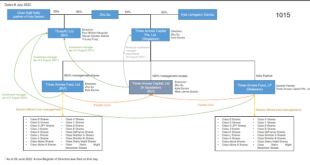

The collapse of Terra in May sent shock waves round the crypto world, triggering domino-like collapses of crypto companies. One of those companies was the investment fund Three Arrows Capital. At the time, everyone thought 3AC was a conservatively-managed investment company that was simply the unfortunate victim of an unforeseen event. If anyone was to blame for 3AC's collapse, it was Do Kwon. How wrong they were. Since 3AC was ordered into liquidation by a British Virgin Islands court,...

Read More »The Blind Spot | Episode 3: From Scottish free banking to Voyager crypto (w/Frances Coppola)

In this episode we are joined by Frances Coppola, a noted freelance commentator on financial markets and crypto, to discuss the failure of crypto lender Voyager. We also ponder what Scotland can learn from the failings of major stablecoins. 2:45 - the crypto collapse chronology 6:30 - Three Arrows 10:00 - Is it 1907 or 1996 in crypto 13:00 - How Sam-Bankman Fried is the new JP Morgan. 18:30 - Nothing new under the sun 21:00 - Crypto's one utility is being a financial flight simulator...

Read More »Why Celsius Network’s depositors won’t get their money back

The crypto lender Celsius has filed for Chapter 11 bankruptcy. This should come as a surprise to absolutely no-one, though the grief and pain on Twitter and Reddit suggests that quite a few "Celsians" didn't want to believe what was staring them in the face. Celsius suspended withdrawals nearly a month ago. So far, every crypto lender that has suspended withdrawals has turned out to be insolvent. There was no reason to suppose that Celsius would be different. Celsius's bankruptcy filing...

Read More »Shipwrecked

Two days after I published my last post, the ship went down. Voyager Digital filed for Chapter 11 bankruptcy protection. The bankruptcy filing revealed the extent of its indebtedness. Tragically, most of its creditors are customers, some of whom hold claims worth millions of dollars. But its largest creditor is Alameda Research, to whom it owes $75m. This is the maximum that Voyager could draw down from Alameda's credit line in a 30-day period. So it appears that Alameda did not pull its...

Read More »The sinking of Voyager

Friday was quite a day. The crypto lender BlockFi provisionally agreed a bailout deal with FTX. The hedge fund Three Arrows Capital (3AC), already in compulsory liquidation in its home territory the British Virgin Islands, filed for Chapter 15 bankruptcy protection in the United States. And the crypto broker Voyager suspended trading and withdrawals. Voyager's press release revealed a massive hole in its balance sheet. Some 58% of its loan book consists of loans to 3AC:And its loan book is...

Read More »There’s no such thing as a safe stablecoin

Stablecoins aren't stable. So-called algorithmic stablecoins crash and burn when people behave in ways the algorithm didn't expect. And reserved stablecoins fall off their pegs - in either direction. A stablecoin that does not stay on its peg is unstable. Not one of the stablecoins currently in circulation lives up to its name. Don't believe me? Well, here's the evidence. Exhibit 1, USDT since the end of April:Exhibit 2, USDC over the same time period:(charts from Coinmarketcap)Both coins...

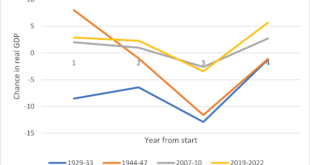

Read More »The Great Unemployment Fudge

In the U.S., we are told, the post-World War II period was a golden age of full employment. High wartime government spending had brought to an end the double-digit unemployment and misery of the Depression, and as war gave way to peace, unemployment settled at a non-inflationary level of 3-5%. It's known as the post-war "economic miracle".But it's a myth. There was never full employment. The low unemployment of the post-war years is a massive statistical fudge. In fact, over five million...

Read More »Can Europe’s Economy Handle Russian Sanctions? | Frances Coppola

Frances Coppola, Economist, Author & banking expert, joins Forward Guidance to give an update on how the West's new sanctions on Russia are playing out. Coppola explains how key commodities such as Russian natural gas and oil continue to flow to Western countries, and she makes an impassioned case for why a ban on Russian energy is necessary to thwart the imperial ambitions of Russian President Vladimir Putin. -- Follow Frances Coppola on Twitter: https://twitter.com/Frances_Coppola...

Read More »Sleepwalking into war

In a broad-ranging discussion the other day about the path of political and economic policy over the last decade, I found myself returning again and again to events in 2014. Events that were apparently unrelated: Bulgaria's banking crisis, Moldova's banking fraud, the collapse of Banco Espirito Santo, the election of Syriza in Greece, the first Scottish independence referendum, UKIP's success in two Westminster by-elections as well as local and European elections. And in Ukraine, the...

Read More » Francis Coppola

Francis Coppola