Here’s a new edition of 3 Minute Macro on the topic of Eurodollars. Eurodollars are a somewhat opaque part of the financial world, but have become increasingly important in the last few decades as dollar deposits outside of the USA have grown. In this video we discuss the basic concept and why Eurodollars are important. I hope you enjoy it. [embedded content] Please follow and like us: About Post Author ...

Read More »Three Things I Think I Think – Housing Risks

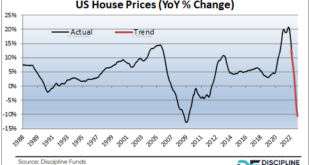

Here are some things I think I am thinking about: Housing, housing, housing. If I had to distill my current macro outlook down into a sentence or two it would be “watch everything housing related”. Housing is going to steer the US economy and inflation in the coming 24 months and the current high mortgage rates create an unusually high level of risk to both house prices and consumer demand. But let’s dig into this a little deeper. 1) Shelter and inflation. Today’s CPI report...

Read More »New Podcast Interview – The Bitcoin Layer

I joined Nik Bhattia on the Bitcoin Layer podcast to discuss the outlook for the macroeconomy in 2023. This interview includes: 1) The general economic outlook for 2023 2) Why 2023 is likely to be a year of disinflation 3) Is the current environment more like 2008 or the 1970s? 4) How the current environment could evolve into more of a credit crisis 5) Portfolio strategies for navigating the next few years 6) How to assign allocations to stocks, bonds and other assets...

Read More »The Cause Of The 2008 Financial Crisis w/ Cullen Roche | The Bitcoin Layer

#short

Read More »Macro Masterclass with Cullen Roche | The Bitcoin Layer

Welcome to The Bitcoin Layer, where we bring you research, analysis, and education for all things bitcoin and macro. Nik sat down with Cullen Roche, author, macro investor, and Chief Investment Officer at Discipline Funds. Cullen discusses the current macroeconomic environment, similarities and differences to 2008, and how stocks will respond as we reach peak interest rates for this cycle. Follow Cullen on Twitter: https://twitter.com/cullenroche Cullen's Book 'Pragmatic Capitalism':...

Read More »Three Things I Think I Think – Who Can You Trust?

1) SBF, FTX, WTF. The big story of the week remains Sam Bankman-Fried and the collapse of crypto exchange FTX. I haven’t written much about this topic because, well, crypto is not nearly as important as the amount of airtime it gets. It’s 0.5% of the world’s financial assets, but seems to get 50%+ of the media airtime. Additionally, I don’t believe that 100+ volatility assets should be a large part of anyone’s savings so in the scope of my asset management approach crypto is a fringe...

Read More »The Business Brew – The Portfolio You Need

Sorry for the radio silence recently. I went on my first vacation in two years over the Thanksgiving week. But now we’re back and getting ready for 2023. I was fortunate to sit down with Bill Brewster who runs the excellent Business Brew podcast. In this episode we talked about all things macro and why macro matters more than ever. My favorite part of the discussion was about the portfolio you need vs the portfolio you want. I am obviously a big believer in behavioral finance and...

Read More »Cullen Roche – Why Macro Matters

Cullen Roche is the Founder of Discipline Funds. Discipline Funds is a low fee financial advisory and asset management firm. Prior to establishing his own business, Mr. Roche founded his own investment partnership in 2005 after working at Merrill Lynch Global Wealth Management where he helped oversee $500MM+ in assets under management. During the the 7 years running the partnership he was able to guide the small business to high risk adjusted returns with no negative full year returns during...

Read More »3 Lessons From the Collapse of FTX (Video)

In this video we discuss the collapse of FTX and the crypto markets and what we can learn from this bear market. This video includes: 1) Understanding volatilities relative to probable investment returns. 2) Learning to think in a first principles way. 3) Reducing or eliminating behavioral biases through systematic investment processes. I hope you enjoy it. [embedded content] Please follow and like us: About...

Read More »Do We Implement Portfolio Construction Completely Backwards?

I’ve had three big investing epiphanies in my investing career. The first big epiphany was that macro matters much more than micro. The direction of the river is much more important than the strength of the swimmer. Anyone can float down a river, but trying to fight the current is often a losing battle. Back in the early 2000’s I used to run a stock picking strategy that unknowingly took advantage of the “overnight effect” in stocks. I generated very high returns during a period...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism