As I note in the opening, money and monetary policy shape our lives and politics, but almost everything that is convntionally believed about it, especially by mainstream economists, is wrong. I show how the Federal Reserve Governors & Federal Open Market Committee clearly believe in the "money multiplier" model, which is a logical fallacy. They are trying to manage a system they don't understand.

Read More »Keen 2018 Masters Lecture 01 Thermodynamics And Value Theory

Economic theories of all persuasions have ignored the role of energy in production ever since Adam Smith's Wealth of Nations was published, yet at the same time have attempted to answer the question of where the physical surplus of outputs over inputs (or the increase in utility caused by production) has come from. This lecture gives an overview of the basics of the relationship between energy and useful work, and argues that the economic theory of value has to start from acknowledging the...

Read More »Talk to the Cambridge Society for Economic Pluralism on non-mainstream macroeconomic modelling

Cambridge University is one of many leading universities where economics students get no exposure to non-mainstream approaches to economics in their curriculum. The students have therefore organised their own Society for Economic Pluralism, and they asked me to speak on "Can we avoid another financial crisis?". I also covered alternative approaches to economic modelling to the mainstream DSGE approach, including: applying Neural Networks to Macroeconomics, which one of my best PhD students...

Read More »Becoming and Economist Lecture 7 Mainstream Modeling (01)

This lecture for my first year ("Level 4") students at Kingston covers Neoclassical modeling from its microeconomic beginnings to the evolution of macroeconomics in response to the Great Depression, Hicks's Neoclassical IS-LM general equilibrium model of Depressions versus "normal times", and ultimately the development of Real Business Cycle models. The next lecture covers the development of DSGE models and the crisis in modelling when these models completely failed to anticipate the Great...

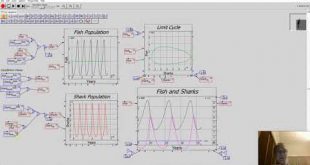

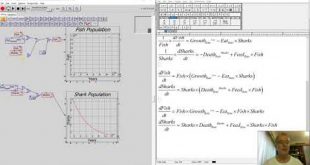

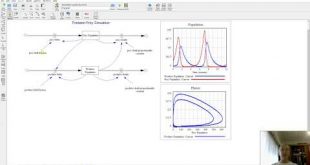

Read More »Minsky 2.0 Introduction (4) Finessing a Predator-Prey Model

I tidy up the predator-prey model developed in the previous video, demonstrate some (overdue!) new features of Minsky such as search and replace, spot a couple of bugs, and make some justifiably disparaging remarks about a recent crop of Neoclassical papers that described critics of DSGE models as "dilettantes".

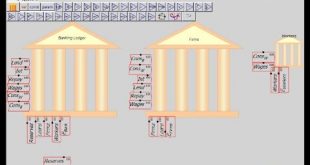

Read More »Minsky 2.0 Introduction (6) A Basic Banking Model

This is the key feature of Minsky in comparison to all other System Dynamics platforms: it is the only one to use double-entry bookkeeping to build models of financial flows. This is an inherently superior paradigm to using flowcharts to model monetary dynamics. I build a basic model which nonetheless shows that models of capitalism without banks, debt and money are useless, and then show just how far Minsky can go in modelling capitalism by showing Pedro Pratas' monetary model of Portugal.

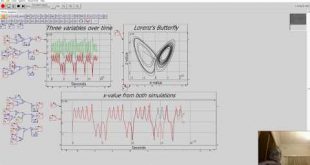

Read More »Minsky 2.0 Introduction (5) Chaotic and Complex System Models

Minsky is excellent for demonstrating the behaviour of complex system models like Lorenz's model of fluid turbulence. It's also perfect for showing how little most economists know about dynamics. I have a go at Professor Reis from the LSE for trying to rescue economic modelling by claiming that weather forecasting 3 to 5 years in advance isn't very good either...

Read More »Minsky 2.0 Introduction (3) Building a Predator-Prey Model

The main strength of system dynamics programs is modelling systems that interact in nonlinear, non-equilibrium ways, and the very first such system discovered was the interaction of predators with prey. This video shows building a simply predator-prey model, and compares the product in Minsky with that in Vensim.

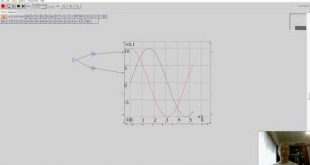

Read More »Minsky 2.0 Introduction (2) Basic Differential Equations

While Minsky is useful for showing simple equations, its real strength is in building models of dynamic processes. The basic dynamic process is population growth, and I build that simple model in this video.

Read More »Minsky 2.0 Introduction (1) Simple Equations And Sin vs Cos

This is the first of six videos to introduce the new version of Minsky, the Open Source System Dynamics modelling tool specifically designed to model capitalism as a monetary, non-equilibrium system. Minsky can in fact be used for any mathematical equation, as I show here with a simple a+b=c equation and a visual demonstration of the interaction of sine and cosine.

Read More » Steve Keen’s Debt Watch

Steve Keen’s Debt Watch