Find the errors Lars Syll had a while ago a top 10 list of econ books. So here is my list of the best from the 20th century. Some are there because they are influential, some because I think they are truly the best, and all because in some way they influenced my views. The list by chronological order:1. Imperial Germany and the Industrial Revolution (1915) by Thorsten Veblen 2. The General Theory of Employment, Interest and Money (1936) by John Maynard Keynes 3. The Great...

Read More »Phishing for phools

I've been trying to read this. Not a huge fan of the field of behavioral economics (or here; subscription required). Don't get me wrong, yes, it provides some critiques of elements of the mainstream (marginalist) approach, regarding essentially the notion of individual rationality, as did the work of, say, Herbert Simon, in the past. People don't tend to act in a rational way, at least not in the substantive way that is prescribed by the mainstream.Evidence on the notion of universal...

Read More »On the return of the natural rate of interest

The natural rate is an old concept, well explained in Wicksell, that almost vanished (Keynes was explicitly against it, even though he partially failed to get rid of it), and has made a come back with the Neo-Wicksellian model that dominates macro today (misnamed New Keynesianism). Below the estimates published in the speech by John Williams. Note that what seems to drive the natural rate of interest is the basic rate determined by the central bank. Either the fall of the natural rate...

Read More »151,000 jobs created last month

Jobs numbers out today. Employment increased by 151,000 in August, and the unemployment rate is still at 4.9% according to the Bureau of Labor Statistics (BLS) report. This suggests that the slow recovery continues, and that to hike the rate of interest as it seems Janet Yellen suggested last week at Jackson Hole would be a mistake. By the way, Bill Gross, which sometimes sounds reasonable on spending and the effects of fiscal policy (or did in the past) suggested as an innovative solution...

Read More »On Tax Havens at the Rick Smith Show

[embedded content]

Read More »The Mediatic-Parliamentary Coup in Brazil

President Dilma Rousseff was finally toppled down today. Yes, it's a coup, different in nature to the previous ones (last in Brazil was in 1964), but with the same consequences. I have discussed the nature of the process here, here, here, and here (this last more on the economy, from last year) before. It is a coup that has received discrete support from the US government, by the way, as much as the elected neoliberal government of Macri in Argentina (Obama visited the latter, a...

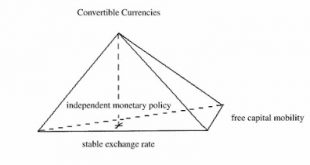

Read More »The Impossible Trinity Revisited

The Economist's brief is available here (subscription required). I have discussed the limitations of the Mundell-Fleming model in some posts (here and here, for example). But I have not discussed the limits to the trilemma fully. In this paper, I argue that under certain circumstances, associated to what Ben Cohen calls the geography of money, the trilemma might not hold. The countries at the top of the pyramid with convertible currencies do not face the harsh trade offs of the countries at...

Read More »Top marginal income tax rate in developed countries

From the new book Tax the Rich: A History of Fiscal Fairness in the United States and Europe by Kenneth Scheve and David Stasavage. Switzerland always at the bottom. More interesting is that Norway and Sweden are not at the top of the list.

Read More »Robert Blecker on Thirlwall’s Balance of Payments Constrained Growth

New paper available here. From the abstract: Several recent critiques have questioned the theoretical logic of standard models of balance-of-payments-constrained growth (BPCG) and the empirical support for ‘Thirlwall’s Law’. On the empirical side, critics charge that most econometric estimates of this model have effectively only tested whether exports and imports grow at similar rates in the long-run. On the theoretical side, the criticisms have focused on the role of foreign income...

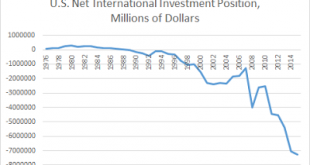

Read More »US Net International Investment Position

Nothing much changed since I posted on this a couple of years ago. The U.S. net international investment position at the end of the first quarter of 2016 was −$7.5 trillion, which corresponds to about 40% of GDP, higher than two years ago. But no real problem in my view Note that this is the sort of number that economists show when they want to suggest a possible run on the dollar, and the demise of its role as a reserve currency. The last report by the Bureau of Economic Analysis (BEA) is...

Read More » Naked Keynesianism

Naked Keynesianism