Why did the Bank of England intervene in the gilt market this week? The answer that has been doing the rounds is that it was protecting the solvency of pension funds. But this doesn't make sense to me. The Bank doesn't have any mandate to prevent pension funds going bust. And anyway, the type of pension fund that got into trouble isn't at meaningful risk of insolvency. There was never any risk to people's pensions. I don't think the Bank was concerned about pension funds at all. I think it...

Read More »Analyst Frances Coppola Talks Crypto Meltdowns and Crashes on “Crypto DeFined” With Kathy Chu

Crypto commentator Frances Coppola talks to Kathy Chu about why she thinks more crypto firms will collapse and how the crypto industry has become interconnected with traditional financial markets. Find her on Twitter at frances_coppola and read her blog at coppolacomment.com. Produced by truthdao.xyz.

Read More »Economist Frances Coppola struggles to find a positive in mini-budget

Economist Frances Coppola struggles to find a positive in the mini-budget: 'The first thing we've seen is a pretty massive sell-off in the pound because the international market doesn't like our currency any more, they think it is going to inflate.' This video clip is from an LBC show presented by James O'Brien on 23/09/22

Read More »Economist Frances Coppola struggles to find a positive in mini-budget | James O’Brien

Economist Frances Coppola struggles to find a positive in the mini-budget: 'The first thing we've seen is a pretty massive sell-off in the pound because the international market doesn't like our currency any more, they think it is going to inflate.' This video clip is from an LBC show presented by James O'Brien on 23/09/22. #JamesOBrien #MiniBudget #LBC LBC is the home of live debate around news and current affairs. We let you join the conversation and hold politicians to account....

Read More »Economist Frances Coppola struggles to find a positive in the mini-budget

Economist Frances Coppola struggles to find a positive in the mini-budget. 'The first thing we've seen is a pretty massive sell off in the pound because the international market doesn't like our currency anymore, they think it is going to inflate.' casawary bird @casawarybird tweeted 'Fantastic prog this morning.Thank you. Can you come up with a new slogan instead of The Poor (which isn't useful & is an untrue representation of inequality) Need to change the onus. eg 'The Rich & the...

Read More »The People’s Quantitative Easing – with Frances Coppola

Frances Coppola is a former banker, an economist, and blogger who wrote a book called 'The Case for People's QE', which you can buy here: https://www.wiley.com/en-gb/The+Case+For+People's+Quantitative+Easing-p-9781509531301 We chatted about the book and about monetary policy in-depth.

Read More »Celsius is heading for absolute zero

Yesterday, the failed crypto lender Celsius filed a monthy cash flow forecast and a statement of its assets and liabilities held in the form of cryptocurrency and stablecoins. They showed that the lender is deeply underwater and will run out of money within two months. Today, Celsius presented an update regarding its chapter 11 bankruptcy plans. Reading this, you'd think it was a different company. Liquidation isn't on the agenda. No, they are talking about "reorganization" and and seeking...

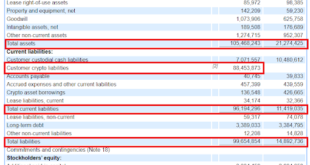

Read More »Why Coinbase’s balance sheet has massively inflated

Coinbase recently filed its interim financial report. It makes pretty grim reading. A quarterly net loss of over $1bn, net cash drain of £4.6bn in 6 months, fair value losses of over 600k... To be sure, Coinbase is not on its knees yet. It still has $12bn of its own and customers' cash (both are on its balance sheet), and a whopping asset base. In fact its assets have increased - a lot. As have its liabilities. Coinbase's balance sheet is five times bigger than it was in December...

Read More »The ones who stay in Omelas

Ursula Le Guin's short story "The Ones Who Walk Away From Omelas" contains a terrible moral conundrum. Many people have agonised over it: to my knowledge, no-one has solved it. Attempts that I have seen all in some way change the framing of the story, whether by justifying blood sacrifice, insisting that there must be a better way, or creating a better alternative. But if you change the framing, you have not solved the problem. You have avoided it.As I read through Le Guin's story to the...

Read More »Lead-Lag Live: Cutting Taxes Could Stop Inflation With Frances Coppola

A crazy world sometimes requires crazy ideas. Twitter: https://twitter.com/leadlagreport Facebook: https://www.facebook.com/leadlagreport Instagram: https://instagram.com/leadlagreport Sign up for The Lead-Lag Report at www.leadlagreport.com and use promo code YOUTUBE30 for 2 weeks free and 30% off. Nothing on this channel should be considered as personalized financial advice or a solicitation to buy or sell any securities. The content in this program is for informational...

Read More » Francis Coppola

Francis Coppola

-310x165.jpg)