There is a great deal of confusion over National Insurance - what it is, how it works and what it funds. I have attempted to clear up some of the muddle elsewhere. But partly, it stems from the existence of something called the NI Fund. If there is a Fund, surely this implies that National Insurance contributions are invested? If so, those (like me) who insist that state pensions are unfunded are talking gibberish.There is indeed a NI Fund. But it is badly named. It would be more accurate to call it the NI Clearing House. It receives NI contributions from workers and employers, and it disburses payments to pensioners and benefit recipients. As long as NI receipts exceed pension & benefit payments, the Fund runs a surplus. But when pension & benefit payments exceed receipts, the Fund runs a deficit.When a clearing house like the NI Fund runs a surplus over a number of years, it builds up reserves. The NI Fund has significant reserves, mostly built up since the start of this century: But although it has reserves, it is incorrect to regard the NI Fund as any sort of "managed fund". It does not invest NI contributions for a future return. There is no "pot" from which people can draw in retirement.

Topics:

Frances Coppola considers the following as important: benefits, national insurance, pensions, public spending, taxation

This could be interesting, too:

Nick Falvo writes Homelessness among older persons

Frances Coppola writes We need to talk about the state pension

Nick Falvo writes Ten things to know about the 2023-24 Alberta budget

Dan Crawford writes Who gets paid sick days?

There is indeed a NI Fund. But it is badly named. It would be more accurate to call it the NI Clearing House. It receives NI contributions from workers and employers, and it disburses payments to pensioners and benefit recipients. As long as NI receipts exceed pension & benefit payments, the Fund runs a surplus. But when pension & benefit payments exceed receipts, the Fund runs a deficit.

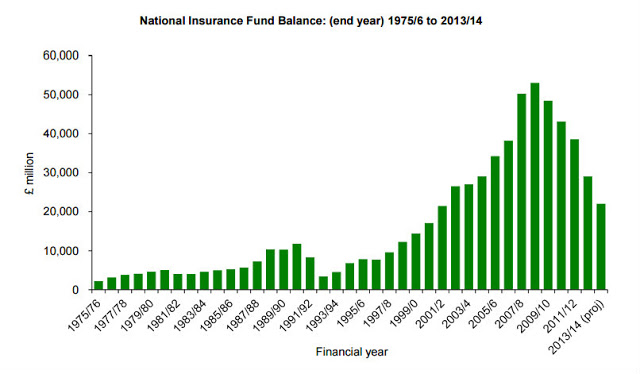

When a clearing house like the NI Fund runs a surplus over a number of years, it builds up reserves. The NI Fund has significant reserves, mostly built up since the start of this century:

But although it has reserves, it is incorrect to regard the NI Fund as any sort of "managed fund". It does not invest NI contributions for a future return. There is no "pot" from which people can draw in retirement. Rather, the NI Fund reserves are a liquidity buffer, not unlike the cash reserves that banks are required to maintain in order to ensure that they can meet their payment obligations.

Payments into the fund vary with the business cycle: in a downturn, payments into the fund fall as unemployment rises. But the Fund must continue to make payments to pensioners and benefit recipients even when its income is falling: indeed, as unemployment rises, payments out of the Fund actually increase, since unemployment benefit is one of the benefits that it funds.

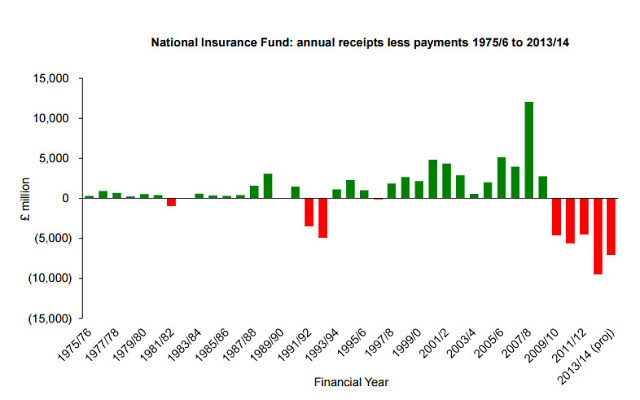

The cyclical nature of the NI Fund balance is clear from this chart:

The three "red zones" are the recessions of 1981-2, 1991-3 and 2009-10.

Clearly, if the NI Fund had no reserves, maintaining payments in a recession would be a problem. Holding liquid reserves is therefore a sensible prudential measure. To ensure that it can always meet its payment obligations, the Fund has a statutory requirement to hold liquid reserves of at least 16.7% of payments. And it holds these reserves in the form of government debt, not because government wants to "borrow" from the Fund, but because government debt is the safest and most liquid form of investment.

Contrary to popular opinion, it does not appear that the increasing demands on the Fund are due to NI-funded working-age benefits (JSA, ESA and maternity benefits). Nor has the Government "raided" the NI Fund surplus to plug fiscal holes elsewhere, as some have alleged. The problem is pension payments. The pensions bill rose by £6bn between 2011/12 and 2012-13. This is partly because although people are living longer, pension ages have not been rising in line with increasing longevity. And as the post-war "baby boomers" retire, there are more claims on the Fund.

But the story is not entirely one of rising payments. On the receipts side, prolonged stagnation of wages puts downwards pressure on the Fund's receipts, while very low interest rates decrease the Fund's investment income: because of the need to invest in safe liquid assets, it cannot diversify to maintain its investment income.

Anyway, whatever the cause, the Fund is in trouble. In 2014/15, the Fund's deficit was sufficiently large to take it uncomfortably close to the statutory minimum reserve level, so the Treasury topped it up with a grant of £4.6bn from general taxation. Further grants will probably be needed in 2015/16 and 2016/17. The Government Actuary expects the Fund to return to surplus in 2017/18, but this forecast is dependent on the UK economy continuing to recover - and on reductions in payments due to planned rises in state pension age for both men and women. Should either of these disappoint, the Fund will continue to need top-ups from general taxation.

This touches on the WASPI issue. In the short-term, the solvency of the NI Fund depends in part on women's pension age reaching 65 by 2018, and the state pension age for both men and women reaching 66 by 2020. Rolling back even the 2011 acceleration of women's state pension age rises, let alone attempting to delay the rises legislated in 1995, would mean the NI Fund would remain in deficit for longer.

Of course, this is a matter of political choice. We could argue that the depressed receipts into the Fund are due to Government cost-cutting measures from 2010 onwards, and had a more expansionary fiscal policy been adopted, the Fund might now be in better shape. But I well remember the 2010 deficit panic. We really did fear we would walk the same path as Greece. For better or worse, we chose a government that promised us austerity. The 2011 Pensions Act, which so many people (including me) think was unfair, was a consequence of our choice.

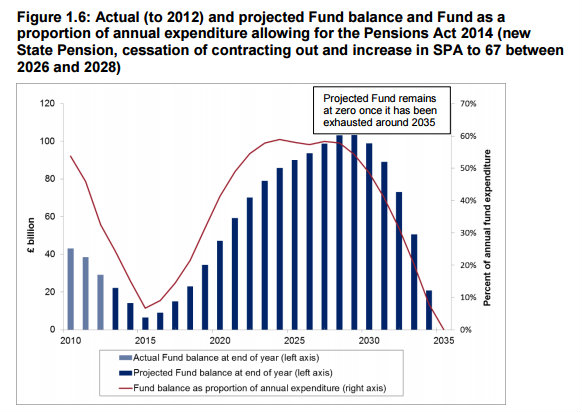

But even with such controversial and upsetting changes to entitlements, the longer-term future of the NI Fund is still insolvency, as this chart from the Government Actuary shows:

By 2035, there will be no NI Fund. Will there still be a State Pension? We do not know. If there is, it will presumably be funded from general taxation.

The National Insurance scheme is already unfit for purpose. By 2035, it will be pointless. We must reform it sooner, rather than later.

Related reading

The foolishness of the old - Pieria

Is funding for the State Pension really about to run out? - This Is Money

First two charts taken from Research Briefing: National Insurance Fund Accounts 1975-2014, (downloadable pdf).

Third chart from Government Actuary's Quinquennial Review of the National Insurance Fund as at April 2010.