages and incomes vs. inflation to improve in the coming months as well.