The 44th Annual Conference on the Political Economy of the World-System takes place during a critical juncture for both the field of world-systems analysis and for the world-system itself. The first four sessions of the conference bring together papers that reconstruct the theoretical and methodological lineages of world-systems analysis by recuperating neglected foundational texts and by putting the world-systems perspective into dialogue with other critical approaches in the social...

Read More »Reflections after the Post Keynesian Economics Workshop

By Santiago Graña Colella (Guest blogger)During my bachelor’s degree, I have little access to heterodox literature. What is worst, in most subjects, it was explained that the economy works in a particular fashion everywhere and every time, but without stating that this way was one interpretation of the economy, particularly the neoclassical interpretation. Consequently, most students do not know many alternatives to the economic theory thought to them and after five years (in Latin America)...

Read More »Mainstream Economics/Sold Out?

I recently taught a short workshop (online) on Post Keynesian Economics (PKE) for Summer Academy for Pluralist Economics. I basically discussed the definitions of heterodox and Post Keynesian economics, and some critical issues in the theory of output, employment, money and inflation, and income distribution and growth. Students were from several countries, backgrounds, disciplinary fields and stages in their academic careers (from undergraduates to PhD candidates). I will post some brief...

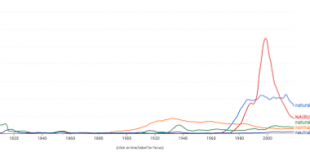

Read More »Friedman vs. Wicksell

Slowly, but steadily the Wicksellian concept of a natural, normal or neutral rate of interest is making a come back and becoming more relevant and cited than Friedman's natural rate of unemployment and its awkward twin the Non Accelerating Inflation Rate of Unemployment (NAIRU).Note that up to Friedman's infamous presidential address the normal rate dominated the field. But in all fairness, even thought it has lost space it seems that Friedman's natural rate of unemployment has a lot of...

Read More »UNCTAD INET-YSI Summer School 2020

Register here. I will be talking about Myths about monetary policy, inflation targeting and central banks.

Read More »60 Years of Sraffa’s PCMC: Watch the whole seminar here

Ed Nell, who shared his signed copy of PCMC The whole Zoominar can be watched at the Review of Keynesian Economics' (ROKE) Facebook page here. It starts early with the live-stream, you can jump to minute 49 or so and watch from the onward.

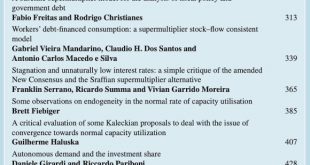

Read More »Autonomous demand, capacity utilization, and the supermultiplier

New issue of ROKE is out. Check out the free papers by Serrano, Summa and Garrido Moreira, and by Fiebiger, beyond the intro by Summa and Freitas.

Read More »60 Years of Sraffa’s Production of Commodities by Means of Commodities/ROKE Webinar

Tomorrow we will talk about this book that is the Rosetta Stone of the history of economic ideas (read post 6 below for more on that). I'm happy to have a great panel to discuss it. In the meantime below 7 previous posts on Sraffa's contributions to economics, which might be helpful for some.Sraffa and the Marshallian System Sraffa, Marx and the Labor Theory of Value (LTV) Sraffa, Ricardo and Marx The Standard Commodity and the LTV The Capital Debates Microfoundations of Macroeconomics...

Read More »Argentina: Past Industrialization Problems and Perspectives (in Portuguese)

[embedded content] Interview with Fausto Oliveira, economic journalist that produces the channel Brazilian Industrial Revolution. For those interested in the process of economic development and its relation to the process of industrialization in the periphery (and speak Portuguese) I highly recommend it.

Read More »On the Argentinean economy this Friday (in Portuguese, but okay if you speak Spanish)

More information soon with the link.

Read More » Naked Keynesianism

Naked Keynesianism