The German parliament today, after heated debate, approved the much discussed debt package worth hundreds of billions of euros for defence and infrastructure. With the necessary two-thirds majority, the parliament in Berlin passed a constitutional amendment allowing defence and security expenditures to be exempt from the Schuldenbremse (debt brake). The previously strict debt rules for the federal states will also be relaxed.

Better late than never.

Keynes is alive and kicking!

Articles by Lars Pålsson Syll

Vad historien lär oss

March 18, 2025Vad historien lär oss

Vad det förflutna lär oss är att människan gång på gång ställs inför beslut som är avgörande för framtiden. Genom dessa ställningstaganden sker inriktningen av vårt samhällsbygge. Grunden till vårt välfärdssamhälle har lagts av många människors tålmodiga arbete. I det forna Egypten byggde man pyramiderna. Vi har byggt ett samhälle som — visserligen med kvarstående orättvisor och brister — präglats av solidaritet, gemenskap och ansvar för medmänniskorna. Människan behöver inte vara en lekboll för anonyma ekonomiska lagar eller tekniska krafter. Hon kan själv forma sin framtid. Men det förutsätter att hon känner den verklighet, i vilken hon arbetar och vet vad hon vill. Det är den viktigaste lärdomen som historien ger oss.

Tage

What’s wrong with economics — a primer

March 18, 2025What’s wrong with economics — a primer

This is an important and fundamentally correct critique of the core methodology of economics: individualistic; analytical; ahistorical; asocial; and apolitical. What economics understands is important. What it ignores is, alas, equally important. As Skidelsky, famous as the biographer of Keynes, notes, “to maintain that market competition is a self-sufficient ordering principle is wrong. Markets are embedded in political institutions and moral beliefs.” Economists need to be humbler about what they know and do not know.

Martin Wolf /FT

Mainstream economic theory today is still in the story-telling business whereby economic theorists create mathematical make-believe analogue models of the target system – usually

Read More »Late-winter blessing (personal)

March 15, 2025While enjoying a lovely weekend on our island in the Karlskrona archipelago, my beloved captured this stunning photo of our garden adorned in its late-winter attire. Pure magic!

Read More »Hovern’engan

March 14, 2025.[embedded content]

Read More »Krigskeynesianismens återkomst

March 14, 2025I Sveriges vassaste ekonomipod — Starta pressarna — diskuterades igår socialdemokraternas utspel om att inrätta en ny ‘Totalförsvarsfond’ om minst 250 miljarder kronor som ska göra det möjligt att tidigarelägga investeringar och påskynda utbyggnaden av Sveriges försvar.

På många sätt är detta så klart ett bra förslag — men också lite sorgligt att det skulle till en galen USA president och krigshot för att socialdemokratins ledning skulle ta sitt ‘statsbudgetförnuft’ till fånga. Under intryck av vad man tidigare gjort i Danmark och nyligen i Tyskland visar det sig nu helt plötsligt bli möjligt att glömma tjatet om ‘sunda statsfinanser’ och Göran-Persson-mantrat om att “den som är satt i skuld är icke fri.”

I fjol hade vi en lång debatt om det finanspolitiska ramverket och

Finding Eigenvalues and Eigenvectors (student stuff)

March 14, 2025Finding Eigenvalues and Eigenvectors (student stuff)

.[embedded content]

When applying principal component analysis in econometrics courses we often want to reduce data dimensionality. Eigenvalues and eigenvectors help us do that. In macroeconomics — especially when we use dynamic programming and Bellman equations to solve optimization problems — eigenvalues and eigenvectors help us determine convergence and stability properties. So — good to have at least some basic knowledge of these square matrix concepts.

From one old guy to another old guy

March 12, 2025The pretence-of-knowledge syndrome

March 12, 2025From Lars Syll

What does concern me about my discipline, however, is that its current core — by which I mainly mean the so-called dynamic stochastic general equilibrium approach — has become so mesmerized with its own internal logic that it has begun to confuse the precision it has achieved about its own world with the precision that it has about the real one …

The dynamic stochastic general equilibrium strategy is so attractive, and even plain addictive, because it allows one to generate impulse responses that can be fully described in terms of seemingly scientific statements. The model is an irresistible snake-charmer … So we are left with the tension between a type of answer to which we aspire but that has limited connection with reality (the core) and more sensible but incomplete

Släpp skuldbromsen!

March 12, 2025Den tillträdande tyska förbundskanslern, kristdemokraten Friedrich Merz, har tillsammans med sin tilltänkta koalitionspartner annonserat en uppgörelse om att utnyttja parlamentets två tredjedels majoritet – förutsatt att de får med sig de Gröna – för att släppa på skuldbromsen.

Syftet är att finansiera försvarssatsningar över 1 procent av BNP samt att skapa en infrastrukturfond på svindlande 5000 miljarder euro under tio år. Merz har också föreslagit att EU ska undanta medlemsländernas försvarsinvesteringar från sina budgetregler.

Sverige borde ta intryck av denna tyska omsvängning. Vi är en mindre version av Tyskland i ekonomiskt avseende. Sedan 90-talskrisen har vi haft ett stort bytesbalansöverskott, som i fjol uppgick till knappt 7 procent av BNP. Vi har dessutom haft

Music that heals my soul in troubled times

March 12, 2025Trump — un bouffon sous kétamine

March 9, 2025The pretence-of-knowledge syndrome

March 9, 2025What does concern me about my discipline, however, is that its current core — by which I mainly mean the so-called dynamic stochastic general equilibrium approach — has become so mesmerized with its own internal logic that it has begun to confuse the precision it has achieved about its own world with the precision that it has about the real one …

The dynamic stochastic general equilibrium strategy is so attractive, and even plain addictive, because it allows one to generate impulse responses that can be fully described in terms of seemingly scientific statements. The model is an irresistible snake-charmer … So we are left with the tension between a type of answer to which we aspire but that has limited connection with reality (the core) and more sensible but incomplete

Trying to explain tariff incidence to MAGA supporters

March 8, 2025Vice President JD Vance — a bottom-of-the-barrel choice

March 8, 2025.[embedded content]

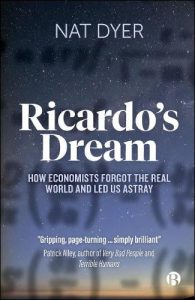

Read More »How economists forgot the real world

March 8, 2025From Lars Syll

The book’s argument is that in straining to peer through the chaos and confusion of the world to the underlying mechanisms, too much economic thinking, both in Ricardo’s day and ours, mistook a small, unrepresentative sample as the whole picture. This has distorted the vision of generations. If your scientific ideal is a simple, logical model, there is a tendency to focus on those parts of reality that are more regular or can be easily counted. The awkward aspects more difficult to capture in formal laws or mathematics the fact that humans are a diverse group of emotional and social primates, for example, or the natural, political, and legal contexts in which markets are born and function— tend to get filtered out, set apart, and eventually forgotten. One

Tyskland lättar på skuldbromsen — och Sverige bör följa efter!

March 7, 2025Tyskland lättar på skuldbromsen — och Sverige bör följa efter!

.[embedded content]

I Tyskland har den så kallade Schuldenbremse (skuldbromsen) varit en central del av den ekonomiska politiken sedan år 2009. Regeln begränsar hur mycket staten får låna, med syftet att hålla den offentliga skulden låg. Kruxet med regeln har dock varit uppenbar — den hindrar nödvändiga investeringar i infrastruktur, grön omställning och välfärd. Sverige har med sitt på senare år starkt ifrågasatta finanspolitiska ramverk haft en liknande tradition av samhällsekonomiskt skadlig ‘budgetdisciplin’. Låt oss hoppas att partierna som stöttat ramverket nu drar lärdom av den tyska debatten och överväger att tydligt lätta på de finanspolitiska restriktionerna för att möta framtidens

How economists forgot the real world

March 7, 2025How economists forgot the real world

The book’s argument is that in straining to peer through the chaos and confusion of the world to the underlying mechanisms, too much economic thinking, both in Ricardo’s day and ours, mistook a small, unrepresentative sample as the whole picture. This has distorted the vision of generations. If your scientific ideal is a simple, logical model, there is a tendency to focus on those parts of reality that are more regular or can be easily counted. The awkward aspects more difficult to capture in formal laws or mathematics the fact that humans are a diverse group of emotional and social primates, for example, or the natural, political, and legal contexts in which markets are born and function— tend to get filtered out,

Read More »The Envelope Theorem (student stuff)

March 6, 2025Trump’s betrayal

March 6, 2025I am in a grim and introspective mood this morning. I have been reflecting on how my father might react to where we are. He was one of those who fought against fascism. His life was shortened by being wounded during that fight. As a result, I never knew him as a healthy person. What, I wonder, would he make of America’s turn away from democracy and towards autocracy? What would he make of the pillaging of Ukraine’s resources as payment for so-called “aid” given by America in the past few years? What would he make of the sudden alliance between America and Russia? And what, most of all, would he make of the abandonment of the essence of the alliances forged back then and by people like him on the front lines? At the very least he would, I think, feel betrayed. Perplexed,

Read More »Karush-Kuhn-Tucker (student stuff)

March 5, 2025.[embedded content]

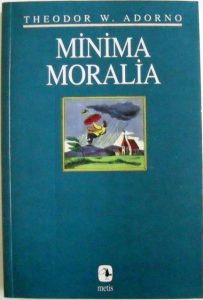

Read More »Truth and knowledge

March 3, 2025The relation of knowledge to power is one not only of servility but of truth. Much knowledge, if out of proportion to the disposition of forces, is invalid, however formally correct it may be.If an émigré doctor says: ‘For me … is a patological case’, his pronouncement may ultimately be confirmed by clinical findings, but its incongruity with the objective calamity visited on the world in the name of that paranoiac renders the diagnosis ridiculous, mere professional preening. Perhaps … is ‘in-himself’ a pathological case, but certainly not ‘for-him’. The vanity and poverty of many of the declarations against … by émigrés is connected with this. People thinking in the forms of free, detached, disinterested appraisal were unable to accommodate with in those forms the

Read More »Best advice to an aspiring economist — don’t be an economist!

February 28, 2025From Lars Syll

A science that fails to reflect on its own history and neglects critical methodological and theoretical questions about its practice is a science in crisis.

As early as 1991, a commission led by Anne Krueger—featuring esteemed economists such as Kenneth Arrow, Edward Leamer, and Joseph Stiglitz—highlighted a fundamental weakness in graduate economics education. Drawing from their own experiences, they observed an alarming disconnect between theoretical and econometric tools and real-world problems. They noted that both students and faculty felt the absence of “facts, institutional information, data, real-world issues, applications, and policy problems.” Their conclusion was stark: graduate programs were producing “a generation with too many idiot savants skilled in

Slava Ukraini!

February 28, 2025Models and evidence in economics

February 27, 2025Models and evidence in economics

Analogue-economy models may picture Galilean thought experiments or they may describe credible worlds. In either case we have a problem in taking lessons from the model to the world. The problem is the venerable one of unrealistic assumptions, exacerbated in economics by the fact that the paucity of economic principles with serious empirical content makes it difficult to do without detailed structural assumptions. But the worry is not just that the assumptions are unrealistic; rather, they are unrealistic in just the wrong way.

Nancy Cartwright

One limitation of economics is the restricted possibility of performing experiments, forcing it to mainly rely on observational studies for knowledge of real-world economies.

Read More »President Trump talking bollocks

February 25, 2025President Trump talking bollocks

.[embedded content]

Confirms — again — what we already knew: Trump is a reckless, untruthful, outrageous, incompetent and undignified buffoon!

Keynes and Knight on uncertainty

February 25, 2025Keynes and Knight on uncertainty

First, Knight and Keynes derive from their different philosophical worldviews distinct definitions of uncertainty. Keynes’s is a wholly epistemic uncertainty concept (see Packard and Clark, 2020), the ignorance of an actor regarding the objective and knowable (a priori) probabilities of future outcomes. Such probabilities are discoverable by learning the underlying ‘probability-relations’ between causes and effects. Scientific efforts mitigate uncertainty by illuminating these probability-relations and by producing ever-increasing evidential weight until each uncertainty is eventually absconded.

Mark D Packard, Per L Bylund, Brent B Clark

An interesting paper that merits a couple of comments.

To understand real-world

Germany’s Hitleresque party

February 24, 2025.[embedded content]

Read More »Solving a simple DP problem (student stuff)

February 23, 2025Solving a simple DP problem (student stuff)

.[embedded content]

In case you want to solve the problem yourself, here’s a Python script yours truly made (assuming the utility function is of the natural log kind and with some explicit numerical parameterization):

import numpy as np

import matplotlib.pyplot as plt

# Parameters

beta = 0.9 # Discount factor

r = 0.1 # Depreciation rate

T = 3 # Time horizon

k0 = 4.0 # Initial capital

# Production function: f(k) = k^0.5

def f(k):

return k**0.5

# Utility function: u(c) = ln(c), ensuring c > 0

def u(c):

return np.log(c) if c > 0 else -np.inf

# Discretize capital grid

k_vals = np.linspace(0.1, 10, 100)

# Initialize value function and policy storage

V = [{} for _ in range(T + 1)]

policy = [{} for

Best advice to an aspiring economist — don’t be an economist!

February 23, 2025Best advice to an aspiring economist — don’t be an economist!

A science that fails to reflect on its own history and neglects critical methodological and theoretical questions about its practice is a science in crisis.

As early as 1991, a commission led by Anne Krueger—featuring esteemed economists such as Kenneth Arrow, Edward Leamer, and Joseph Stiglitz—highlighted a fundamental weakness in graduate economics education. Drawing from their own experiences, they observed an alarming disconnect between theoretical and econometric tools and real-world problems. They noted that both students and faculty felt the absence of “facts, institutional information, data, real-world issues, applications, and policy problems.” Their conclusion was stark: graduate