Here’s a good podcast I did earlier this month about Monetary Policy and the Federal Reserve. Jack and Justin are great friends of mine and run an excellent podcast called Excess Returns. Please check it out if you haven’t already. There has been a lot of debate about Federal Reserve policy in the wake of the pandemic. But many of those involved in that debate want to promote a specific position and interpret the facts in a way to accomplish that goal. In this episode, we wanted to...

Read More »Will the Surging Dollar Crash the Global Economy?

Here’s a new 3 Minute Money. In this video I discuss the implications of the surging US Dollar: Why is the USD surging despite rising inflation? What does this signal about the global economy? What does this mean for Federal Reserve policy? I hope you learn something and enjoy the video. [embedded content] About Post Author ...

Read More »Debunking Common Investment Myths

I joined Dr. Daniel Crosby on the Standard Deviations podcast for a wide ranging discussion about portfolio management and navigating the conspiracy theories of the financial markets. This one’s short and sweet at just over 30 minutes. We covered a lot of ground and Daniel is a great host. Check out his podcast here. Tune in to hear: – What is “all duration investing” and what behavioral upside might this approach have for investors? – How can you better organize a bucketing...

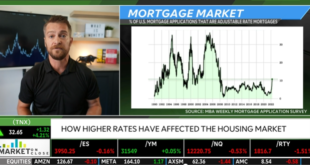

Read More »TD Ameritrade Interview – My Outlook on Housing

I joined Oliver Renick on TD Ameritrade Network last Friday to discuss the housing market and some of my recent comments from the newest Three Minute Money video. In short: Interest rates over 6% creates an unaffordability problem that is likely to put downward pressure on prices as demand dries up and supply increases. This isn’t a 2008 repeat, however, because you won’t have the low quality adjustable rate borrower being forced to panic sell.We’re also unlikely to see a financial...

Read More »The Investors Podcast – Masterclass on Inflation Continued

I joined The Investor’s Podcast for the 9th time! I am officially the Alec Baldwin of the show, but far less handsome. We continued our talk about inflation and how to navigate these difficult times. If you missed the first Masterclass on Inflation please check it out here. I hope you learn something new from this: IN THIS EPISODE, YOU’LL LEARN: Why inflation will be moderate in the coming years.Why deflation is more likely than hyperinflation.Whether velocity of money is...

Read More »Everything Investors Need to Know About Federal Reserve Policy with Cullen Roche

There has been a lot of debate about Federal Reserve policy in the wake of the pandemic. But many of those involved in that debate want to promote a specific position and interpret the facts in a way to accomplish that goal. In this episode, we wanted to take a step back cover the facts about the Federal Reserve and how it operates. And we couldn't think of a better person to do that with than our friend Cullen Roche. We discuss the history of the Fed, what its mandates are, the tools it can...

Read More »Cullen Roche – Debunking Common Investment Myths (Live from San Diego)

This week on Standard Deviations with Dr. Daniel Crosby, Dr. Crosby is joined by Cullen Roche. Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds. Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances. He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio...

Read More »Is the Housing Market Going to Crash?

Here’s a new 3 Minute Money on housing. In this video I cover: The dynamics of the boom Why housing is so important to the broader economyThe risk that surging rates poseWhy this boom was different from the Housing Bubble boomwhat a potential bust might look like. I hope you enjoy it. [embedded content] About Post Author ...

Read More »How The U.S. Tries To Control Inflation | Inflation Masterclass w/ Cullen Roche (TIP472)

By popular demand, Stig Brodersen has invited back Investment expert Cullen Roche for the 9th time! They continue their inflation masterclass and talk about the current outlook for inflation. IN THIS EPISODE, YOU’LL LEARN: 00:00:00 - Intro 00:00:40 - Why inflation will be moderate in the coming years 00:08:19 - Why deflation is more likely than hyperinflation 00:16:54 - Whether velocity of money is important for inflation 00:21:41 - Whether a negative budget balance leads...

Read More »Three Things I Think I Think – Bad Ideas

1) ESG – Still a Convoluted Mess. My long standing position on ESG (Environmental, Social & Governance) investing is that secondary markets are a not a great place to try to enact change. In short, it’s another form of active stock picking except now you’re letting your emotions get in the way. For instance, I might hate Exxon Mobil because they pollute the environment, but XOM also invests huge amounts of money into renewables. In fact, the only way they’ll survive in the future...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism