A professor of economic history critiques MMT. MMT doesn't go far enough. It remains embedded in the present system, which itself is the root of the socio-economic problem the world faces. While Trevor Jackson agrees that MMT is descriptive of the present system, it remains too faithful to it to address emergent challenges. I have been saying this for some time but for other reasons having to do with the world system. It's past time to start thinking seriously about economic and political...

Read More »Renate Pore — Deficit is not democracy’s ‘Achilles’ heel’ (Opinion)

Articulate defense of MMT against debt phobia and deficit hysteria based on The Deficit Myth.Charleston Gazette-Mail | OpinionRenate Pore: Deficit is not democracy's 'Achilles' heel' (Opinion)

Read More »Watch “As leaks expose UK op to ‘weaken’ Russia, suppression of Grayzone reporting backfires”

After The Grayzone's Max Blumenthal reported on newly leaked documents exposing a massive UK government propaganda campaign against Russia, Twitter added an unprecedented warning label that the material "may have been obtained through hacking." Although Twitter may have intended to restrict the article, the warning had the opposite effect: it quickly went viral. Max Blumenthal and Aaron Maté discuss the suppression effort and the damning UK government leaks at the heart of it. After years...

Read More »The U.S. Air Force Just Admitted The F-35 Stealth Fighter Has Failed

The protection racket continues.But over 20 years of R&D, that lightweight replacement fighter got heavier and more expensive as the Air Force and lead contractor Lockheed Martin packed it with more and more new technology.Yes, we’re talking about the F-35. The 25-ton stealth warplane has become the very problem it was supposed to solve. And now America needs a new fighter to solve that F-35 problem, officials said.Forbes The U.S. Air Force Just Admitted The F-35 Stealth Fighter Has...

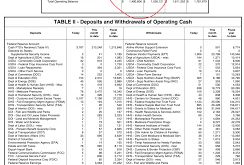

Read More »Fed systems down

Says it was an “operational problem”... ie not a technical problem..... Nobody wants to receive reserve assets? Hmmmmmmm... The Fed's system that allows banks to send money back and forth went down for several hours https://t.co/KNFxH0Uh6n— Jeff Cox (@JeffCoxCNBCcom) February 24, 2021 $70B reserves to depositories yesterday:Perhaps destabilization starting....

Read More »My new podcast episode is out.

War Watch

MintPress NewsWhat Planet Is NATO Living On?Medea BenjaminGeopolitika“We want a regime change in Russia”Maurizio BlondetSouthFront Putin: Enemies Want To Put Russia Under External Control, But They Will FailTASSPutin says Russia thwarted the activity of hundreds of foreign agents nationwideSputnik InternationalPutin: Information Campaign Exists Abroad to Undermine Russia's Achievements in MedicineThe GrayzoneReuters, BBC, and Bellingcat Participated in Covert UK Foreign Office-funded...

Read More »Researchers identify mechanism by which exercise strengthens bones and immunity

Scientists at the Children's Medical Center Research Institute at UT Southwestern (CRI) have identified the specialized environment, known as a niche, in the bone marrow where new bone and immune cells are produced. The study, published in Nature, also shows that movement-induced stimulation is required for the maintenance of this niche, as well as the bone and immune-forming cells that it contains. Together, these findings identify a new way that exercise strengthens bones and immune...

Read More »Zero Hedge — Hong Kong Market Tumbles After “Shock” Transaction Tax Hike To Pay For Government Handouts

While Hong Kong has been an outlier when it comes to taxing stock transactions, with major markets such as the U.S. and regional rival Singapore refraining, HK's action may prompt more politicians into acting to transfer some capital from the financial sector to the people. Indeed, talk of implementing a tax on financial transactions has recently been rekindled by some Democrats in the U.S. after the recent trading frenzy in GameStop Corp. shares.Zero HedgeHong Kong Market Tumbles After...

Read More »Nikkei — US And Allies To Build ‘China-free’ Tech Supply Chain

The economic and military pressure on China and Russia is leading to a military alliance and technology sharing. "Competition." Exactly the result anticipated and looked forward to by the military-industrial complex that feeds off hostility.NikkeiUS And Allies To Build ‘China-free’ Tech Supply ChainTaisei Hoyama and Yu Nakamura, Nikkei staff writersSee alsoWith his plan to build a concert of democracies to contain China, US President Joe Biden is making a grave mistake. The US and China...

Read More » Mike Norman Economics

Mike Norman Economics