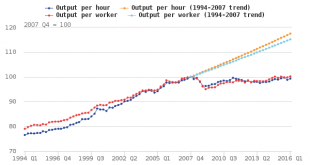

The ONS has produced a fascinating discussion of the UK's productivity puzzle, with some great charts. This one shows just how much the UK's productivity has slumped: Notice when productivity started to slump. It was much earlier than 2008. In fact the data (which ONS have helpfully provided in Excel) show that output per hour started to fall in Q4 2006. The productivity slump, therefore, cannot be caused by the financial crisis. I suspect we have a "third variable" problem here. It seems...

Read More »Short-run effects of the Brexit shock

The Governor of the Bank of England's opening remarks at the release of today's Financial Stability Report were stark: At its March meeting, the FPC judged that “the risks around the referendum [were] the most significant near-term domestic risks to financial stability.” Some of those risks have begun to crystallise. The Governor was admirably calm and balanced in his press conference. But nevertheless there was a degree of schadenfreude about his remarks. Prior to the referendum, the Bank...

Read More »Parliament and Brexit

I spent much of this weekend arguing on Twitter. (Yes, I know, nothing new there....) Specifically, arguing that Brexit cannot go ahead without Parliament. I said that before Article 50 is triggered, the result of the referendum must be debated by the full House of Commons, and ratified by a free vote. Unsurprisingly, since I openly supported Remain, a number of people assumed that I was suggesting this as a way of overturning the result. They are wrong. I think a Parliamentary vote is...

Read More »Who is really to blame for Brexit?

Guest post by Tom Streithorst. Brexit already looks a disaster. Sterling has plunged to the lowest level in thirty years, the FTSE fell more than 12% at the open, global equities lost $2 trillion in value in less than a day, and gold, the traditional safe haven in times of turmoil, has shot up. Uncertainly reigns. Firms are less likely than ever to hire or invest. It is going to get worse. Who shall we blame? David Cameron is the obvious villain. He did not need to call this referendum....

Read More »The snake oil sellers

The fallout from Britain’s historic decision to leave the European Union continues. Domestically, there are regrets, recriminations and accusations. Young people,particularly those aged 16-17 who did not have a vote, complain that the vote did not take their interests into account A petition for a second referendum reached over 3m votes in a few days, although it was subsequently found to have been hacked: the true number is uncertain. The media have spent the weekend tracking down...

Read More »Silence

I have reluctantly decided that there will be no more posts on Coppola Comment until after the referendum.Since I have declared my support for Remain, anything I write about the UK and the EU is now inevitably seen as biased, and anything I write about any other subject is - equally inevitably - seen as avoiding the issue. I cannot, for example, write a balanced analysis of the likely effects on financial services of a vote in either direction, though that is my specialism. Nor can I...

Read More »The EU’s greatest achievement

"The EU's greatest achievement is the Euro", said Michael Portillo on the BBC's This Week programme last Thursday.No, Michael, it isn't. It is the EU's worst mistake.As Yanis Varoufakis entertainingly explains in an interesting lecture published in the Australian Journal of Political Economy, the creation of the Euro led inexorably to the buildup of unsustainable debt - both private and public - in the Eurozone periphery countries: The problem is that creating a monetary union is a...

Read More »Sisyphus,Tantalus and a prisoner’s dilemma

Should Greece leave the Euro? That was the title of the Oxford debate at the Prague Summit in which I had the pleasure of participating yesterday.But this is the wrong question. Unless there is a considerable shift in Eurozone politics, Greece WILL leave the Euro - eventually. The question is when, and how.To see this, we need to look at the motivations of all the players involved in the negotiations. The Greek negotiations resemble a "prisoner's dilemma", in which the best outcome for...

Read More »If only we could return to the glorious 1990s…..

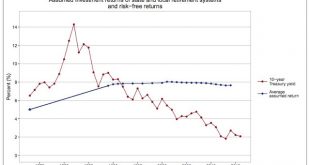

The chart below comes from Silver Watch on Twitter. I haven't been able to identify the original source, but it illustrates perfectly the point I have been trying to make for quite some time now. Pension funds are not taking on more risky investments because the risk premium has fallen, but because the risk-free rate has fallen: In fact, as the chart shows, the risk-free rate has been falling steadily for over thirty years. This is not a post-crisis blip. It is a secular trend. Yet pension...

Read More »Schroedinger’s assets

In a new paper*, Michael Woodford has reimagined the famous “Schroedinger’s Cat” thought experiment. I suspect this is unintentional. But that’s what happens when, in an understandable quest for simplicity, you create binary decisions in a complex probability-based structure.Schroedinger imagined a cat locked in a box in which there is a phial of poison. The probability of the cat being dead when the box is opened is less than 100% (since some cats are tough). So if p is the probability of...

Read More » Francis Coppola

Francis Coppola