“Opioid Overdose Now Provides 1 in 6 Donor Hearts,” Ashley Lyles, MedPage Today Overdose-death donors have accounted for a rapidly growing proportion of cardiac allografts, with a 14-fold increase from about 1% in 2000 to now 16.9%, “consistent with the rising opioid epidemic,” reported Nader Moazami, MD, of New York University Langone Health in New York City, and colleagues in The Annals of Thoracic Surgery. Earlier findings: A total of 1,710 of 15,904...

Read More »May jobs report: this is the kind of report you see at negative inflection points

May jobs report: this is the kind of report you see at negative inflection points HEADLINES: +75,000 jobs added U3 unemployment rate unchanged at 3.6% U6 underemployment rate declined -0.2% from 7.3% to 7.1% (new expansion low) Leading employment indicators of a slowdown or recession I am highlighting these because many leading indicators overall strongly suggest that an employment slowdown is coming. The following more leading numbers in the report...

Read More »CORE and Periphery in the Reform of Econ 101

CORE and Periphery in the Reform of Econ 101 Thanks to Greg Mankiw, I’ve seen a preview of the piece by Sam Bowles and Wendy Carlin that will be published in a forthcoming Journal of Economic Literature. It’s apparently part of a roundtable on the teaching of introductory economics, and not surprisingly Bowles and Carlin focus on the freely downloadable CORE text produced with support from the Institute for New Economic Thinking. The starting point of...

Read More »A Bernie Sanders Narrative for Seniors

A Bernie Sanders Narrative for Seniors What follows is some unsolicited advice for the Sanders campaign. Politico has an important piece on the downside of the extraordinary age bias in Sanders’ support. Like a teeter totter, the large advantage Sanders enjoys among younger voters is counterbalanced by his dismal showing among the older crowd. The article reviews voting breakdowns from the 2016 campaign and current poll results, and it shows that...

Read More »75 Years After The Longest Day

75 Years After The Longest Day Yes, I am watching “The Longest Day” on TMC. Have not seen it for decades, but this 75th anniversary of D-Day seems to be the time to do it. This will be a rambling post all over the place. I note that according to the film, it was German Field Marshall Rommel who is depicted calling it “the longest day,” the day before it happened, seeing it coming. I have been there several times, first in Fall 1953 when I was young...

Read More »A Very Erroneous Chart in the Economic Report of the President

A Very Erroneous Chart in the Economic Report of the President Menzie Chinn has been reading the latest Economic Report of the President and finds a very erroneous and misleading chart, which is figure 1-6 from this this document (see page 45), which states: Equipment investment, in particular, exhibited a pronounced spike in the fourth quarter of 2017, as both the House and Senate versions of the TCJA bill, which were respectively introduced on...

Read More »The slowdown cometh

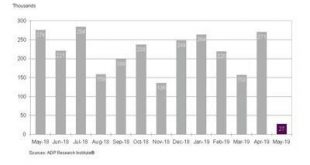

by New Deal democrat The slowdown cometh I submitted a long post on the above to Seeking Alpha. They haven’t put it up yet. When they do, I’ll link to it here. UPDATE: Here’s the link. Long story short: you all know that a year ago I forecast a slowdown by about mid-year this year. Everything except for portions of GDP and jobs has acted in accordance with that forecast. And, judging by this morning’s ADP jobs report for May: the official jobs report...

Read More »Open thread June 7, 2019

“While Considering Medicare For All: Policies For Making Health Care In The United States Better”

Robert Kocher and Donald M. Berwick “While Considering Medicare For All: Policies For Making Health Care In The United States Better,” Health Affairs Dr. Donald Berwick is the former Director of Medicare and Medicaid who talked about waste in Medicare and Doctors knowing such waste exists. “It is unlikely that the United States will move quickly to a full publicly financed health insurance when Congress next considers health policy after the 2020...

Read More »Tariffs and Monetary Policy: Moral Hazard and Rent Seeking

Tariffs and Monetary Policy: Moral Hazard and Rent Seeking President Trump’s threat to impose tariffs on Mexico over immigration has pushed Federal Reserve Chair Jay Powell to say that if the tariffs lead to economic growth slowing, the Fed will cut interest rates. While the bump may be about to end, this announcement was followed by a solid global surge of stock markets on June 4 followed by smaller increases the next day. This sets up a moral...

Read More » The Angry Bear

The Angry Bear