Source: piketty.pse.ens.fr/ideology.et

Read More »Facts & Values: Distinction or Dichotomy?

from Asad Zaman This continues from the previous post on the Downfall of Rhetoric in 20th Century Even though our goal is to explain how apparently objective looking statistics conceal arbitrary and subjective judgments, the path we take requires a detour through “epistemology”, or the theory of knowledge. Instead of the deep discussion provided by Putnam (2002, Collapse of the Fact/Value Dichotomy), we will take a shortcut, and look at how these philosophical debates and controversies...

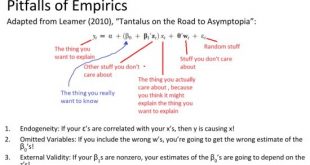

Read More »Econometrics — the scientific illusion of an empirical failure

from Lars Syll Ed Leamer’s Tantalus on the Road to Asymptopia is one of yours truly’s favourite critiques of econometrics, and for the benefit of those who are not versed in the econometric jargon, this handy summary gives the gist of it in plain English: Most work in econometrics and regression analysis is made on the assumption that the researcher has a theoretical model that is ‘true.’ Based on this belief of having a correct specification for an econometric model or running a...

Read More »2 new WEA books

“This stimulating book provides a clear account both of what Modern Monetary Theory entails and of the many objections to it. Its great value is that it will make readers have to think for themselves through many fundamental issues of macro-economic theory and policy.” – Charles Goodhart, London School of Economics Few concepts have attracted more publicity and less conceptual scrutiny as the term ‘complexity’ in economics. Therefore, this volume is a most welcome contribution.” –...

Read More »The coronavirus could wreck the economy. These steps would help limit the damage

from Dean Baker and Jared Bernstein Though we don’t yet know the extent of its threat, a widespread coronavirus epidemic in the United States is increasingly possible. In addition to the downright scary health consequences, we think the virus will quickly do serious damage to the U.S. economy, reducing growth in at least the first half of this year, pushing up unemployment and possibly ending the historically long expansion. And we’re far from alone. The economic challenges posed by...

Read More »Downfall of rhetoric in 20th century

from Asad Zaman One of most effective and powerful among modern forms of rhetoric is the use of statistics to conceal the ancient methods for persuasion. How this is done is the main topic of our essay. In a sequence of posts ( Lies, Damned Lies, and Statistics, Subjectivity Concealed in Index Numbers, The Values of a Market Society, Cross-Country Comparisons of Wealth, and Purchasing Power Parity), I have tried to explain how the statistics we use conceal arbitrary value judgments. This...

Read More »Econometrics — a crooked path from cause to effect

from Lars Syll In their book Mastering ‘Metrics: The Path from Cause to Effect Joshua Angrist and Jörn-Steffen Pischke write: Our first line of attack on the causality problem is a randomized experiment, often called a randomized trial. In a randomized trial, researchers change the causal variables of interest … for a group selected using something like a coin toss. By changing circumstances randomly, we make it highly likely that the variable of interest is unrelated to the many other...

Read More »Anchored in neoclassical theory

Despite growing diversity in research, the theory flow of economics, often referred to as neoclassical, continues to dominate teaching and politics. It developed in the 19th century as an attempt to apply the methods of the natural sciences and especially physics to social phenomena, In the search for an “exact” social science, social relationships are abstracted to such an extent that calculations are possible. The neoclassical economics department primarily poses a question: How do...

Read More »Purchasing Power Parity

from Asad Zaman In a sequence of posts starting with Lies, Damned Lies, and Statistics, I have argued that the attempt to reduce multiple indicators to one number always introduces subjective elements relating to choice of factors, and relative weights to be assigned. By using technical jargon to justify choice of weights, the value judgments involved in this choice are concealed under a cloak of objectivity. This creates a modern form of rhetoric, where the arguments are made using...

Read More »Do stockholders look forward to a decade of very low returns?

from Dean Baker In spite of completely missing the crash of the stock bubble in 2000-2002 and the housing bubble in 2007-2010, people tend to think that the big actors in the stock market have great insight into the economy’s prospects. While I won’t claim to have a crystal ball that predicts the future of the economy (I had warned of both of those crashes), I did learn arithmetic in third grade. There are some simple and important statements we can make about future stock returns, based...

Read More » Real-World Economics Review

Real-World Economics Review