– by New Deal democrat On Friday I highlighted the sharp positive revision to the personal saving rate. That was a byproduct of a similar sharply higher revision to real personal income over the past two years. Here is what those revisions, to real personal disposable income, look like: Instead of being up 6.8% since just before the pandemic, real disposable income is up 10.6%. A historical look at the most salient economic indicators for the success or failure of the Presidential candidate for the incumbent party over a decade again by James Surowiecki concluded that growth in real disposable personal income, especially during the election year, was the single most important factor. Nate Silver (I know, I know) has an “economic

Topics:

NewDealdemocrat considers the following as important: 2024, 3rd QTR, NowCast, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

– by New Deal democrat

On Friday I highlighted the sharp positive revision to the personal saving rate.

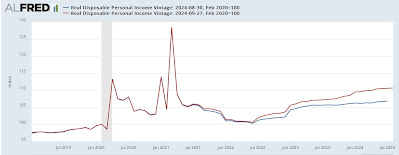

That was a byproduct of a similar sharply higher revision to real personal income over the past two years. Here is what those revisions, to real personal disposable income, look like:

Instead of being up 6.8% since just before the pandemic, real disposable income is up 10.6%.

A historical look at the most salient economic indicators for the success or failure of the Presidential candidate for the incumbent party over a decade again by James Surowiecki concluded that growth in real disposable personal income, especially during the election year, was the single most important factor. Nate Silver (I know, I know) has an “economic fundamentals” model based on a similar review, which also includes real disposable personal income. Up until Friday, it had shown that indicator was the worst variable for Harris.

Well, here’s what it looks like after Friday’s revisions:

Although the big inflationary episode of 2021-22 – including the record surge in house prices and thereafter mortgage rates – remains in the forefront of people’s minds, the current state of the economy is very favorable for the incumbent candidate.

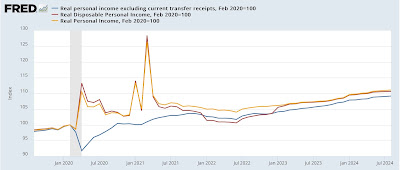

It’s also worthwhile to emphasize yet again how bid an impact the 2020 and 2021 pandemic stimulus packages had on people’s budgets, enabling them to get through the periods of lockdown and restrictions, by comparing real personal income *including* the stimulus payments (red and gold in the graph below) vs. *without* those payments (blue):

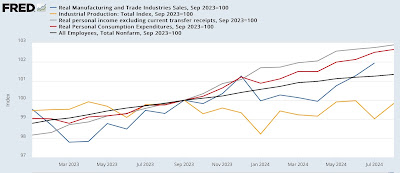

Finally, here is the latest update in the “nowcast” of the economy, showing real income (less government transfers), real sales, real spending, industrial production, and jobs:

With the exception of industrial production, which has not made any progress in the quarter century since trade with China was normalized, all of the other coincident measures of the economy are undeniably positive.

Leading Indicators Continue to Improve – Angry Bear, by New Deal democrat