[embedded content]

Read More »Latin America turn to the right and American policy

Tom Jobim said that Brazil was not for beginners, and he was right. The Brazilian economy is in free fall. As I noted before the causes are strictly internal, and not related to any fiscal problem. Inflation was low, even if closer to the top margin of the inflation target. Devaluation of the currency has led to higher inflation, on the low two digit level, just slightly above 10%. At the same time, fiscal contraction has led to a collapse of about 3.5% of GDP last year. There is little need...

Read More »Fed holds on the interest rate hike, for now

From the Federal Reserve Board press release: "The Committee currently expects that, with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace and labor market indicators will continue to strengthen. However, global economic and financial developments continue to pose risks. Inflation is expected to remain low in the near term, in part because of earlier declines in energy prices, but to rise to 2 percent over the medium term as the...

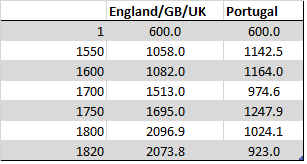

Read More »Free trade and Portuguese decline

Last weekend, as a result of Brad DeLong's post on free trade, we had a brief Twitter exchange. He had suggested that the Heckscher-Ohlin (HO) model* implies gains from trade associated to comparative advantage. He went further and suggested, after I implied that the Methuen Treaty between England and Portugal had not been favorable to the latter, that Portugal had indeed benefited greatly from free trade.It is important to note, before we get to Portugal, that the HO model, which is a...

Read More »Argentina and global integration

Decent Vultures A short note in Spanish for Página/12 on the new direction of the Macri's government, with the emphasis on free trade and financial deregulation. Will try to post something longer in English later this week.

Read More »Budget’s exercise to achieve financial stability at cost of real economy in India

By Sunanda Sen* (Guest Blogger)Success achieved by the Indian economy , as highlighted in the recent budget of the central government rests on four pillars which include current GDP growth rate at 7.6%, drop in inflation ( as measured by the CPI index) around 6%, a record stock of official reserve at $350bn and most importantly, a reduced fiscal deficit at 3.5% of current GDP.Looking beyond the official figures to convey the positive note, one comes across reservations; first that the GDP...

Read More »Tom Palley on Paul Krugman and Free Trade

Tom's new post titled 'Self-Protectionist Moment: Paul Krugman Protects Himself and the Establishment' criticizes Krugman's role as an establishment economist and defender of free trade. He says: Paul Krugman has a new op-ed ('A Protectionist Moment?') in which he tries to walk away from his own contribution as an elite trade economist to the damage done by globalization, while also lending his political support to Hillary Clinton and the neoliberal globalization wing of the Democratic...

Read More »Free trade loses political support

Wall Street Journal notes the obvious, given the US presidential campaign. Here some old entries that explain the theoretical problems with "free trade." Some are more theoretical (first three) and others more in tune with the issues related to Free Trade Agreements (FTAs) and Bilateral Investment Agreements (BITs).On 'free' and managed trade (Ricardian model)More on "free" trade (HOS model)Free trade again (on the role of absolute rather than comparative advantage)On free trade and...

Read More »Wealth of Nations at 240

Last month Keynes' General Theory was 80. Today Adam Smith's Wealth of Nations turns 240 (h/t Paulo Gala)! Below the often misunderstood quote on the notorious invisible hand. He says: "As every individual, therefore, endeavours as much as he can both to employ his capital in the support of domestic industry, and so to direct that industry that its produce may be of the greatest value; every individual necessarily labours to render the annual revenue of the society as great as he can. He...

Read More »Desegregation and dissent at MIT’s PhD program

I read recently this paper (subscription required) by Sandy Darity and Arden Kreeger in HOPE. in the paper they show how the 1970s efforts to attract more African-American PhD students were eventually abandoned, since faculty deemed the project a failure. They argue that the: "factor that shaped the MIT faculty’s conclusion that the experiment had failed was their impression that black graduate students—particularly when they entered the program in sufficiently large numbers to form a Black...

Read More » Naked Keynesianism

Naked Keynesianism