Read More »

Cheap fun with the stock market, arithmetic and CEO pay

from Dean Baker Everyone with a 401(k) has been impressed by the stock market’s run-up in recent years. Even adjusting for inflation, the S&P 500 is more than 20 percent higher than its peak in the 1990 stock bubble. Of course, the economy is nearly 40 percent larger, which makes the run-up somewhat less striking. Nonetheless, the ratio of stock prices to corporate earnings is at unusually high levels. According to data from Nobel Laureate and economist Robert Shiller, the current...

Read More »DSGE models in the ‘New Keynesian’ repair shop

from Lars Syll The problem of the DSGE-models (and more generally of rational expectations macroeconomic models) is that they assume extraordinary cognitive capabilities of individual agents. Recent developments in other disciplines including psychology and brain science overwhelmingly document that individual agents struggle with limited cognitive abilities, restricting their capacity to understand the world. As a result, individual agents use small bits of information and simple rules...

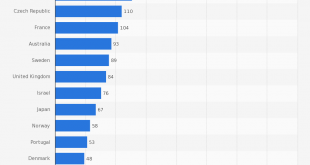

Read More »Ratio between CEOs and average workers in world by country

A realist approach to econometrics

from Asad Zaman The talk linked below explains why the positivist/nominalist methodology used in Econometrics leads to mostly nonesense regressions. It also explains how a realist alternative can be developed. “The Philosophy and Techniques for Quantitative Research” – Keynote Address by Dr. Asad Zaman, VC PIDE at Workshop on 19-20 April, 2018 Dept of Economics, Fatima Jinnah Women’s University, Rawalpindi, Pakistan. My message will come as a surprise to students gathered here to learn...

Read More »The pretense-of-knowledge syndrome

from Lars Syll What does concern me about my discipline … is that its current core — by which I mainly mean the so-called dynamic stochastic general equilibrium approach — has become so mesmerized with its own internal logic that it has begun to confuse the precision it has achieved about its own world with the precision that it has about the real one … While it often makes sense to assume rational expectations for a limited application to isolate a particular mechanism that is distinct...

Read More »Economies, carbon dioxide and the atmosphere

In April the concentration of carbon dioxide in the atmosphere exceeded an average of 410 parts per million (ppm). Before the Industrial Revolution, carbon dioxide levels did not exceed 300ppm in the last 800,000 years. (Scripps Institution of Oceanography)

Read More »Facebook: The sorry company

from Dean Baker Earlier this month, Facebook CEO Mark Zuckerberg apologized to Congress for allowing improper access to the data of tens of millions of Facebook users. This was just one of a long sequence of apologies that Zuckerberg has made for this and other failures of the social media giant. Given this track record, it’s probably will not the last apology that Zuckerberg has to make for his company. It is long past time for Congress to take action so that Zuckerberg does not have to...

Read More »Mathematics and economics

from Lars Syll Many mainstream economists have the idea that because heterodox people — like yours truly — often criticize the application of mathematics in economics, we are critical of math per se. This is totally unfounded and ridiculous. I do not know how many times I have been asked to answer this straw-man objection to heterodox economics. No, there is nothing wrong with mathematics per se. No, there is nothing wrong with applying mathematics to economics. Mathematics is one...

Read More »Citigroup Plutonomy Reports update

from Edward Fullbrook “Plutonomy” is the word that Wall Street and City bankers use in private to designate the political economy in which they operate and in which today we all live. They go to great trouble to keep us 99% ignorant of their perceptions of today’s economic and political realities, and which their “plutonomy” concept reveals. In November 2010, I put up the post Citigroup attempts to disappear its Plutonomy Report #2 which was viewed over 40,000 times. It included links...

Read More » Real-World Economics Review

Real-World Economics Review