from Dean Baker Mark Twain famously quipped that everyone always talks about the weather, but no one ever does anything about it. (This was before global warming.) In the same vein, it is common for people to rant about billionaires, like Rupert Murdoch and Elon Musk, controlling major media outlets and using them to advance their political whims. But, no one seems to do anything about it. There is a reason for inaction. For the foreseeable future, it is hard to envision a political...

Read More »Mainstream economics — a methodological strait-jacket

Jamie Morgan: To a member of the public it must seem weird that it is possible to state, as you do, such fundamental criticism of an entire field of study. The perplexing issue from a third party point of view is how do we reconcile good intention (or at least legitimate sense of self as a scholar), and power and influence in the world with error, failure and falsity in some primary sense; given that the primary problem is methodological, the issues seem to extend in different ways from...

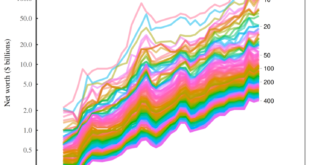

Read More »Weekend read – The Great Gatsby curve among America’s über rich

from Blair Fix Economists are not known for their literary imaginations. Flip through any economics textbook and you’ll find a barrage of terms like the ‘Philips curve’ and the ‘Fisher effect’. The jargon is simple enough — empirical relations are usually named after the person who discovered them. But this convention is neither descriptive nor fun. The exception to this vanilla naming practice is a pattern called the ‘Great Gatsby curve’.1 It’s named after F. Scott Fitzgerald’s famous...

Read More »WEA Conference: CAPITALISM, SOCIALISM AND DEMOCRACY 80 YEARS LATER

2024 WEA Online Conference. CAPITALISM, SOCIALISM AND DEMOCRACY 80 YEARS LATER – the relevance of the issues raised by Schumpeter On the WEA Conference website, you can find all the details for submissions and participation: https://schumpeter2024.weaconferences.net/ Starting from Schumpeter’s book, this WEA Online Conference, led by Arturo Hermann and Maria Alejandra Madi, would promote an open debate on how these concepts of Capitalism, Socialism and Democracy characterise our...

Read More »Economics and the way the world works

from Lars Syll With any phenomenon of interest, understanding its nature or essential properties allows us to relate to, or interact with, it in more knowledgeable and competent ways than would otherwise be the case … A surprising number of social theorists, when embarking on substantive analyses, pay almost no attention at all to insights bearing on the nature of these (or any other) factors. Instead, the preferred option is to select the types of methods, procedures or tools to be...

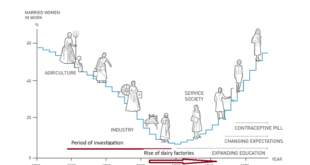

Read More »Claudia Goldin, inspirational

Claudia Goldin won the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel. I can write about her work. But here, I will be inspired by her work. One of the events she emphasizes is that women’s participation in the ‘GDP’ labor market became less after say 1860, as shown in the figure. Below I will investigate if this model (this is a model) can be used for the interpretation and analysis of my data on long-term agricultural development (yes, it can). The...

Read More »Green education

from Maria Alejandra Madi For instance, the growing quantity of legal proceedings pertaining to passivity on climate change represents a noteworthy advancement in the endeavour to safeguard the natural environment. The high-profile legal case known as the “Case of the Century” in France has garnered significant attention, as non-governmental organisations (NGOs) have levied accusations against the French state for its perceived inadequate efforts in addressing climate change....

Read More »The current state of game theory

from Lars Syll Back in 1991, when yours truly earned his first PhD with a dissertation on decision making and rationality in social choice theory and game theory, I concluded that “repeatedly it seems as though mathematical tractability and elegance — rather than realism and relevance — have been the most applied guidelines for the behavioural assumptions being made. On a political and social level, it is doubtful if the methodological individualism, ahistoricity and formalism they are...

Read More »Weekend read – An order of men

from Peter Radford And women in this more enlightened era. One of the great ironies of the last few decades is the ascendancy of “individualistic” thinking in economic theory combined with the primacy of the “collective” we call the corporation in the real world. The two offer highly contrasting explanations of how economic activity takes place. The one is based upon relationships between individuals acting rationally and equipped with amounts of information — and, presumably, the...

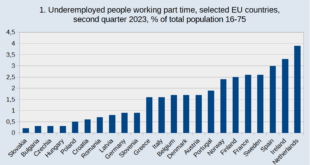

Read More »Broad unemployment in Southern Europe. Down, but…

Eurostat recently published new data on EU unemployment. The question: how is Southern Europe doing, after the Great Financial Crisis of 2009 when unemployment rates in Spain and Greece were above 20 and even 25%? Compared with the years directly after 2009 Spanish and Greek rates are down a lot, even when levels are still above 10%. But this is not all there is. Next to ‘normal’ unemployment, which is still at a crisis level, economic statisticians also define broad unemployment as...

Read More » Real-World Economics Review

Real-World Economics Review