by New Deal democrat Weekly Indicators for May 27 – 31 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. There was a touch of weakening across several timeframes. The economy is just weak enough that continuing trade and tariff tantrums could take a slowdown and do enough damage to make it a downturn. As usual, clicking over and reading should be informative for you, and helps me just a little bit for the effort I put into the work....

Read More »Q1 corporate profits and real gross domestic income

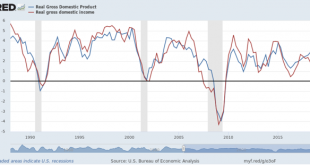

Q1 corporate profits and real gross domestic income Yesterday the second estimate of Q1 GDP came out, which means that corporate profits for Q1 were finally reported. In my post earlier this week at Seeking Alpha, I wrote that corporate profits are of higher forecasting importance because of the contradiction in the signals being sent by the bond market vs. the housing market. So what light do they shed on the forecast for the next 12 months? I wrote a...

Read More »Trump’s Latest Mexican Tariff Tirade Irks Senator Grassley

Trump’s Latest Mexican Tariff Tirade Irks Senator Grassley Senator Grassley rebukes the latest idiocy from the White House: President Trump dropped a trade war bomb on Thursday when he announced his intent to put in place new and harsh tariffs on goods from Mexico until the “illegal Immigration problem is remedied.” And among the many worried, negative reactions was one from Senate Finance Committee Chair Chuck Grassley, in a strongly worded statement....

Read More »Michigan, Do Not Be Fooled – You Just Lost More Than You Got in Return

No Fault Auto Insurance I am active in Michigan politics and many do not like me. The state’s no fault insurance has been a cost burden on many people. There is a lack of transparency in how the fees for the Personal Injury Protection portion of No Fault insurance were calculated, how fees to doctors and hospitals are set, and how much is in the PIP fund. Over the last couple of weeks Republican Senate Leader Mike Shirkey and the Republican House Leader...

Read More »Kiribati is Low But Not as low as Whale Shit at the Bottom of the Ocean

It is possible to cause a huge (short term possibly reversed) increase in carbon capture by algae by dumping iron sulfate in the ocean. On the other hand, uh, well, maybe it won’t work and you will just get a few tons of fish (not many tons of carbon containing detritus on the bottom of the ocean. Now the general principal seems to be that, so long as there isn’t proof beyond reasonable doubt that a proposal will work, to stick to the tried and true and...

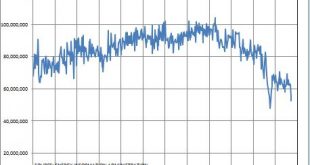

Read More »WHAT IS HAPPENING TO COAL PRODUCTION ?

Does anyone know why coal production is falling out of bed? It is down some 40% from its August level. But coal employment is still near its’ recent peak, which implies that productivity is horrible. I suspect the problem is exports to China. Maybe someone needs to ask Trump about this.

Read More »Open thread May 31, 2019

A Decision Theory Case to Chew On

A Decision Theory Case to Chew On Here’s something I posted over on Andrew Gelman’s wonderful blog: I read Alive and thought it unknowingly made a very powerful point about decision theory, that you always have to balance the risks of action against the risks of inaction. The plane was stuck in snow on a slope that led down to a valley that was partially inhabited. Yes, the immediate survivors could not see this, and sending a party down the slope seemed...

Read More »Resolving the contradiction between the yield curve and housing

by New Deal democrat Resolving the contradiction between the yield curve and housing If you listen to the yield curve, it is screaming “recession!” If you listen to new home sales, they are saying “no worries!” One of them is wrong. For the last couple of weeks, I have been going back over history in an effort to resolve the contradictory signals. One important portion of that work has been to focus on the non-financial leading indicators, and in...

Read More »Will China Play The Rare Earth Card In The Trade War?

Will China Play The Rare Earth Card In The Trade War? The rumor that China might play its “rare earth card” was the rumor today that helped push down both stock and oil markets according to a variety of reports. The trigger for this seems to have been a visit on May 26 by China’s president, Xi Jinping, to a rare earth facility, along with some rumbling statements associated with that visit. They may not do it, but the possibility of blocking exports...

Read More » The Angry Bear

The Angry Bear