Read More »

Reported coronavirus cases worldwide – map

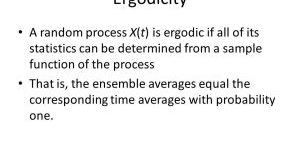

Ergodicity: a primer

from Lars Syll Why are election polls often inaccurate? Why is racism wrong? Why are your assumptions often mistaken? The answers to all these questions and to many others have a lot to do with the non-ergodicity of human ensembles. Many scientists agree that ergodicity is one of the most important concepts in statistics. So, what is it? Suppose you are concerned with determining what the most visited parks in a city are. One idea is to take a momentary snapshot: to see how many people...

Read More »Coronavirus impact on stock markets – graph

Pandemics: lessons looking back from 2050

from Fritjof Capra and Hazel Henderson Imagine, it is the year 2050 and we are looking back to the origin and evolution of the coronavirus pandemic over the last three decades. Extrapolating from recent events, we offer the following scenario for such a view from the future. As we move into the second half of our twenty-first century, we can finally make sense of the origin and impact of the coronavirus that struck the world in 2020 from an evolutionary systemic perspective. Today, in...

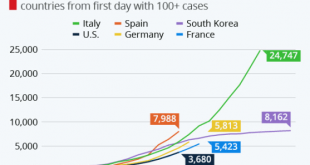

Read More »Cumulative number of deaths by number of days for 11 countries

Coronavirus: upward trajectory or flattened curve?

Machine learning — puzzling ‘big data’ nonsense

from Lars Syll If we wanted highly probable claims, scientists would stick to low-level observables and not seek generalizations, much less theories with high explanatory content. In this day of fascination with Big data’s ability to predict what book I’ll buy next, a healthy Popperian reminder is due: humans also want to understand and to explain. We want bold ‘improbable’ theories. I’m a little puzzled when I hear leading machine learners praise Popper, a realist, while proclaiming...

Read More »Prepare for the coronavirus global recession

from Larry Elliot in The Guardian Travel bans. Sporting events cancelled. Mass gatherings prohibited. Stock markets in freefall. Deserted shopping malls. Get ready for the Covid-19 global recession. Up until a month ago this seemed far-fetched. It was assumed that the coronavirus outbreak would be a localised problem for China and that any spillover effects to the rest of the world could be comfortably managed by a bit of policy easing by central banks. When it became clear that Covid-19...

Read More »Statistical models for causation — a critical review

from Lars Syll Causal inferences can be drawn from nonexperimental data. However, no mechanical rules can be laid down for the activity. Since Hume, that is almost a truism. Instead, causal inference seems to require an enormous investment of skill, intelligence, and hard work. Many convergent lines of evidence must be developed. Natural variation needs to be identified and exploited. Data must be collected. Confounders need to be considered. Alternative explanations have to be...

Read More » Real-World Economics Review

Real-World Economics Review