Old charters still shed light on recent monetary developments… While in the Leeuwarden archive, investigating 19th century quantities and insurance prices of clay soil hay in central Friesland (a coastal part of the Netherlands) I got sub-focused and found myself thumbing through the Frisian ‘Charter books’ (internet version here). These books contain all Frisian government ‘oorkonden’ from the end of the fifteenth century onwards. ‘Oorkonden’ literally translates as ‘ear messages’. And...

Read More »Mainstream economics — a vending machine view

from Lars Syll The theory is a vending machine: you feed it input in certain prescribed forms for the desired output; it gurgitates for a while; then it drops out the sought-for representation, plonk, on the tray, fully formed, as Athena from the brain of Zeus. This image of the relation of theory to the models we use to represent the world is hard to fit with what we know of how science works. When applying deductivist thinking to economics, economists usually set up ‘as if” models...

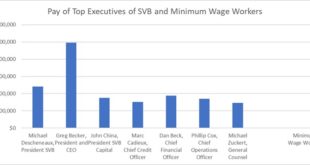

Read More »Silicon Valley Blues

from Peter Radford The circumstances of Silicon Valley Bank are well rehearsed by now. The bank sat at the epicenter of the tech-bro start-up ecosystem and played a pivotal role in the collection and disbursement of all the cash that flows through that system. It was an extremely odd bank. Unlike the everyday banks most of us deal with it had very few deposits that originated from regular customers. Most of its deposit base consisted of the chunky piles of cash belonging to start-ups...

Read More »SVB was Donald Trump’s bailout

from Dean Baker There are two key points that people should recognize about the decision to guarantee all the deposits at Silicon Valley Bank (SVB): It was a bailout Donald Trump was the person responsible. The first point is straightforward. We gave a government guarantee of great value to people who had not paid for it. We will get a lot of silly game playing on this issue, just like we did back in 2008-09. The game players will tell us that this guarantee didn’t cost the government a...

Read More »The answer to the Silicon Valley bank bailout: Federal Reserve Banking

from Dean Baker Word from the grapevine is that the risk of contagion may cause the Fed or the FDIC to engineer some sort of bailout of uninsured deposits, where they get paid back in full, instead of being forced to accept a partial loss on deposits over $250k. That would be unfortunate, since the people who run these companies that have large deposits are supposed to be brilliant whizzes, who should be able to understand things like FDIC deposit insurance limits. Their incessant...

Read More »Weekend satire: The key to managing inflation? Higher wages

from Blair Fix To manage inflation, governments have a simple tool at their disposal: raise wages as fast as possible.— Milton Fryman For the last few months, I’ve been diving into the economics of inflation. In this post, I’m excited to review some forgotten history. Our journey starts with a basic question: what is the key policy tool for managing the rate of inflation? According to mainstream economics, the key tool is the rate of interest. Hike this rate, economists argue, and you...

Read More »Getting causality into statistics

Lars Syll Because statistical analyses need a causal skeleton to connect to the world, causality is not extra-statistical but instead is a logical antecedent of real-world inferences. Claims of random or “ignorable” or “unbiased” sampling or allocation are justified by causal actions to block (“control”) unwanted causal effects on the sample patterns. Without such actions of causal blocking, independence can only be treated as a subjective exchangeability assumption whose justification...

Read More »Cryptocurrency after FTX

from Jamie Morgan If you think cryptocurrency is priapic capitalism’s latest attempt to dick you, you are probably not alone. In the last year or so most people’s perception of cryptocurrency has fallen about as far as it could. Opinion, much like the value and solvency of the assets, has plummeted from ‘the sky’s the limit’ to a soft sewage-landing. Great swathes of the population of the US and UK invested in cryptocurrency over the pandemic period. Since then, a swift spiral of...

Read More »Econometric fictionalism

from Lars Syll If you can’t devise an experiment that answers your question in a world where anything goes, then the odds of generating useful results with a modest budget and nonexperimental survey data seem pretty slim. The description of an ideal experiment also helps you formulate causal questions precisely. The mechanics of an ideal experiment highlight the forces you’d like to manipulate and the factors you’d like to hold constant. Research questions that cannot be answered by...

Read More »Wolf knows better. I know he knows

from Peter Radford What am I supposed to make of this? Martin Wolf, someone whose work I always pay attention to, flubs it and leaves us with a partial picture. That’s unlike him. Perhaps it was the editing? In any case the notion that the UK needs to generate more savings, which is what Wolf is arguing in his recent Financial Times article, needs a slight augmentation in his basic analysis. The problem begins when he says that “Investment is financed by savings”. This is a very...

Read More » Real-World Economics Review

Real-World Economics Review