The stability problem in Sraffian economic There is little doubt that the structure of the Sraffian system is identical to GET [General Equilibrium Theory] in its commitment to the algebra of simultaneous equations but with this difference: the equations in GET are demand and supply equations, whereas the equations in Sraffian economics are physical input-output relations, which are supposed to determine prices independently of demand. The existence...

Read More »DSGE models — worse than useless

DSGE models — worse than useless Mainstream macroeconomics can only progress if it gets rid of the DSGE albatross around its neck. It is better to do it now than to wait for another 20 years because the question is not whether but when DSGE modeling will be discarded. DSGE modeling is a story of a death foretold … Getting rid of DSGE models is critical because the hegemonic DSGE program is crowding out alternative macro methodologies that do work … DSGE...

Read More »Bayesianism — a patently absurd approach to science

Bayesianism — a patently absurd approach to science Mainstream economics nowadays usually assumes that agents that have to make choices under conditions of uncertainty behave according to Bayesian rules (preferably the ones axiomatised by Ramsey (1931), de Finetti (1937) or Savage (1954)) — that is, they maximise expected utility with respect to some subjective probability measure that is continually updated according to Bayes theorem. If not, they are...

Read More »Wie Statistiken manipuliert werden

Wie Statistiken manipuliert werden .[embedded content]

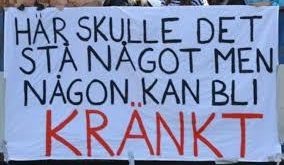

Read More »Kränkthetspladder vid Malmö universitet

Kränkthetspladder vid Malmö universitet Det handlar om en gästföreläsning på masterprogrammet i sexologi vid Malmö universitet … Gästföreläsaren visade rasistiska nidbilder, som så kallade blackfaces och yellowfaces, och använde flera gånger n-ordet. Till saken hör att ordet och nidbilderna var en del av en medveten pedagogisk strategi. Eller som tre ansvariga vid universitetet skrev i ett svar på en insändare i Sydsvenskan den 24 februari: ”Avsikten med...

Read More »Ten years jubilee

Tired of the idea of an infallible mainstream economics and its perpetuation of spoon-fed orthodoxy, yours truly launched this blog in March 2011. The number of visitors has increased steadily, and now, ten years later and with millions of page views, I have to admit of still being — given the rather wonkish character of the blog, with posts mostly on economic theory, statistics, econometrics, theory of science and methodology — rather gobsmacked that so many are interested...

Read More »Neo-Ricardian economics — rigorous and totally irrelevant

Neo-Ricardian economics — rigorous and totally irrelevant I claim that Sraffian economics, however rigorous in its use of the simultaneous equations method … is irrelevant to our understanding of the real world and, judging by its failure to draw any policy implications, is largely irrelevant to the major concerns of modern economists … This is not a judgment based simply on my opinion, which is ultimately no better than yours. Relevance is not a matter for...

Read More »The general equilibrium fixation

The general equilibrium fixation As already stated, it is a complete misnomer to call the conditions under which the general economic equilibrium is discussed “free” or “perfect competition” … My quarrel is, however, not primarily with the word “competition,” but rather with the concentration on that largely irrelevant subject matter, whatever name is given to it. It is hard to explain the persistence of this fixation; perhaps it is the silent recognition...

Read More »Faktaresistenta foliehattar försökte starta en tidning

Faktaresistenta foliehattar försökte starta en tidning Nättidningen Bulletin är en slående påminnelse om hur illa det kan gå när folie-hattarnas politiska vänner ger sig in på medieområdet. En skock högerhaverister med SD-anpassad agenda, renons på publicistiskt förstånd och journalistiskt omdöme, fick för sig att starta en tidning som på ett seriöst sätt skulle bli en motvikt till de etablerade kanalerna. Förebilden var, hette det, New York Times, men i...

Read More »Svenska vaccinmotståndare — fubickar i foliehatt

Svenska vaccinmotståndare — fubickar i foliehatt [embedded content]

Read More » Lars P. Syll

Lars P. Syll