I gave this talk today (October 7th 2017) to the Green Party Annual Conference at the invitation of Natalie Bennett, the previous leader of the Greens. Natalie chaired my session and the very lively question and answer session that followed it.

Read More »OECD New Approaches to Economic Challenges: Can We Avoid Another Financial Crisis?

This is one of the highlights so far of my life as a rebel economist: giving an invited talk at the OECD. The OECD was one of the formal economic policy groups that wildly misinterpreted the economic data of 2007, believing that it heralded "sustained growth in OECD economies ... underpinned by strong job creation and falling unemployment.” Five years later, they established the New Approaches to Economic Challenges (NAEC) initiative, and they're trying to expand the horizons of economics...

Read More »A quick introduction to modelling in Minsky & preview of the next release

Minsky (the Open Source system dynamics program specifically designed to support monetary macroeconomics, downloadable from https://sourceforge.net/projects/minsky/) is difficult for economists to use, not because it has a poor interface, but because economists are simply unfamiliar with the methods of system dynamics, whereas they are second nature to engineers. In this brief lecture (about 90 minutes), I show how to model both a flowchart model and a double-entry bookkeeping model in...

Read More »The Raconteur Files: how I developed my analysis of credit and crises

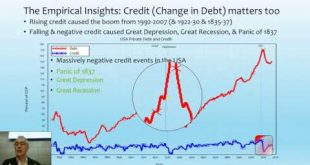

This is a rather extempore talk compared to my usual: no Powerpoint slides, but lots of swapping between papers by Minsky, models in Minsky, Mathcad files to show how I developed my mathematical models, and to show the over the top levels of debt that first financed the booms of the 1990s-early 2000s, and then caused the crisis of 2008 and the subsequent slump.

Read More »Launch of the Polish translation of Debunking Economics

This is the talk I gave in the beautiful city of Poznan at the launch of the Polish translation of Debunking Economics. I cover the need to derive macroeconomic from macroeconomics, the role of energy in production, and the effect of a government running a budget deficit.

Read More »BBC Business Live interview on 10th anniversary of Northern Rock

It wasn't all that long (or deep!), but here it is for those who'd like to watch it

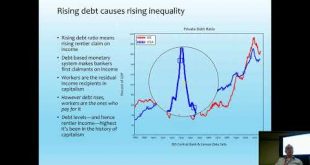

Read More »Why the poor pay for high debt, even if they don’t borrow (in 13 minutes & 15 seconds flat)

This was an invited talk to public servants organized by the Exploring Economics group (https://www.exploring-economics.org/en/). In just over 13 minutes I provide a complex systems argument that the poor pay for debt, even if they didn't personally borrow it, because workers are the residual income recipients in capitalism.

Read More »How Austerity Works: a simple numerical example that any intelligent person can understand

I provide a simple numerical explanation of how austerity works at the micro (individual person, industrial sector, or country) and the macro level (country, or group of countries in a currency union).

Read More »Exploring Economics Lectures 06: A theory of value for a new political economy

This lecture shows that the Labour Theory of Value is incompatible with the Laws of Thermodynamics and is therefore fundamentally false. This Theory is also incompatible with Marx's dialectical philosophy, which is consistent with the Laws of Thermodynamics and with the philosophy of organicism that Winslow argued underlay Keynes's approach to economics. I show that this philosophy can provide a coherent and structured approach to building a realistic new political economy. This is the...

Read More »Exploring Economics Lectures 05: Making economics consistent with thermodynamics

This lecture shows that the Physiocrats were the only school of thought to be consistent with the Laws of Thermodynamics in their model of production, and derives a production function in which energy plays an essential role. This is the fifth of six lectures I recorded that I gave to the Exploring Economics Summer School (https://www.exploring-economics.org/en/summer-academy/details/) held just outside the city of Erfurt in southern Germany (I recorded all but the second lecture).

Read More » Steve Keen’s Debt Watch

Steve Keen’s Debt Watch