A soft landing (disinflation without a recession) looks possible. Also the remaining threat is the FED’s sticking with high interest rates, even though inflation is at a very reasonable level. I personally publicly and will almost certainly decline even if unemployment remains low. The change can be predicted, because the US index includes owner equivalent rent, a price which no one pays which is a calculation of how much homeowners would pay if they rented their houses. Rent in the following year and owner equivalent rent are very predictable, because leases generally have monthly rent in dollars fixed for at least one year. The rent on newly signed leases can be used to predict future average rent — rent is in practice a 12 month moving

Topics:

Robert Waldmann considers the following as important: disinflation and no recession, Education, Hot Topics, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

A soft landing (disinflation without a recession) looks possible. Also the remaining threat is the FED’s sticking with high interest rates, even though inflation is at a very reasonable level. I personally publicly and will almost certainly decline even if unemployment remains low.

The change can be predicted, because the US index includes owner equivalent rent, a price which no one pays which is a calculation of how much homeowners would pay if they rented their houses. Rent in the following year and owner equivalent rent are very predictable, because leases generally have monthly rent in dollars fixed for at least one year. The rent on newly signed leases can be used to predict future average rent — rent is in practice a 12 month moving average of newly signed rental contract rent.

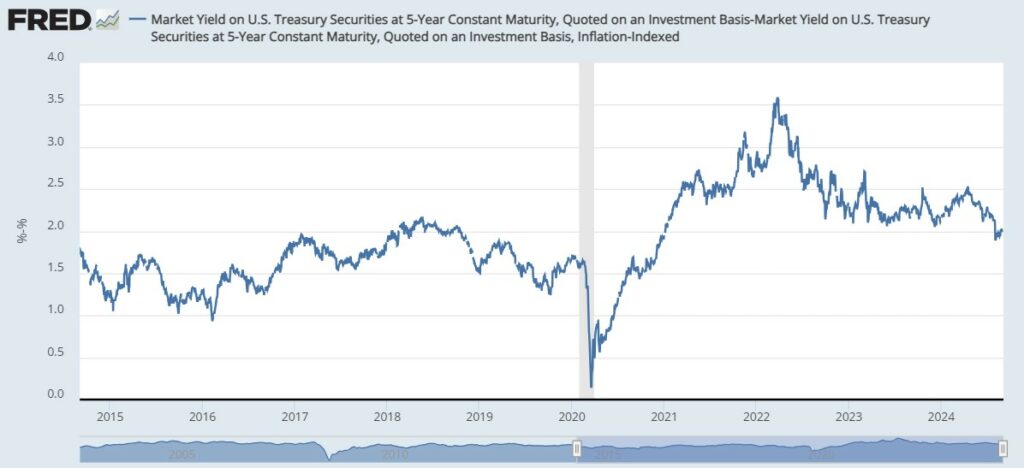

Also median term inflation expectations remained anchored. This is part;y shown by the TIPS breakeven inflation point, the relative price of ordinary nominal treassury bonds and treasury inflation protected securities (TIPS) whose maturity value (and coupons if any) are set as multiples of the CPI.

After a minor increase up to 3.5% the 5-year TIPS breakeven inflation rate declined to the standard (and target) 2%. This corresponds (roughly) to inflation expected by bond traders. Roughly because the value of regular nominal treasuries is increased because they are extremely liquid. Also the expectations which matter are not those of bond traders. But it’s still useful information.

Anchored expectations are confirmed by surveys of median term inflation expectations.

The argument that a soft landing was impossible was, to the extent it was based on economic theory or stylized facts, dependent on the assumption that expected future inflation must be equal to current inflation. Really it was based on recollection of the 70s and early 80s and not earlier episodes.

The more optimistic guess was partly based on the guess that high inflation was strictly due to epidemic related supply chain disruptions and would end when the epidemic ended (or we got used to it , in between people still get Covid but the vaccinated don’t die from it). The truth was somewhere in between with inflation persisting, largely because of rent and the owner occupied equivalent rent given the huge increase in rent with new contracts which slowly hit people whose rent updated after a year.

The contrasting conclusions of paleo Keynesians all based on the Phillips curve reminds us of one of it’s main problems (aside from not fitting data well). The term “expected inflation” does not refer to someting which is itself predicted or even measured very well. The curve is sometimes used to relatte inflation and unemployment (so inflation expectations are assumed to be constant or “anchored”) or to relate the accelration of inflation and unemployment so expected future inflation is assumed to be equal to current inflation. Most paleo Keynesians agree that expectations are sometimes anchored and sometimes de-anchor and then argue if the anchor is about to slip.