It seems increasingly probable. Stanley Fischer suggested that is possible in his speech last weekend at Jackson Hole. My bet is that unless labor markets numbers are terrible Friday, there is a good chance there will be a minor rate increase in the next meeting. That is a bit of a surprise. It's also not a very good idea, as I noted before, and Mark Weisbrot suggests here.

Read More »Thirlwall à la Godley

Short note on Thirlwall's Law by Lance Taylor available here. As he notes on Thirlwall's Law: "Insofar as they [the conditions to generate it] are 'extreme,' the plausibility of (3) [Thirlwall's Law] is open to doubt," which is one of the points I raised in my recent debate with Jaime Ros. Causality here remains from exports to growth, which was reversed in Clavijo and Ros, but there is a healthy skepticism about the generality of the law.Arguably Godley had a version of Thirlwall's Law...

Read More »Martin Feldstein on Wall Street Instability and Interest Rate Policy

Martin Feldstein, chairman of the Council of Economic Advisers (CEA) during the Reagan administration, and one of the most influential economists in policy circles says that: "Market participants know that the economy is now essentially at full employment, that the consumer-price index is close to 2% and that there is little risk of deflation."Few things. This:Broader measure of unemployment is at 10.4%. Then this:That is, the increase in employment, for the growing population, since the...

Read More »Thirlwall’s Law debate in Investigación Económica

The other side Jaime Ros, with Pedro Hugo Clavijo, wrote a critique of Thirlwall's Law (in Spanish). Replies by Carlos Ibarra here, Esteban Pérez here and myself here. Their rejoinder here. All in Spanish. Haven't read the whole rejoinder yet (just got it), but for some reason they insist that the supermultiplier implies that exports are always the main source of autonomous demand.* Hm, that's weird. Just puzzled by that one. They should read Bortis and Serrano (this one with Fabio...

Read More »Did anyone notice the global financial crisis of 2007–2008?

By Paul DavidsonOn November 4, 2008, at the dedication of a new building, Queen Elizabeth of Great Britain visited the London School of Economics (LSE). While there she was given a briefing by academics at the LSE on the origins and effects of the global financial crisis and its resulting turmoil in international financial markets. The Queen is reported to have asked, “Why did nobody notice it developing?” The director of research at LSE told her, “At every stage someone was relying on...

Read More »Obituaries: Nathan Rosenberg (1927-2015)

E-mail was sent to the Society for the History of Economics (SHOE) informing that Nathan Rosenberg has passed away. Have not seen an obituary, but will link later. He was the author How the West Grew Rich, that suggested that freedom was central for creating the supply-side conditions for economic growth in Western Europe. Several heterodox neo-Schumpeterians used his work, in particular Inside the Black Box. Personally I prefer demand-driven stories, including for technology. At any...

Read More »China and secular stagnation

So in the last couple of weeks the Chinese problems have been in the news. And many suggest that the troubles in the US are not unrelated. For example, the New York Times tells us that according to Larry Summers: “The risks of a deflationary, secular stagnation in the US would be increased by a large devaluation of the renminbi.” And Krugman resuscitates Bernanke's global savings glut as the explanation for everything, from China's slowdown, depreciation and stock troubles to the recent...

Read More »Keynes beauty contest in the NYTimes

Still very slow posting. Will pick up in September, I hope. Here a link to a game that is representative of what Keynes referred to as the beauty contest, which described the behavior of financial markets. Keynes original quote from chapter 12 of the General Theory says that:"professional investment may be likened to those newspaper competitions in which the competitors have to pick out the six prettiest faces from a hundred photographs, the prize being awarded to the competitor whose choice...

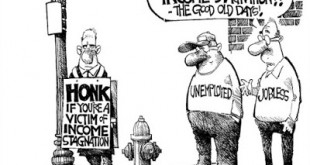

Read More »Palley on economic stagnation

Tom's new paper titled "The US Economy: Explaining Stagnation and Why It Will Persist." It's a policy problem, not a structural phenomenon. The abstract:This paper examines the major competing interpretations of the economic crisis in the US and explains the rebound of neoliberal orthodoxy. It shows how US policymakers acted to stabilize and save the economy, but failed to change the underlying neoliberal economic policy model. That failure explains the emergence of stagnation, which is...

Read More »Unemployment is unchanged and so is the Republican Party

So nothing new in the last report. 215k jobs created and unemployment rate at 5.3%. Below the employment to population ratio.It has started to go up. But there is a long way to go. By the way, in the Republican debate I didn't hear anything different as a solution for the economic problems. Tax cuts, presumably for the wealthy (job creators is not used anymore), a flat tax and even tything instead of income taxes. Deregulation always. They are for military expansion too. And yes military...

Read More » Naked Keynesianism

Naked Keynesianism