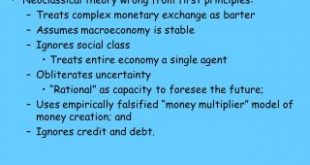

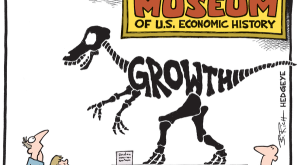

Modern economics — an intellectual game without practical relevance Modern economics is sick. Economics has increasingly become an intellectual game played for its own sake and not for its practical consequences for understanding the economic world. Economists have converted the subject into a sort of social mathematics in which analytical rigour is everything and practical relevance is nothing. To pick up a copy of The American Economic Review or The...

Read More »Schlechte Lehrer, schlechtere Schüler

Schlechte Lehrer, schlechtere Schüler Eine neue Studie, die der ZEIT vorab vorliegt, enthält eine Mahnung, die genau jetzt notwendig ist. Diese Mahnung lautet: Es kommt nicht nur darauf an, wie viele Lehrer und Erzieher es gibt, sondern vor allem darauf, wie gut sie sind. Denn von der Qualität des Personals hängt ab, wie viel die Kinder lernen. Kindergärten und Schulen boomen derzeit allerdings so stark, dass sie diesen Anspruch bisweilen hintanstellen: So...

Read More »Always on my mind

Always on my mind [embedded content] Advertisements

Read More »Cose Della Vita

[embedded content] Advertisements

Read More »Leave your hat on

Leave your hat on [embedded content] Advertisements

Read More »DSGE models — unparalleled and spectacular failures

DSGE models — unparalleled and spectacular failures The unsellability of DSGE models — private-sector firms do not pay lots of money to use DSGE models — is one strong argument against DSGE. But it is not the most damning critique of it. To me the most damning critiques that can be levelled against DSGE models are the following two: DSGE models are unable to explain involuntary unemployment In the basic DSGE models the labour market is always cleared –...

Read More »Krugman’s misapplication of neoclassical growth models

Krugman’s misapplication of neoclassical growth models The fallacies loanable funds theory commits might be explainable by the misapplication of some ideas and concepts of neoclassical growth models … to the sphere of money and finance … The Ramsey and Solow models are models of real investment only. Financial markets, financial assets and financial saving do not play any role in those models. There is only one good which, for simplicity, will be called...

Read More »Pseudo-vetenskapligt mumbo jumbo på svenska universitet

Pseudo-vetenskapligt mumbo jumbo på svenska universitet Jag sprang nyligen på en sammanställning av genusdoktorsavhandlingar från 2014. Många godbitar. Men en av dem var särskilt anmärkningsvärd, nämligen nummer 19 i uppräkningen. Det handlar om doktors-avhandlingen “Rum, rytm och resande” från Linköpings universitet (pdf). Sammanställningen sammanfattar: “Avhandlingen undersöker järnvägstationer som fysiska platser och sociala rum ur könsperspektiv....

Read More »Demystifying Trickle Down

[embedded content] Advertisements

Read More »The causes of secular stagnation and the loanable funds theory

The causes of secular stagnation and the loanable funds theory What are the causes of secular stagnation? What are the solutions to revive growth and get the U.S. economy out of the doldrums? … One headline conclusion stands out: the secular stagnation is caused by a heavy overdose of savings … All these savings end up as deposits, or ‘loanable funds’ (LF), in commercial banks … The glut in savings supply is so large that banks cannot get rid of all the...

Read More » Lars P. Syll

Lars P. Syll