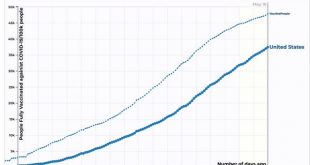

Coronavirus dashboard: entering the home stretch? G*d willing, I will only feel the need to update this information for another month or two. The US is simply making great progress on all fronts, and there are no new outbreaks in any of the States. Close to 40% of the entire US population is totally vaccinated, and almost 50% has received at least one dose: As a result, both cases and deaths are lower than their troughs last summer,...

Read More »Rep. Katie Porter on drug prices

Big Pharma says they need to charge astronomical prices to pay for research and development. Yet, the amount they spend on manipulating the market to enrich shareholders completely eclipses what's spent on R&D. Today, I confronted a CEO about the industry's lies, with visuals ⤵️ pic.twitter.com/c3jSLr0yVd— Rep. Katie Porter (@RepKatiePorter) May 18, 2021 Tags: big pharma, drug prices...

Read More »Equi-realism about carbon pricing and other approaches to global warming favors a failsafe approach to regulation

Unfortunately, carbon pricing does not seem to be on the agenda of either the Biden administration or progressive advocates of an aggressive policy response to climate change. In part this neglect reflects ideological bias against market-based approaches to regulation and in favor of methods that are more direct in their effects. But it also reflects hard-headed political considerations. Carbon pricing is unpopular because it makes energy more...

Read More »The Public Reappearance Of The Israeli-Palestinian Conflict

The Public Reappearance Of The Israeli-Palestinian Conflict Sigh, so much that is so obvious, and so much that is not, but so much that is so sad, especially as there seems to be little real prospect of any serious improvement or settlement on the underlying issues. Indeed, it is probably the case we did not see anything happen for a good 7 years because from the Palestinian side things looked so hopeless in the face of ongoing Israeli expansion...

Read More »Population and the Economy

Hear that China is in trouble with an aging, decreasing population. Headline says that California is in trouble; decreasing population for the first time ever. Years ago now, we heard that Japan was in trouble with an aging, decreasing population. Japan’s doing fine, thank you. And, China and California will both be better off for the decrease. More is not always better. We know where they are coming from with this stuff. They bought into the old...

Read More »Open thread May 18, 2021

Monday Reads on A Tuesday

China successfully lands a rover on the red planet, National Geographic, Andrews The Zhurong rover survived the harrowing “seven minutes of terror,” touching down on a vast plain called Utopia Planitia that may once have been the site of an ancient ocean. Zhurong will search for evidence of water and past habitability on Mars, possibly paving the way for future human missions. China is now only the second country in history to explore the Martian...

Read More »Disposable People Reinstated

Today (Saturday, May 15th) I learned that my EconoSpeak post, “Disposable People” (which has over 2500 views) has been reinstated by Blogger. I never knew it had been removed. If I was a GOP whiner, this would be a prime example of cancel culture in operation. But of course, it’s only an artefact of “moderation that has to rely on algorithms” to identify potential community guidelines violations. ...

Read More »April’s Producer Data

April’s consumer and producer prices, retail sales, and industrial production; March business inventories and JOLTS, Commenter RJS, Market Watch 666 Producer Prices rose 0.6% in April on Higher Wholesale Food Prices, Wider Margins for Transportation Services The seasonally adjusted Producer Price Index (PPI) for final demand rose 0.6% in March, as prices for both finished wholesale goods and margins of final services providers rose 0.6%. That...

Read More »The Eternal Sunshine of Spotless Politics

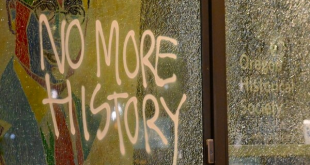

Protesters trashed windows at the Oregon State Historical Society and left this graffiti: Credit: Willamette Weekly Econospeak . . . Tags: econospeak blog

Read More » The Angry Bear

The Angry Bear