Market rallied after last week’s selloff. Cyclical peak approaching.

Read More »Help me help you!

I can’t help you if you don’t want to help yourself.

Read More »China’s “Lehman moment!” ?

Only if the BOC reacts by making the same reification error as the Fed did and adds bazillions of reserve balances “to lend out!”….China’s Lehman moment is today with Evergrande down 90%.If that follows the 2008 contagion path, markets collapse within 3-4 weeks.— Endless Capital w/ no pullbacks (@endless_frank) August 28, 2023

Read More »This was a very instructive week.

Investor (bad) behavior was SO on display!

Read More »Reactions to Fed Chair Powell’s Speech — Stephanie Kelton

Curiously to me, Stephanie does not mention the role of raising the interest rates as potentially contributing to inflation when Mike, Warren, and Bill have been doing so for some time.The LensReactions to Fed Chair Powell's SpeechStephanie Kelton | Professor of Public Policy and Economics at Stony Brook University, formerly Democrats' chief economist on the staff of the U.S. Senate Budget Committee, and an economic adviser to the 2016 presidential campaign of Senator Bernie Sanders

Read More »Was that the top?

More fiscal support coming next week but a rocky road ahead after that.

Read More »Stop Trying To Make BRICS Happen — Brian Romanchuk

BRICS was a brilliant bit of sell side marketing, but it has taken a life of its own. One needs to stop projecting fantasies onto the global financial system, and accept that its form follows function.The extreme dominance of the share of global GDP after World War II by the United States was a historical accident, and so the relative rise of other economic powers was inevitable. Meanwhile, the eagerness of the United States to use sanctions as a foreign policy tool is going to create...

Read More »William Mitchell — New feudalism seems to forget about the capitalists

Bill on feudalism and capitalism. Capitalism and feudalism are essentially different in that land is the dominant factor in feudalism and land rent is the chief means of expropriation. Under capitalism, capital and expropriation of surplus value through industrial (technological) production along with financial rents are the dominant factors, although land and land rent are also still key in generating passive income resulting from ownership (title). That is to say, capitalism and feudalism...

Read More »Nvidia. Market outlook. Show some appreciation.

Here’s what I said about Nvidia a year ago.

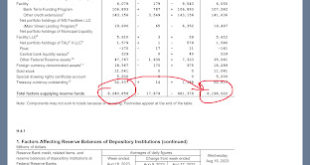

Read More »System reserves

Total System reserves took a nice 50b drop last week but it does no good if Tsy runs TGA down by almost 200b at same time.. TGA account balance supposed to be $650b…. TGA reduction increases bank deposits while banks capital still under pressure from the Fed rate increasing psychos…TGA:TGA topped at around 550b coming up out of debt ceiling and rolled over taking financial asset prices with it since late July… I think TGA should be back up to mid 400s as of yesterday’s Treasury operations…...

Read More » Mike Norman Economics

Mike Norman Economics