Producer prices remain tame – by New Deal democrat Producer prices for final demand (blue) rose 0.1% in July, while upstream raw commodity prices (red) rose 0.7%, close to their highest monthly increases in the past two years: In the larger pre-pandemic scheme of things, the one month rise in commodity prices is not a matter of concern at this point. On a YoY basis, final demand producer prices are up 2.2%, while raw commodity prices are up 1.5%: Like all other prices except for imputed shelter costs, this is well within the Fed’s target range. We’ll see how this pans out for consumer prices tomorrow. The Bonddad Blog “April producer prices reflect some building pressure from a strong economy with full employment,” Angry

Topics:

NewDealdemocrat considers the following as important: prices increase, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Producer prices remain tame

– by New Deal democrat

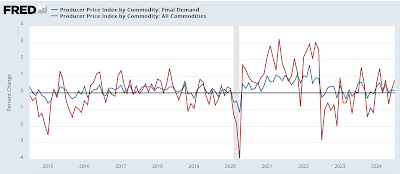

Producer prices for final demand (blue) rose 0.1% in July, while upstream raw commodity prices (red) rose 0.7%, close to their highest monthly increases in the past two years:

In the larger pre-pandemic scheme of things, the one month rise in commodity prices is not a matter of concern at this point.

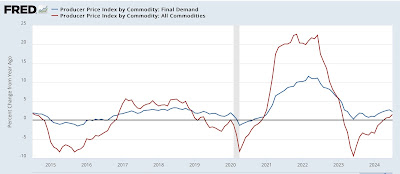

On a YoY basis, final demand producer prices are up 2.2%, while raw commodity prices are up 1.5%:

Like all other prices except for imputed shelter costs, this is well within the Fed’s target range. We’ll see how this pans out for consumer prices tomorrow.

“April producer prices reflect some building pressure from a strong economy with full employment,” Angry Bear by New Deal democrat