from Lars Syll It is widely recognized but often tacitly neglected that all statistical approaches have intrinsic limitations that affect the degree to which they are applicable to particular contexts … John Maynard Keynes was perhaps the first to provide a concise and comprehensive summation of the key issues in his critique of Jan Tinbergen’s book Statistical Testing of Business Cycle Theories … Keynes’s intervention has, of course, become the basis of the “Tinbergen debate” and is a...

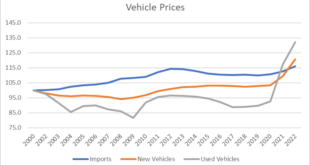

Read More »The future of vehicle prices

from Dean Baker On a lazy Friday afternoon, a person’s thoughts naturally turn to car price indexes. There is actually a reason that I became interested in this topic. I noticed that in the January Consumer Price Index, the new vehicle index rose 0.2 percent. The December measure was revised up due to new seasonal adjustment factors so that what had been reported as a 0.1 percent decline last month is now reported as a 0.6 percent increase. I was inclined to think this was an aberration...

Read More »Economics as religion

from Lars Syll Contrary to the tenets of orthodox economists, contemporary research suggests that, rather than seeking always to maximise our personal gain, humans still remain reasonably altruistic and selfless. Nor is it clear that the endless accumulation of wealth always makes us happier. And when we do make decisions, especially those to do with matters of principle, we seem not to engage in the sort of rational “utility-maximizing” calculus that orthodox economic models take as a...

Read More »Invisible hand and unmentionable foot

from Duncan Austin . . . it is an empirical matter whether the Hand is stronger than the Foot, or vice-versa. Unfortunately, various environmental and social trajectories indicate that the Foot is now overpowering the Hand in important ways. Note that the situation is not that markets are outright ‘good’ or ‘bad’ – as polarizing capitalism-versus-socialism debates so often quickly descend to – but rather how helpful or harmful current markets are based on how well they...

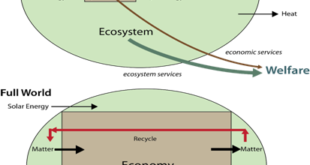

Read More »Further growth has become uneconomic: The diagram the World Bank refused

from Herman Daly and RWER issue 102 Let’s draw a big circle around the rectangle and label it “”Environment”. The Earth-environment, let us say, has one input from space, solar energy, and one output back to space, waste heat. No significant material inputs from or outputs to space.[1] Materials circulate as energy flows through the environment. The inputs to the economy come from the containing finite environment and constitute depletion, a cost. The final outputs return to the...

Read More »The difference between logic and science

from Lars Syll In mainstream economics, both logic and mathematics are used extensively. And most mainstream economists sure look upon themselves as “twice blessed.” Is there any scientific ground for that blessedness? None whatsoever! If scientific progress in economics lies in our ability to tell ‘better and better stories’ one would, of course, expect economics journals to be filled with articles supporting the stories with empirical evidence confirming the predictions. However, the...

Read More »Origins and consequences of US monetary hegemony

from Asad Zaman The two World Wars in the 20th century depleted the gold stocks of European governments and made a return to the (UK Sterling based) gold standard impossible. This led to the Bretton Woods conference of 1944, where leaders of the world came together to find an alternative, non-gold-based, global trading system. John Maynard Keynes brought a proposal for a symmetric trading system, but it was rejected in favor of the dollar standard, which transferred global hegemony from...

Read More »Rolling Stones Mono #shorts Aftermath (US)

Including Paint It Black which was not on the UK version of Aftermath 2016 ABKCO Records, 2023 reissue

Read More »Rolling Stones Mono #shorts Aftermath (UK)

2023 ABKCO Records reissue of 2016 the Mono boxset Colored vinyl

Read More »MOFI #shorts One-Step OTB

Great tune, excellent musicianship, fabulous recording Mobile Fidelity Sound Labs Krieg did a great job on this one!

Read More » Real-World Economics Review

Real-World Economics Review