Here are three things I think I am thinking about. 1) Shorting is Hard. Shorting Bubbles is Really Hard. I was thinking about the collapse in commodity prices in recent years and reviewing some of my past views. I have been highly critical of the commodity boom in recent decades arguing that the financialization of commodity products had created a false demand for these assets as Wall Street increasingly sold commodities as a part of asset allocation plans to the general public. I even called commodities a bubble back in 2011. I was even more explicit about silver. I actually shorted silver at about and rode it up to before it totally collapsed a few weeks later. I made no money on the trade. It wasn’t the first time I’d almost perfectly timed a bubble and made no money on it. In my book I discuss my experience shorting the Hang Seng bubble back in 2007. These experiences remind me how difficult the markets can be. You can have the thesis completely right and still end up being wrong. I’d argue this is even more difficult shorting markets because asset prices tend to rise over the long-term for fundamental reasons. Shorting is like trying to swim against the flow of a river. It’s not impossible, but you’re fighting an uphill battle. Swimming is a lot easier when you just swim with the flow of the river.

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Here are three things I think I am thinking about.

1) Shorting is Hard. Shorting Bubbles is Really Hard.

I was thinking about the collapse in commodity prices in recent years and reviewing some of my past views. I have been highly critical of the commodity boom in recent decades arguing that the financialization of commodity products had created a false demand for these assets as Wall Street increasingly sold commodities as a part of asset allocation plans to the general public. I even called commodities a bubble back in 2011.

I was even more explicit about silver. I actually shorted silver at about $40 and rode it up to $50 before it totally collapsed a few weeks later. I made no money on the trade. It wasn’t the first time I’d almost perfectly timed a bubble and made no money on it. In my book I discuss my experience shorting the Hang Seng bubble back in 2007.

These experiences remind me how difficult the markets can be. You can have the thesis completely right and still end up being wrong. I’d argue this is even more difficult shorting markets because asset prices tend to rise over the long-term for fundamental reasons. Shorting is like trying to swim against the flow of a river. It’s not impossible, but you’re fighting an uphill battle. Swimming is a lot easier when you just swim with the flow of the river. Heck, you might even have enough time to crack a few beers along the way. Good luck doing that when you’re busy paddling against the current.

2) We Already Have “People’s QE”. There has been a lot of chatter in recent weeks about “People’s QE”. This is a policy being pushed by several economists in the UK arguing that QE should be implemented in such a way that promotes public infrastructure and investment. Richard Murphy, who popularized the policy explains it as such:

“GIQE always starts with debt. It may be debt issued by local authorities, or NHS trusts to replace PFI, or the Green Investment Bank, or whoever, but all will be within the state sector. Never once will there be GIQE without debt, or it would not be QE.

And that debt would, because of the requirements of the EU Lisbon Treaty, be issued to private sector banks in the first instance: that is what the law requires.

However, under a GIQE programme government would require that the Bank of England (BoE) make funding available to purchase such debt almost immediately after its issue to private banks.”

He goes on to argue that the bonds being purchased could simply be retired which would result in no increase in public debt.

All of this sounds too good to be true. Because it is. In fact, it seems to defy the laws of basic accounting. Banks create money by creating new liabilities. You cannot expand the asset side of the balance sheet without also expanding the liability side of the balance sheet. So, if this new Green Investment Bank creates bonds or buys other bonds it is expanding its balance sheet in the process. Creating a new entity in the mix doesn’t change the accounting behind how QE works. It just changes the labels on who owns the various assets/liabilities. But since the GIB is still going to be a government entity its existence is no different from standard QE where one psuedo govt entity (the Central Bank) buys the debt. It all just results in various asset swaps that do not expand the equity of the private sector.

The more confusing thing with this proposal is that we already have QE for the people. It’s called deficit spending. When the government deficit spends it adds to the private sector’s net worth because deficit spending involves the creation of a private sector asset and a public sector liability. This new bond is created from thin air and adds to private sector financial net worth. If the Central Bank buys the bond then great. Creating new entities and changing the ownership labels doesn’t change the laws of accounting.

Unless I am misunderstanding something in the proposal it seems like there is a lot of confusion over basic accounting principles here….

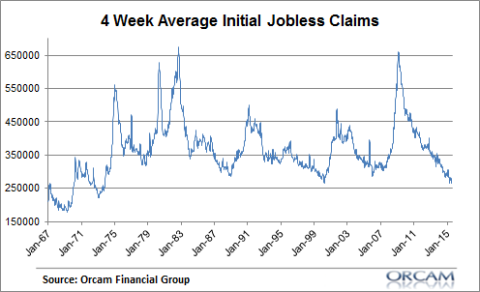

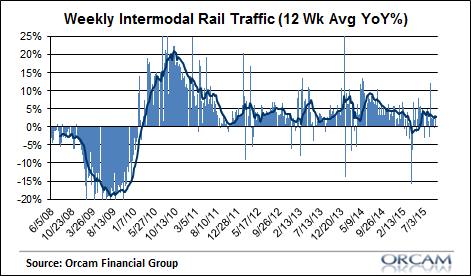

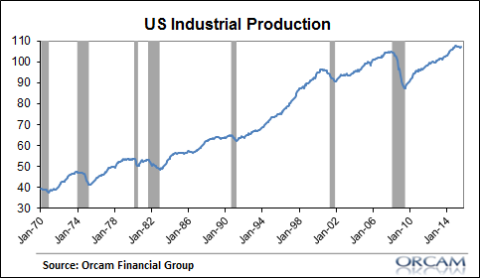

3) The China Effect? What China Effect? The macro data still doesn’t seem to be reflecting the media’s big concerns about China and Greece. Despite an endless onslaught of media driven fear over these international events the data seems to be chugging along at the same pace. Here are three indicators that show there hasn’t been much of an impact:

- Jobless claims – still near all-time lows.

- Rail traffic is still chugging along with a 12 week moving average of 2.6%.

- This morning’s industrial production report was just shy of its all-time high readings: