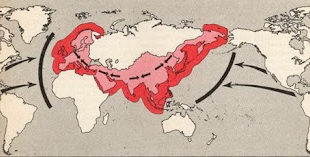

More intersection of geopolitics (control of territory) and geoeconomics (resource). Russia and Central Asia, along with Africa, which is now also in play with many US and allied bases there, on to mention Latin America, which is already ringfenced by the Monroe Doctrine, are where much of the world's natural resources are located. These areas are now part of the battleground for control in the new Great Game based on unipolarism (continued domination of the globe by the West under the...

Read More »De-Gamify The Earth — Caitlin Johnstone

Basically the problem is that our whole planet has been gamified. All the Earth’s life, resources and geography have been folded into this sick game where people commodify them into points called money, for no other reason than to score as many points as possible.Read in conjunction with the MMT analogy of money as points on scoreboard in a game.CaitlinJohnstone.comDe-Gamify The EarthCaitlin Johnstone

Read More »Structural Deficits Are Deflationary — NeilW

Neil shows how it is necessary to understand accounting along with institutional arrangements and their effects.New WaylandStructural Deficits Are DeflationaryNeilW

Read More »There’s a hurricane coming!

Literally…in Southern California. And the markets will be stormy too!

Read More »Towards a Libertarian/Austrian Modern Money Theory — L. Randall Wray

Achieving price stability through MMT but without going back to the gold standard.Real Progressives (August 16, 2023) Towards a Libertarian/Austrian Modern Money Theory L. Randall Wray | Professor of Economics, Bard CollegeOriginally posted on July 27, 2010 at the New Economic Perspectives blog

Read More »Argentina adopting US dollar to fight inflation would be ‘insane’ neocolonialism, says economist Ha-Joon Chang — Ben Norton

Right-wing politicians in Argentina want to adopt the US dollar as the national currency to fight inflation. Development economist Ha-Joon Chang said this is “insane”, warning dollarization would make the Latin American nation a “colony”.Recognition is dawning that it won't be easy for the Global South/East to break out of the neoliberal, neo-imperial, and neocolonial model. Geopolitical EconomyArgentina adopting US dollar to fight inflation would be ‘insane’ neocolonialism, says economist...

Read More »August 16, 2023

Answering a question. How are you? New flows with the things to look at?

It was the evolution of how I came about that.

Read More »Book Review — How Universal Basic Income Became the Pessimist’s Utopia — Jason Resnikoff

In Welfare for Markets, Anton Jäger and Daniel Zamora show that cash transfers emerged as an alternative to the welfare state favored by a left that had abandoned hope in socialism and a right hostile to democratic management of the economy.What exactly do David Graeber, Milton Friedman, Charles Murray, Yannis Varoufakis, and Mark Zuckerberg have in common?” It sounds like the setup to a bad joke. The punch line may not be funny exactly, but it is revealing. Although they share practically...

Read More »Like I said…first week in August market tops.

I said this months ago.

Read More » Mike Norman Economics

Mike Norman Economics