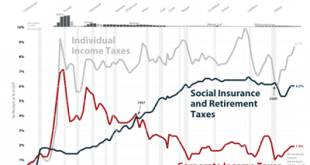

The source of the graph is here. The data can be downloaded here. I think Anwar Shaikh had a paper with a title similar to this post. And the point is well illustrated in the graph. The working class itself pays for it. Share Get link Twitter Google+

Read More »The Global Political Economy of Raúl Prebisch

Book edited by Matias Margulis is now out in print. From the blurb:The Global Political Economy of Raúl Prebisch offers an original analysis of global political economy by examining it through the ideas, agency and influence of one of its most important thinkers, leaders and personalities. Prebisch’s ground-breaking ideas as an economist – the terms-of-trade thesis and the economic case for state-led industrialization – changed the world and guided economic policy across the global South....

Read More »Student Debt, Auto Loans and Trump’s Economic Policies at the Rick Smith Show

Student Debt, Auto Loans and Trump's Economic Policies at the Rick Smith Show Ce site utilise des cookies provenant de Google afin de fournir ses services, personnaliser les annonces et analyser le trafic. Les informations relatives à votre utilisation du site sont partagées avec Google. En acceptant ce site, vous acceptez l'utilisation des cookies.En savoir plusOK ! Loading

Read More »Robert Wade on Trumponomics vs. Free Trade

Echoing some of the arguments discussed here in the blog (for a list of posts on free trade go here, and for the effect of free trade on the Trump election here, here and here) Robert Wade suggests that the economics profession defense of "Free Trade" might have something to do with the election of Trump. Wade's phrase is perfect (apparently Adrian Wood came up with it): "Like Gresham’s Law, 'alternative facts' drive out facts." The alternative fact here is the theory of comparative...

Read More »50+ Economists Warn Against Neoliberalism’s Return in Ecuador

Ahead of upcoming elections, a call for austerity and economic policies structured for the elites to be left in the nation's pastby Ha-Joon Chang, James K. GalbraithOver the past ten years, Ecuador has achieved major economic and social advances. We are concerned that many of these important gains in poverty reduction, wage growth, reduced inequality, and greater social inclusion could be eroded by a return to of the policies of austerity and neoliberalism that prevailed in Ecuador from the...

Read More »Master of Arts degree in Economics at John Jay College

The Master of Arts degree in Economics at John Jay College is a new graduate program providing both practical skills for work in economic policy, and a foundation for study at the PhD level. Located in the heart of Manhattan, it is one of a handful of graduate economics programs in the country that makes alternative perspectives a core part of the curriculum. Students at John Jay will study the history of economic thought, Marxian and Post Keynesian theory, economic history, the economics...

Read More »Latin America’s Crisis: The End of the Commodity Super-Cycle, or the Return of Neoliberalism

[embedded content] Video of the talk at Keene State College on March 20th, 2017.

Read More »How Capitalism is Killing Itself

[embedded content] Short documentary on the limits of capitalism mostly based on an interview by Richard Wolf. I find the simplistic explanation of exploitation at the end (around minute 27:30) based on the time of work (prices proportional to labor incorporated) to be problematic (for a discussion of the Labor Theory of Value, LTV go here). At any rate, worth watching whether you agree with Wolf's interpretation of Marx and capitalism or not.

Read More »Latin America’s Crisis: The End of the Commodity Super-Cycle, or the Return of Neoliberalism?

From this announcement about my talk at Keene State College today at 7pm. "Professor Vernengo will offer a public lecture and discussion of the recent slowdown in economic growth. The talk will consider the degree to which these events reflect the fall in primary commodity prices, particularly oil, or are instead the result of a return to neoliberal policy prescriptions. Dr. Vernengo is currently Full Professor of Economics at Bucknell University. He is the former Senior Manager of...

Read More »Latin American corner: Neo Fisherism, New Keynesianism and monetary policy in Latin America (II)

By Naked Keynes (Anonymous Guest Blogger)The positive relationship between nominal interest rates and inflation is not a new stylized fact in economic theory. In the 19th Century Thomas Tooke (1774-1858) considered it a general rule illustrated by the data presented in his History of Prices and the State of Circulation, 1792-1856 (published over the period 1838-1857). Tooke rationalized the positive relationship between inflation and interest rates by postulating that the interest rate...

Read More » Naked Keynesianism

Naked Keynesianism