from Lars Syll Empirical efforts at testing the correctness of the rational expectations hypothesis have resulted in a series of empirical studies that have more or less concluded that it is not consistent with the facts. In one of the more well-known and highly respected evaluation reviews made, Michael Lovell (1986) concluded: it seems to me that the weight of empirical evidence is sufficiently strong to compel us to suspend belief in the hypothesis of rational expectations, pending the...

Read More »MasterCard, Bill Gates and their “war on cash”

from Norbert Haering and the current issue of RWER If people write about a war on cash, even well-meaning readers will tend to think of them as doomsayers with paranoid tendencies. However, many will have second thoughts if they hear that there is indeed a Better Than Cash Alliance, which has the goal of replacing cash by digital payments on a global scale, and that this Alliance is doing this with the explicit support of the government of the 20 most powerful countries. The term “war on...

Read More »Econometrics — analysis with incredible certitude

from Lars Syll There have been over four decades of econometric research on business cycles … But the significance of the formalization becomes more difficult to identify when it is assessed from the applied perspective … The wide conviction of the superiority of the methods of the science has converted the econometric community largely to a group of fundamentalist guards of mathematical rigour … So much so that the relevance of the research to business cycles is reduced to empirical...

Read More »Hickel response on degrowth

from Dean Baker [This is the last piece in an exchange with Jason Hickel on growth.My last piece is here.] Baker says “I am at a loss to understand why we would have a war on growth.” I don’t know why he is at a loss. I explained the reasons for this in my previous post. There are two I focus on. (1) Because growing the GDP means growing energy demand, and this makes the task of switching to renewable energy significantly more difficult (nearly three times more difficult between now...

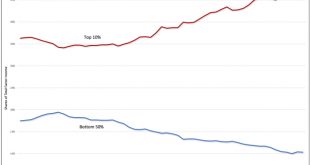

Read More »Dollarization in the United States

from David Ruccio The United States is increasingly becoming dollarized. That’s because, for decades now, those at the bottom have been left behind, forced to attempt to get by in ever more precarious conditions. If you asked mainstream economists what dollarization means, they would immediately define it as a country officially adopting the currency of another for financial transactions. Often, of course, that currency has been the U.S. dollar, as was the case for Ecuador in January...

Read More »Your model is internally consistent? So what!

from Lars Syll ‘New Keynesian’ macroeconomist Simon Wren-Lewis has a post on his blog discussing how evidence is treated in modern macroeconomics (emphasis added): The unique property that DSGE models have is internal consistency. Take a DSGE model, and alter a few equations so that they fit the data much better, and you have what could be called a structural econometric model. It is internally inconsistent, but because it fits the data better it may be a better guide for policy. Being...

Read More »Trade: It’s still about class, not country

from Dean Baker While Donald Trump keeps taking wild shots in his trade wars with China and other countries, the media have been cheering him on in at least one aspect of his campaign. All the elite types agree that “we” have an interest in clamping down on China’s alleged theft of our intellectual property. While some “we” might share that interest, most of the country does not. Just to be clear on the agenda here, the alleged theft takes three forms. The first is what passes for actual...

Read More »issue no. 86 of the real-world economics review

real-world economics reviewissue no. 86 download whole issue Who is behind the campaign to rid the world of cash?Norbert Haering download 2 The trouble with human capital theoryBlair Fix download 15 A progressive trade policyDean Baker download 33 The transformational role of the Great RecessionConstantine E. Passaris download 45 Realizing nudging’s potentialJohn F. Tomer download 66 A comment on corporationsPeter Radford download 83 The...

Read More »Demise of the Dollar?

from Asad Zaman SADLY, it is true that ‘money makes the world go round’. But, it is also true that very few people understand how. This article is an attempt at explaining the basics of our global trading system. A good starting point is the Bretton-Woods conference which took place in 1944, while the Second World War was still raging. The two World Wars had drained the treasuries of the European states, making the gold standard impossible to maintain. An entirely new system had to be...

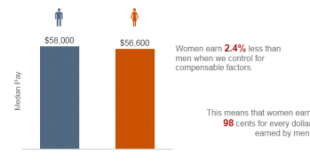

Read More »‘Controlling for’ — a methodological urban legend

from Lars Syll Trying to reduce the risk of having established only ‘spurious relations’ when dealing with observational data, statisticians and econometricians standardly add control variables. The hope is that one thereby will be able to make more reliable causal inferences. But — as Keynes showed already back in the 1930s when criticizing statistical-econometric applications of regression analysis — if you do not manage to get hold of all potential confounding factors, the model risks...

Read More » Real-World Economics Review

Real-World Economics Review