The great thing about Twitter is that the instant you put a bad take into the universe you will get roasted for it. The bad part about Twitter is that the instant you put a bad take into the universe you will roasted for it. I kid, kind of. There’s actually a lot to learn in saying the wrong things and I’ve surely benefitted from putting my wrong opinions out into the universe only to have someone correct me. So I guess you could say that there’s no such thing as a stupid take, only stupid...

Read More »The Fed Should Stop Using the Term “Transitory”

This website exists in large part because our government is extremely bad at communicating complex topics to the general public. I’ve tried to fill that void by explaining some of these more complex topics over the years. So I dedicate yet another post to our government, whose communication skills continue to leave something to be desired…. TRANSITORY – adjective 1: OF BRIEF DURATION : TEMPORARY 2: A GENERALLY POOR WAY TO DESCRIBE INFLATION The Fed keeps saying inflation will be...

Read More »How Does the Fed “Manipulate” Interest Rates?

Warning – hard money types are going to lose their minds over this article. I apologize in advance. It’s impossible to talk about interest rates without running into people who think the Fed has “manipulated” interest rates lower than they otherwise would be. As if the bond market has become nothing more than one huge completely manipulated Federal Reserve market. This is a really intuitively appealing argument and it’s not even completely wrong, but I want to add some important...

Read More »What is “Fractional Reserve Banking”?

The term “fractional reserve banking” is commonly used in a confusing manner in both mainstream economics and within lay conversations about economics. I hope this article with clear up some of the common confusions. Fractional reserve banking is the idea that banks take their reserves and lend them into some fraction based on the quantity of reserves they hold. This idea has been largely debunked since the financial crisis. In reality, banks do not lend their reserves, except to one...

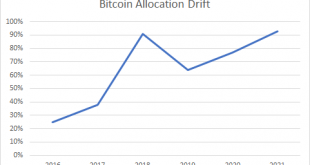

Read More »Does a 100 Vol Asset Belong in Retirement Accounts?

The Washington Post reports that some 401K providers are considering cryptocurrencies in their portfolios. The idea that alternative assets should be more widely available has become a more and more common refrain due to the fact that many of the best performing asset classes in the last 10 years are crypto and venture capital, two asset classes that are closed off to most traditional investment accounts like 401Ks and IRAs. Should this change? Let’s explore. For the purposes of this...

Read More »Three Things I Think I Think – Transitory Stuff

Here are some things I think I am thinking about: 1) “Transitory” inflation….Contrary to popular opinion, I am not the Director of Communications at the Federal Reserve. I don’t even work for the Federal Reserve. I’m just a lowly asset manager who happens to oversee a big chunk of fixed income so I worry incessantly about inflation and interest rates. That led me to obsess about how the Fed actually works and so here I am constantly writing about how the Fed works and how they think about...

Read More »Three Things I Think I Think – Bitcoin, Moar Bitcoin and Inflation

Here are some things I think I am thinking about: 1) Moar Bitcoin! Back when I was a young adventurous person I used to have an exciting portfolio filled with interesting individual stock bets. But then I learned a bunch of economics/finance, got old/fat and turned into a pretty boring indexer. So I just love it when other people make wildly insane bets that I can write blog posts about. And I think that’s why I love the MicroStrategy story so much. In case you haven’t been following...

Read More »Three Things I Think I Think – The More Things Change the More They Stay the Same

Here are some things I think I am thinking about: 1) Markets are crazy, part 2,343,325. I like to say that markets don’t really “cycle” like a sine wave. They tend to trend up and to the right with temporary shocks along the way. Whatever causes the shock (up or down) will always be different. But the responses are more or less the same. That is, people get greedy, then they get really greedy, then they get fearful and then they get really fearful. Timing all of this is damn near...

Read More »Everything Wrong with the “Money Printer Go Brrrr” Meme

You’ve probably seen some version of the following meme in the last few years. In case you haven’t it’s generally used to infer that Jerome Powell is printing money and hyperinflation is coming. I love a good meme and few things make me happier than hilarious nonsense on the internet. So I feel bad debunking this meme because it’s kind of funny and memes are mostly harmless, but this is one of those memes used by people who want you to believe something that isn’t right. Anyhow let’s get...

Read More »Three Things I Think I Think – Crypto, Crypto, Crypto

Here are some things I think I am thinking about. 1) So. Much. Crypto. I am about to write a post entirely about crypto. But before I do that I want to make it clear that this space gets WAY too much attention. I mean, we’re talking about an asset class that is incredibly small relative to the scope of the global financial asset portfolio. At just 1% of global financial assets the entire crypto space is about the size of Amazon. Amazingly though, the crypto space dominates the airwaves....

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism