A final grand distraction before the president is forced to relinquish his office is a real danger that deserves serious attention.Talk about pure evil! Donald Trump is intent on creating as much chaos as possible on his way out of the White House. Could that include saddling Joe Biden with another war in the Middle East?But a war with the mullahs—the devout wish of Iran hawks like Michael Flynn, who supported Trump from the start and who now has his ear as the White House melts down in...

Read More »OECD warns governments to rethink constraints on public spending

Fresh austerity risks a public backlash, says chief economist Laurence BooneThe economic impact of the coronavirus pandemic should transform governments’ attitude to public spending and debt, according to the chief economist of the OECD, who has warned that fresh austerity would risk a popular backlash.Laurence Boone, who has run the economics directorate at the Paris-based organisation since 2018, told the Financial Times that the public would revolt against renewed austerity or tax rises...

Read More »Chip war heats up with new Kirin 9010 for Huawei

According to an industry leaker, Huawei may be the first manufacturer to announce a 3nm chipsetChip war heats up with new Kirin 9010 for Huawei

Read More »Dialectics of government deficits — S Adikesavan

Review of Stephanie Kelton's The Deficit Myth and its application to India.The Hindu — Business Line (India)Dialectics of government deficitsS Adikesavan

Read More »Meet The Pseudo-Left Imperialists Fighting Against Universal Healthcare

On twitter AOC put out a video with her in her kitchen making dinner, while saying the problem was not left-wing or right-wing governments, it was about democratic, liberal governments and undemocratic authoritarian ones. She seemed to be implying that China, Venezuela, Bolivia, etc, were all in the firing line. So, she's another war-monger, a liberal interventionist. And I once admired Cenk Uygur too, but he's even worse. Since comedian Jimmy Dore called on progressive members of Congress...

Read More »Social Construction of Reality and Its Consequences

By deploying the brain’s ability to compress information and think abstractly, humans are the only animals on the planet who can simply make things up, agree on them as a group, and they become real. This “social reality” is a superpower that gives us far more control over reality than we might think."Reality," phenomenal that is, is subjective constructed socially and layered on physicality. The Author explains how happens through "the Five Cs: creativity, communication, copying,...

Read More »A ‘Self-Aware’ Fish Raises Doubts About a Cognitive Test

A report that a fish can pass the “mirror test” for self-awareness reignites debates about how to define and measure that elusive quality.Very few animals have ever passed the mirror test for self-recognition — even most primates fail it. The news that a fish seemed to recognize itself in one recent study has made psychologists and animal behaviorists wonder anew what (if anything) the mirror test proves.A ‘Self-Aware’ Fish Raises Doubts About a Cognitive Test

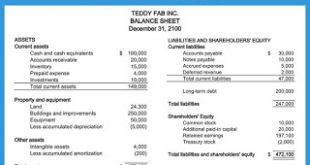

Read More »Balance Sheet

Proper Balance Sheet under Accrual Basis or Cash Basis Accounting:

Read More »Who owns Huawei?

Huawei is an independent, privately-held company. We are not owned or controlled by, nor affiliated with the government, or any other 3rd party corporation.In fact, Huawei is owned by our employees through an Employee Stock Ownership Program (ESOP) that has been in place since the beginning. No one can own a share without working at Huawei, and as of 2018 there were 96,768 shareholding employees. Our founder, Ren Zhengfei, owns a 1.14% stake in the company.Who owns Huawei?

Read More »China and International Update

The foreign minister noted that Washington may feel anxious about China’s “rapid development,” but he urged the US to focus on “self-improvement” rather than trying to “block” others from advancing. Wang stressed that as China becomes a larger player on the world stage, it will not attempt to emulate Washington’s behavior. We don't need a world where China becomes another United States. This is neither rational nor feasible. Rather, the United States should try to make itself a better...

Read More » Mike Norman Economics

Mike Norman Economics