The ‘deductivist blindness’ of modern economics Scientific progress … is frequently the result of observation that something does work, which runs far ahead of any understanding of why it works. Not within the economics profession. There, deductive reasoning based on logical inference from a specific set of a priori deductions is “exactly the right way to do things”. What is absurd is not the use of the deductive method but the claim to exclusivity made for...

Read More »Macroeconomic blindspots

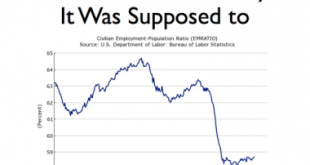

There was an unusual degree of consensus among economists about what would happen if Britain voted for Brexit in the referendum on June 23 last year. The language used by the International Monetary Fund was typical: It expressed fears of an “abrupt reaction,” adding that this “may have already begun” … What happened instead was that Britain enjoyed the best growth of any major advanced economy in 2016 … Andy Haldane compared the pitfalls of economic prediction to the single...

Read More »Why governments should run deficits

Why governments should run deficits Lynn Parramore: Do you think there are lessons in what has happened in the Eurozone for students of economics and the way the subject is taught? Mario Seccareccia: Yes, indeed. Ever since the establishment of the modern nation-state in the late eighteenth and nineteenth centuries, the creation of the euro was perhaps the first significant experiment in modern times in which there was an attempt to separate money from the...

Read More »Factoring polynomials the Californian way (personal)

Factoring polynomials the Californian way (personal) [embedded content] And I thought I had seen them all …

Read More »The Swedish model is dying

The Swedish model is dying The 2017 OECD Economic Survey of Sweden — presented today in Stockholm by OECD Secretary-General Angel Gurría and Sweden’s Minister of Finance Magdalena Andersson — points out that income inequality in Sweden has been rising since the 1990s. I would say that what we see happen in Sweden is deeply disturbing. The rising inequality is outrageous – not the least since it has to a large extent to do with income and wealth...

Read More »News media and knowledge

News media and knowledge [embedded content] Hans Rosling (1948-2017) RIP

Read More »Why not make macroeconomics a science?

Why not make macroeconomics a science? The trouble is, too many theorists — especially in the mainstream of the discipline — have drifted far from the real world. Their ambition has been to build mathematically elegant and internally consistent models of the economy, even if that requires wholly unrealistic assumptions. Granted, just as maps have to simplify complex terrain, theoretical models must ignore aspects of reality to be any use. But there’s a line...

Read More »Why reading newspapers makes you stupid

Why reading newspapers makes you stupid Lydon: You say newspapers make us stupid, and I’m not quite clear why. Taleb: Because they always give you an explanation to events so that you have the feeling that you know what’s going on. They tell you the stock market went down, because of fear of a recession, and that’s false causation with uncertainty there. They check their facts, but you can’t check their causes. So, you have the feeling of over-causation...

Read More »Uncertainty and the pretty, polite techniques of economics

Uncertainty and the pretty, polite techniques of economics All these pretty, polite techniques, made for a well-panelled Board Room and a nicely regulated market, are liable to collapse. At all times the vague panic fears and equally vague and unreasoned hopes are not really lulled, and lie but a little way below the surface. Perhaps the reader feels that this general, philosophical disquisition on the behavior of mankind is somewhat remote from the...

Read More »A Swedish giant has left us

A Swedish giant has left us Sad, sad, sad, news reached us today. One of Sweden’s greatest actors ever — Björn Granath — passed away today, aged 70. He made many great performances, but the one that has stayed with me more than any other is the portrait of the rebel Erik in Pelle the Conqueror (1987). [embedded content] “We’ll set out and conquer the world.”

Read More » Lars P. Syll

Lars P. Syll