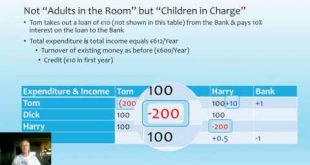

The EU's "Stability and Growth Pact" has as one of its primary rules that “The Member States undertake to abide by the medium-term budgetary objective of positions close to balance or in surplus…” I explore what this objective implies in the context of a model of the economy of "TomDickHaria": what happens to its collective GDP where one member tries to achieve the surplus goal set out in the "Stability and Growth Pact?

Read More »Talk at Rethinking Economics Bologna on post-Neoclassical Economics Teaching & Research

I'm preparing for a post-University role as a campaigner for the reform of economics teaching and research (see https://www.patreon.com/ProfSteveKeen), so the invite to speak on the topic of "The future of Economics teaching and research" at a Rethinking Economics conference in Bologna last week was extremely well timed. Unfortunately the recording at the venue itself stuffed up (no sound), and there wasn't time to give the entire talk since, unexpectedly, the great Luigi Pasinetti agreed to...

Read More »What if my analysis is used for evil purposes?

One of my Patrons posed a very good question to me: in a nutshell, how would I respond to a politician who took my ideas and perverted them for political gain? Here’s Andre’s full query: Hi Steve, thank you, you’ve given me the gift of some of the most important ideas and explanations I’ve come across in my lifetime. I was wondering how you might respond to a politician who misreads your latest book, and then declares: 1. People will love me, because Steve Keen says I can become...

Read More »Can we avoid another financial crisis?

Help me rebuild economics at https://www.patreon.com/ProfSteveKeen Can we avoid another financial crisis? In 2008, conventional economics led us blindfolded into the greatest economic crisis since the Great Depression. Almost a decade later, with the global economy wallowing in low growth that they can’t explain, mainstream economists are reluctantly coming to realise that their models are useless for understanding the real world. How did mainstream economists not see the crisis...

Read More »A Biographical Economic Interview with Peter Kelly of East London Radio

This is an extensive and intense interview with Peter Kelly of East London Radio. We covered all manner of topics in just on an hour. I won't try to detail all the topics here because there were just too many! I hope you find it an interesting conversation. The sound volume may be a but low; if so, just turn it up. The video is just that shot of my Patreon campaign (https://www.patreon.com/ProfSteveKeen), which as of today has 308 Patrons providing me with US$2665 net per month. This is...

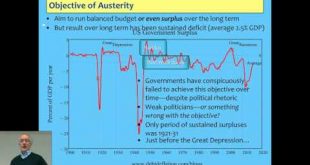

Read More »Kingston Contemporary Issues Lecture 08 Austerity

Mark Blyth describes Austerity as a "dangerous idea", and I give a monetary explanation of why Mark is right. The whole vision of "sound finance" is a recipe for the collapse of capitalism. Rather than "saving for a rainy day", austerity causes economic cyclones. The only two sustained periods of government surpluses in the USA's history preceded its two greatest economic crises, the Great Depression and the Great Recession. These were not coincidences.

Read More »Kingston Contemporary Issues Lecture 7 the Euro Crisis

In 1992, Wynne Godley predicted that the Euro would amplify any future economic downturn into a crisis: "“ If a country or region has no power to devalue, and if it is not the beneficiary of a system of fiscal equalisation, then there is nothing to stop it suffering a process of cumulative and terminal decline leading, in the end, to emigration as the only alternative to poverty or starvation…"

Read More »Kingston Contemporary Issues Lecture 6 Minsky and explaining the Global Financial Crisis

This lecture covers how Hyman Minsky developed his "Financial Instability Hypothesis" to answer the question “Can "It"—a Great Depression—happen again?", by combining insights from Marx, Fisher, Schumpeter, Kalecki, and finally Keynes. I show how his model can be explained simply by working from the macroeconomic definitions of employment, income distribution, and debt. It is, at its heart, the simplest possible complex systems explanation of how a market economy with debt can fall into a...

Read More »Support me on Patreon

Click here to support me on Patreon As I explain in this video, government attempts to turn University entrance into a marketplace have had the unintended side-effect of undermining pluralist economics. The UK government has removed controls on the number of places that Universities can offer in first year courses, and as a result there has been an increase in humanities places offered by highly ranked Universities. Final year high school students have flocked to these...

Read More »The Myth of the Money Multiplier

This is one of the most widely believed models in economics, but it is simply wrong, I show how this false model drove the policy measures by Central Banks during the economic crisis, resulting in huge expenditures being needed to cause relatively trivial stimuli.

Read More » Steve Keen’s Debt Watch

Steve Keen’s Debt Watch