Real incomes and Presidential approval: most measures did not surpass pre-pandemic levels until 2023, or this year! – by New Deal democrat This post is somewhat of a follow-up to one I wrote two weeks ago, about perceptions of income vs. inflation, as well as following up on yesterday’s post considering the electoral implications of the current economy. It’s a truism – if certainly an oversimplification – that people vote their pocketbook. Real incomes are thought by some analysts to be an important determinant of that behavior. But, alas, there’s no one way to measure real income. Back 10 years ago, I occasionally used to track 4 of them. Adding real median household income, there’s five. So let’s take a look at the entire pack.

Topics:

NewDealdemocrat considers the following as important: income, Infllation, politics, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Real incomes and Presidential approval: most measures did not surpass pre-pandemic levels until 2023, or this year!

– by New Deal democrat

This post is somewhat of a follow-up to one I wrote two weeks ago, about perceptions of income vs. inflation, as well as following up on yesterday’s post considering the electoral implications of the current economy.

It’s a truism – if certainly an oversimplification – that people vote their pocketbook. Real incomes are thought by some analysts to be an important determinant of that behavior. But, alas, there’s no one way to measure real income. Back 10 years ago, I occasionally used to track 4 of them. Adding real median household income, there’s five.

So let’s take a look at the entire pack.

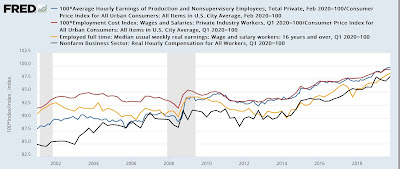

First off below is an update of all 4 measures of real income I tracked 10 years ago: real nonsupervisory hourly wages, the employment cost index, median real weekly income, and real compensation per hour. Here is the historical look since the turn of the Millennium up until the pandemic, normed to 100 as of just before the pandemic:

The first three tell similar stories. They were generally stagnant during the George W. Bush Administration’s expansion. When gas prices fell below $1.50/gallon late in the Great Recession, there was a brief small spike, followed by a decline for several years thereafter. Finally, beginning in 2013 when the unemployment rate fell below about 7%, real wages rose consistently until the pandemic hit.

The fourth series, real business compensation, is subject to compositional issues. As higher paid professions pulled away from nonsupervisory, non-professional jobs, their pay increased more than the lower tiers of job holders. As a result, their real pay increased significantly during the Bush Administration, and declined only slightly after the Great Recession.

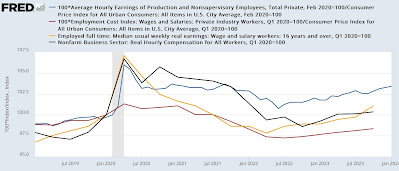

Now here is the update for the past five years:

Once again, the compositional effects of the pandemic stand out. Recall that lower paid services workers, especially in leisure and hospitality, were especially hard hit by pandemic related layoffs. This shows up in the surge in real hourly compensation, and to a lesser extent in real average hourly wages, and median real weekly earnings.

By contrast, the employment cost index tracks pay for the same mix of job categories, so is not subject to the same compositional issues.

Further, note that all four show the effects of the spike in gas prices surrounding Russia’s invasion of Ukraine, and the subsequent undoing of that spike.

But what really stands out is that, except for real average hourly wages, the other three measures of real job income fell below their pre-pandemic levels and stayed there at least into 2023. Real hourly compensation of all workers finally rose above its February 2020 level in the 2nd quarter of 2023 (and most recently is up 1.1%), and real median weekly earnings not until the 4th quarter (up only 0.4%). The employment cost index in real terms is *still* below its pre-pandemic level (by -1.6%).

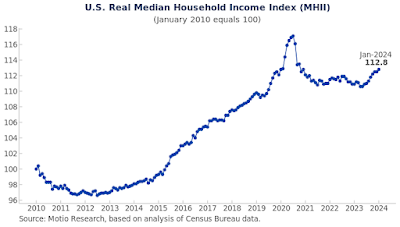

Finally, let’s compare with real median household income. Recall from my post two weeks ago that Motio Research has a method for calculating and updating this monthly, rather than having to wait for the annual update in September of the following year. Here’s their most recent graph through January:

Since then they have published an essay on their methods and the current status of their metric. Most importantly they say:

The spike and sharp decline in March-October 2020 are primarily attributed to the effect of nonresponse bias in the CPS during the initial months of the pandemic [due to n]onresponse bias … [of] lower-income households . . . . We recommend taking the February 2020 value as the peak for 2020 for practical purposes.

. . . . The index reached a post-Covid minimum value in April-May 2023 and has shown renewed strength since June 2023. With a value of 112.8 in January 2024, the index is approaching the pre-Covid peak of 112.9 observed almost four years ago, in February 2020.

As I noted in my post two weeks ago, this is a powerful explanation for the poor approval ratings of President Biden. By most measures, the median household was worse off following the pandemic up until late last year, and by some measures ever so slightly even now.

Because the short leading indicators continue to suggest improvement in the economy in the months ahead, I do expect real income measures to further improve as well. Once households feel that improvement, Biden’s approval rating, and his standing in the polls, should improve as well.

Perceptions of inflation vs. wage growth: why the divergence? Angry Bear, by New Deal democrat