It’s been 8 years since I first published my book Pragmatic Capitalism and I finally got around to updating the book with a Second Edition. It had become very hard to acquire and copies were selling for hundreds of dollars. I even saw hyperinflationary prices of $43,000. And no, you should never pay $43,000 for a book. Not even one that has millions of dollars of monetary knowledge in it. Just kidding of course. You should definitely pay $43,000 for my book. Unless of course you can find...

Read More »Macro Outlook Update – This Too Shall Pass

I joined Matt McCall on the Making Money show for an update on my macro outlook for the rest of the year and the coming years. It was a wide ranging interview and we covered a lot of ground. I am not super optimistic about the global economy in the coming 18 months and I think investors are going to have to continue to remain somewhat patient. But this doesn’t mean you should abandon your plan. As John Bogle liked to say, stay the course and be patient. I hope you enjoy the interview:...

Read More »The Economic Problem with LIV Golf

* This is a bit off topic, but as a casual golfer/watcher and economic nerd I think it’s an interesting topic. The creation of the LIV Golf tour has shaken the world of golf to its core. LIV is the Saudi Arabia backed league designed to “compete” with the PGA Tour and other world tours. As a pragmatic capitalist, I obviously love competition, but this isn’t competition. In fact, I think it’s likely to hurt golf because it is anti-competitive. This situation is a really interesting one...

Read More »‘Bear Markets Always End’ – How to Prepare for a Market Rebalance With Cullen Roche | Making Money

The first half of the year is in the books... And, unfortunately, it was the worst first six-month period since 1970. But the odds are good that we'll be able to climb out of this rut. In this episode of Making Money With Matt McCall, I'm kicking off the second half of 2022 by sitting down with Cullen Roche, the founder and chief investment officer of advisory firm Discipline Funds. This is a must-watch interview full of insights from both Roche and me that could help set you up for a...

Read More »Three Things I Think I Think – Flation, Flation, Flation

Here are some things I think I am thinking about: 1) Inflation has peaked. Back in January I said inflation had peaked. This morning’s Core PCE data seals the deal for me – it looks like inflation peaked in February. So, I missed it by a month. Still, this one looks very clear to me from here on out. The year over year comparisons become much flatter as the year goes on. By the end of the year a lot of the underlying inflation components are going to be negative. Given all the broad...

Read More »Three Things I Think I Think – The Fed Lost some Money

Here are some things I think I am thinking about: 1) Who Owns the Fed’s Losses? Here’s an interesting article about the Fed’s losses. Since they started raising rates late last year the Fed has $540B of unrealized losses. How problematic is this? First, the Fed earned over $1.2T in interest over the last 12 years. But they distribute all this income to the US Treasury at the end of every year. They don’t keep this income as retained earnings or a capital buffer because the Fed doesn’t...

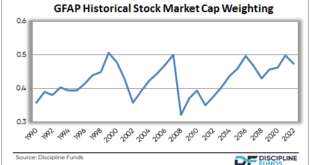

Read More »Your Balanced Index Still Isn’t Balanced

As a general rule I like simple indexing strategies like a 60/40 stock/bond portfolio, for the right person. It’s perfectly consistent with what I would call a “discipline based investing” strategy in that it’s evidence based, low cost, tax efficient, systematic and helps to self regulate behavior by rebalancing back to a less procyclical stock weighting over time. In other words, if you didn’t rebalance your 60/40 then it would grow to 70/30 (or more stocks) over time and this would...

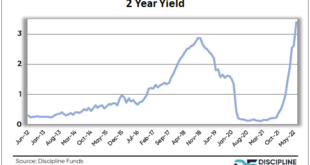

Read More »The Fed’s Policy Mistake has Been Made

Last April I said the Fed was on the verge of a policy mistake. My basic thinking on this was as follows: Excesses in the financial markets and economy were obvious last May when I hinted that the Fed should be raising rates. Inflation kept rising at an uncomfortable rate which warranted some Fed offset, but they remained behind the curve well into late 2021. By the time the war in Ukraine was in motion the economy was already showing worrisome signs of slowing, but energy prices were...

Read More »Is This the Return of the 1970s?

Another hot inflation reading this morning with CPI coming in at 6% on the headline. The good news (if there is any) is that it does look like year over year inflation peaked back in February, but the outlook going forward is more and more muddled as time goes on. On the one hand, you have broadening services inflation and surging commodities. The war in Ukraine and potential for a conflict in Taiwan are strong arguments for continued high inflation. And on the other hand, you have rising...

Read More »Three Things I Think I Think – Government Bankruptcy, Misery & the Return of the 70s

Here are some things I think I am thinking about: 1) The US Government Still isn’t Bankrupt. Kim Dot Com, a New Zealand based technologist wrote a viral thread on Twitter claiming that the US government is bankrupt. A lot of it is based on basic errors and fallacies of composition so I made another Three Minute Money video on this topic to help provide some clarity. This will be old material for regular readers, but the 3 minute format is a nice succinct refresher. [embedded content] 2)...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism