Cullen Roche, CIO of Discipline Funds and author of Pragmatic Capitalism, joins Julia La Roche on episode 50 for a wide-ranging discussion of the macro environment and Housing — the risk keeping him up at night. In this episode, Roche raises the point that when it comes to macro research, a lot of economists argue that the U.S. economy is a housing economy, meaning when the housing market slows down a lot, it filters through everything else. “It’s really up in the...

Read More »Three Things I Think I Think – Bankrupt Ideologies

1) The Competition for Worst Ideology is Heating Up There’s a battle of bad ideologies going on around the debt ceiling debate. Unfortunately, this is a microcosm of what has happened in American politics – the centrists have been silenced as both fringes scream over them. And it’s the fringe thinking that gets all the attention these days. In the case of the debt ceiling we’ve got fringe thinkers on the right actively threatening to let the USA default on debt. And on the other...

Read More »FAQ Answers – Part 1

Here’s the first batch of answers from the Ask Me Anything. We covered a lot of ground in here including my view on factor investing, the FIRE movement, asset allocation in retirement, how bonds work and Fed policy. I hope you enjoy this and if you do please like and subscribe to the YouTube channel and we’ll do more videos in the future. If you have another question feel free to leave it here and we’ll answer it in Part 2. 00:00 Introduction 00:05 What has caused...

Read More »Ask Me Anything (Comments Open!)

We are going to do a new 3 Minute Macro “Ask Me Anything” edition. It should be out next week or so. Please use the comments below to ask me anything and if you ask a really, really good question I’ll include it in the video. Each question will include up to a 3 minute response so anything is fair game. You can also email me here if you prefer that they be privately submitted.

Read More »Three Things I Think I Think – Silly Debates

Here are some things I think I am thinking about: 1) The 3 Most Important Charts Today We posted a new 3 Minute Macro video about the three most important investing charts today. I discuss last week’s employment report and why it changed market sentiment so substantially. Long story short – falling wages reduce the odds of a 1970’s style outcome. I’ve been saying that for the last few months, but the data is really starting to confirm that view. Yesterday’s update to the...

Read More »The 3 Most Important Investing Charts Today

Markets went crazy after last week's employment report. What happened and what are the important takeaways from it all? In this video we explain three of the most important charts in the economy today and what they could mean for the future of the financial markets and the economy. Chapters: 0:08 Intro 00:24 Average hourly earnings and the wage price spiral relief 00:36 Why would rising wages be bad? 00:58 Temp help and why it matters 01:41 Fed Funds Futures 02:24 Three big takeaways...

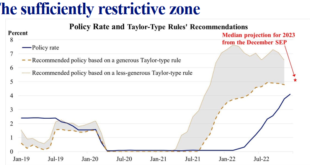

Read More »Three Things I Think I Think – Happy Disinflation Year?

Here are some things I think I am thinking about: 1) 2023, the Year of Disinflation? In my annual outlook I said that 2023 was going to be the year of disinflation. My guess is that Core PCE ends the year around 3%. That’s higher than the Fed’s 2% target but it’s all moving in the right direction. I was pretty pleasantly surprised to see that James Bullard from the Fed, has a similar view of things. In a recent presentation he said that 2023 was likely to be a year of...

Read More »The Best of Pragcap in 2022

Here are some of my favorite posts from 2022. It was a busy year with my young kids so I didn’t write as much as I had hoped, but one of my goals is to start writing a lot more this year. I’ve missed it. In any case, here’s some of my favorites from this year. I hope 2023 is a great one for you. 1) What to do When the Market feels Crashy? This post was written almost a year ago as the bear market was starting. It touches on some important lessons to remember about bear markets and...

Read More »2023 Investment Outlook (Video)

Here is our 2023 investment outlook. I did this a little differently this year by providing a scenario analysis with different probability distributions. I think this is a much better way of analyzing potential outcomes and will allow you to better understand the range of outcomes. My overarching view is that the range of outcomes still remains very wide because we’re digesting the COVID boom which is evolving into a bust. This means that portfolio concentration is likely to be a high...

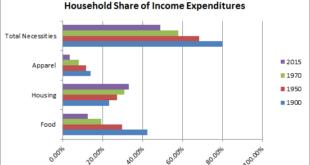

Read More »Needs, Wants and why We Always Feel Unfulfilled

By the age of 30 I was financially independent. My business was self sustaining, I enjoyed my work immensely and no one could tell me what to do. I wrote a best selling book. I wrote some great research. I spent years training for and finished a full Ironman despite having never run more than a few miles just a few years before that. I had a dreamy marriage to a woman who is way out of my league. All of my needs were taken care of. Life had transitioned into what I wanted. But as I get...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism