In-depth analysis on Credit Writedowns Pro. You are here: Economy » Trends and prospects for private-sector deleveraging in advanced economies This post originally appeared on Vox. By Serkan Arslanalp, Reinout De Bock, Matthew Jones Major advanced economies have made mixed progress in repairing the private sector’s balance sheets. This column explores private sector deleveraging trends and calls for a set of policies that will return debt to safer levels. Monetary policies should support private sector deleveraging and policymakers should not ignore the positive impact of debt restructuring and write-offs on non-performing loans. Major advanced economies have made mixed progress in repairing private balance sheets. US and UK households have sharply reduced gross debt levels as a share of GDP, but gross household debt still remains high in many countries (Figure 1). Leverage among nonfinancial firms has come down from its peak in many advanced economies. But debt levels are still high in the corporate sector in some Eurozone countries, in part because of slow progress on the resolution of impaired assets – a company’s assets that are worth less on the market than as listed on the company’s balance sheet. This is unfortunate in light of a growing body of literature showing that high debt levels are generally associated with low medium-term growth (e.g.

Topics:

Guest Author considers the following as important: Debt, deleveraging, economy, global, private sector debt, sectoral balances, Weekly

This could be interesting, too:

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Dean Baker writes The elites’ big lie on inequality

Lars Pålsson Syll writes Best advice to an aspiring economist — don’t be an economist!

Lars Pålsson Syll writes Weekend read: Keynes’ critique of econometrics is still valid

This post originally appeared on Vox.

By Serkan Arslanalp, Reinout De Bock, Matthew Jones

Major advanced economies have made mixed progress in repairing the private sector’s balance sheets. This column explores private sector deleveraging trends and calls for a set of policies that will return debt to safer levels. Monetary policies should support private sector deleveraging and policymakers should not ignore the positive impact of debt restructuring and write-offs on non-performing loans.

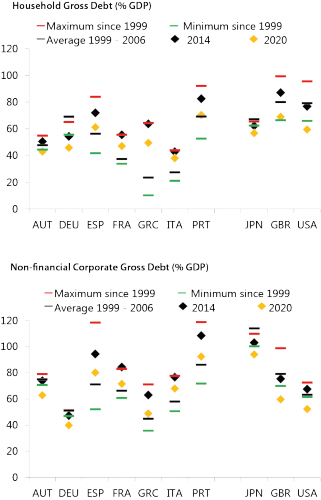

Major advanced economies have made mixed progress in repairing private balance sheets. US and UK households have sharply reduced gross debt levels as a share of GDP, but gross household debt still remains high in many countries (Figure 1). Leverage among nonfinancial firms has come down from its peak in many advanced economies. But debt levels are still high in the corporate sector in some Eurozone countries, in part because of slow progress on the resolution of impaired assets – a company’s assets that are worth less on the market than as listed on the company’s balance sheet. This is unfortunate in light of a growing body of literature showing that high debt levels are generally associated with low medium-term growth (e.g. Bornhorst and Ruiz Arranz 2013). More recently, Rogoff argues that the debt supercycle helps to explain the asymmetric recovery of major economies since 2008 (2015). US corporate leverage is relatively low but companies have increased borrowing in recent years amidst favourable financing conditions.

Figure 1. Range and projections of private sector debt levels1

What factors have contributed to deleveraging?

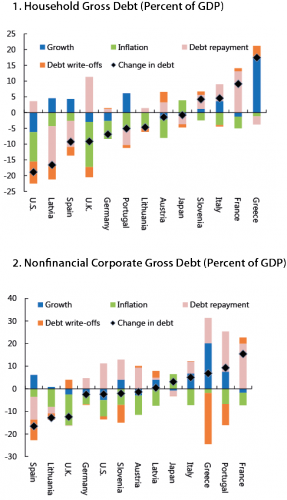

We examine the debt-to-GDP ratio of households and corporates to break down reductions in gross debt ratios into two channels: macroeconomic deleveraging (through real growth and inflation) and balance sheet deleveraging (through debt repayment and write-offs). Countries that have been able to generate higher growth and inflation have been able to minimise the need for balance sheet deleveraging and the associated credit contraction. Write-offs have nevertheless played an important role in tackling high debt burdens where efficient debt resolution mechanisms are in place. An important lesson from the crisis is that addressing weak balance sheets early on can help restart credit flows more rapidly and improve the transmission of both conventional and unconventional monetary policy.

Figure 2. Contributions to deleveraging since 20072

Sources: Bank of Japan, Eurostat; Federal Reserve; and IMF staff estimates.

Note: Debt write-offs reflect “other” changes in debt unexplained by flows and may also capture revaluation of marketable debt.

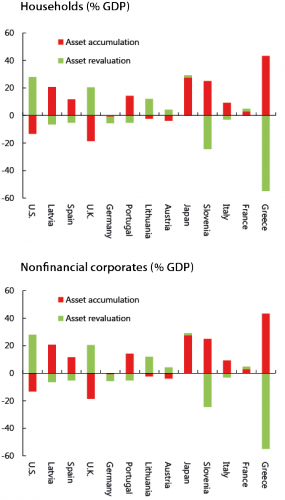

Rising asset prices have also helped to heal balance sheets

Rising bond and equity prices reduce the net financial debt of the private sector, even if gross debt remains unchanged (Figure 3). This is an important policy channel, especially in countries where central bank actions have helped to lower the risk-free rate. This channel has not operated much in many Eurozone countries until recently, but has played an important role in Japan, the UK and the US. Since 2007, the net financial debt of Japanese and UK households and firms has declined by about 10 percentage points of GDP solely as a result of asset price gains, and by 28 percentage points of GDP in the US. In contrast, Eurozone countries such as Greece, France, Portugal, and Spain have not benefited from this channel so far.

Figure 3. Improvement in financial assets since 20073

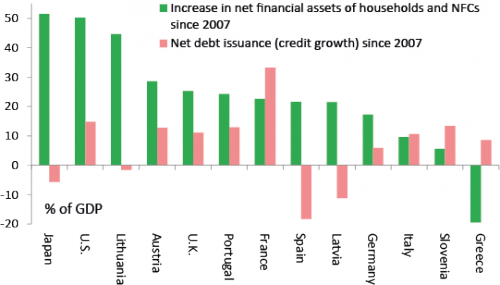

The substantial cross-country variety in the total amount and channels of deleveraging suggest that there are different avenues for countries to reduce debt levels. Nevertheless, countries like Austria, the US or the UK have deleveraged substantially while increasing credit growth (or net debt issuance) in the non-financial private sector since 2007 (Figure 4).

Figure 4. Net Financial Assets of the non-financial private sector since 2007 (% GDP)4

How much more deleveraging could be achieved under current policies?

Projections of debt ratios based on World Economic Outlook data of inflation and growth suggest that nominal growth might not be sufficient to eliminate high debt loads everywhere. Blanchard (2015) warns that there are no magic long-run debt-to-GDP numbers to target but a number of countries that saw sharp increases in debt levels would still remain above their pre-crisis averages (Figure 1). For example, gross non-financial corporate debt in France, Japan, Portugal, and Spain would remain above or near 70% of GDP by 2020 under current World Economic Outlook projections of growth and inflation, higher than their pre-crisis averages and higher than those of other major advanced economies. Similarly, under current World Economic Outlook projections of growth and inflation, gross household debt in Portugal and the UK would remain relatively high by 2020 – although below their pre-crisis historical averages – compared with that of other advanced economies (it is worth adding that we assume no additional debt write-offs in our debt projections).

What more can be done to return debt levels in the private sector to healthy levels?

The IMF warns that declines in potential growth pose downside risks to global growth (2015b). Against this backdrop, the IMF also calls for a complete set of policies to return debt to safer levels (2015a).

- First, monetary policies (including QE) should help support private sector deleveraging by boosting asset prices and generating wealth effects;

However, the positive impact of such policies could wane if potential growth remains low. In such cases, countries need to boost their longer run growth potential through comprehensive reforms.

- Second, debt restructuring and write-offs of non-performing loans can improve the financial and economic transmission of monetary policy by unclogging the monetary transmission mechanism and restarting the flow of credit.

Having efficient debt restructuring mechanisms in place is an essential element of a smooth deleveraging process.

Disclaimer: The views expressed here are those of the authors and do not necessarily represent those of the institutions with which they are affiliated.

References

Bornhorst, F, and M Ruiz Arranz (2013), “The perils of private-sector deleveraging in the Eurozone”, VoxEU.org, 10 November.

Blanchard, O (2015), “Rethinking macroeconomic policy: Introduction”, VoxEU.org, 20 April.

Buttiglione, L, P Lane, L Reichlin, and V Reinhart (2014), Deleveraging, What Deleveraging? The 16th Geneva Report on the World Economy, VoxEU.org eBook, CEPR, 29 September.

Dalio, R (2012), “An In-Depth Look at Deleveraging?”, Bridgewater.

Hüttl, P, and G Wolff (2014), “What is Behind the Reduction of Private Sector Debt? Comparing Spain and the U.K.”, Bruegel.

IMF (2015a), Enhancing Policy Traction and Reducing Risks, Global Financial Stability Report.

IMF (2015b), Uneven growth: Short and Long-term Factors, World Economic Outlook.

Rogoff, K (2015), “Debt supercycle, not secular stagnation”, VoxEU.org, 22 April.

Footnotes

1 Expected deleveraging estimates are based on latest WEO projections of growth and inflation (see Table 1.1 and Table 1.2 in IMF 2015a for more details on calculations). AUT = Austria; DEU = Germany; ESP = Spain; FRA = France; GBR = United Kingdom; GRC = Greece; ITA = Italy; JPN = Japan; PRT = Portugal; USA = United States. Sources: Bank of Japan, Eurostat; Federal Reserve; and IMF staff estimates.

2 Debt write-offs reflect ‘other’ changes in debt unexplained by flows and may also capture revaluation of marketable deb (see Table 1.1 and Table 1.2 in IMF 2015a for more details on calculations). Sources: Bank of Japan, Eurostat; Federal Reserve; and IMF staff estimates.

3 Financial assets from flows of funds and consolidated debt statistics. Sources: Bank of Japan flow of funds; Eurostat financial accounts and consolidated debt statistics; Federal Reserve flow of funds; and IMF staff estimates.

4 Net financial assets are defined as financial assets (such as cash and deposits, securities, equity and mutual fund shares) minus financial debt. The chart sums households and non-financial corporates (see Table 1.1 and Table 1.2 in IMF 2015a for more details on calculations). Sources: Bank of Japan flow of funds; Eurostat financial accounts and consolidated debt statistics; Federal Reserve flow of funds; and IMF staff estimates.