Here are some things I think I am thinking about recently: 1) What a boring year! The Global Financial Asset Portfolio is down about 1.2% year to date. This might come as a shock to people who are glued to financial TV all day and think of the “market” as the stock market. Yes, some stock markets are down quite a bit, but the aggregate “markets” really haven’t budged much. And this goes to show how damaging it can be to constantly be obsessing over the daily moves of your investments. More importantly, it shows how crucial it is to remain diversified and to avoid paying too much attention to the media’s infatuation with every minute by minute move in the stock market. Stocks are an important, but relatively minor slice of an aggregate portfolio. Odds are, if the stock market’s daily moves are driving you mad, you have misinterpreted your personal risk profile and might need a change…. 2) The S&P 500 has value because of people like Donald Trump. I notice a lot of Donald Trump wealth bashing in the media. This story usually goes something like this – “Donald Trump isn’t nearly as wealthy as he claims” or “Donald Trump is only rich because his daddy was rich”. These statements might be true to some degree. But there’s a good bit of hyperbole going on here.

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Here are some things I think I am thinking about recently:

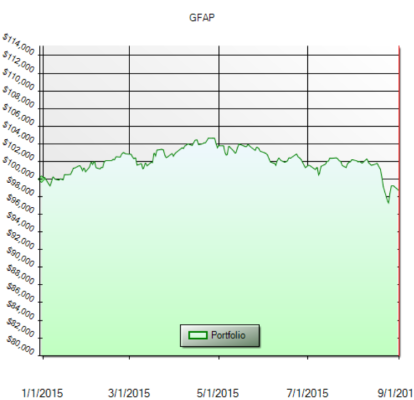

1) What a boring year! The Global Financial Asset Portfolio is down about 1.2% year to date. This might come as a shock to people who are glued to financial TV all day and think of the “market” as the stock market. Yes, some stock markets are down quite a bit, but the aggregate “markets” really haven’t budged much. And this goes to show how damaging it can be to constantly be obsessing over the daily moves of your investments.

More importantly, it shows how crucial it is to remain diversified and to avoid paying too much attention to the media’s infatuation with every minute by minute move in the stock market. Stocks are an important, but relatively minor slice of an aggregate portfolio. Odds are, if the stock market’s daily moves are driving you mad, you have misinterpreted your personal risk profile and might need a change….

2) The S&P 500 has value because of people like Donald Trump. I notice a lot of Donald Trump wealth bashing in the media. This story usually goes something like this – “Donald Trump isn’t nearly as wealthy as he claims” or “Donald Trump is only rich because his daddy was rich”. These statements might be true to some degree. But there’s a good bit of hyperbole going on here. For instance, take this piece in VOX today claiming that Trump would have been better off if he’d just invested his inheritance in an index fund. The author writes:

“Trump is one of five siblings, making his stake at that time worth about $40 million. If someone were to invest $40 million in a S&P 500 index in August 1974, reinvest all dividends, not cash out and have to pay capital gains, and pay nothing in investment fees, he’d wind up with about $3.4 billion come August 2015″

This is unreasonable on so many levels. First, Trump probably didn’t inherit a lump sum of cash. He probably inherited part of the family business, real estate and many other assets valued at $40 million. Second, NO ONE just invests their whole net worth in a zero fee, zero tax, zero withdrawal all stock portfolio and let’s it ride. So, the assumptions here are totally unfair and reflect nothing more than a fiction. But let’s go further and apply something somewhat realistic.

Let’s assume Trump had decided to be a “fat loser” (his words, not mine) and just let his daddy’s inheritance ride in the S&P while spending a small portion of his net worth each year. For instance, if he’d withdrawn 5% of his portfolio per year so he could do nothing all day every day he’d have compounded his S&P 500 portfolio into about $400,000,000 as of August 2015. Not bad, but well below the misleading billions that many assume. And keep in mind that’s before taxes and fees. He’d likely have less than half that if he’d been paying taxes and fees every year.

The more important point is that Trump inherited a lot of money and DID SOMETHING with it. He didn’t just turn into a slacker like a lot of people do when they inherit money. He took a successful company and built it into something bigger and better. And that very production is why index funds have any value in the first place. The S&P 500 doesn’t just rise because some slacker waves a magic wand at higher prices. It rises over time because people like Donald Trump work their butts off to make companies more valuable.

I find myself in a weird position here because I think Trump has said a lot of awful things about people recently. So, there’s no denying he’s been rude to a lot of people and could benefit from a bit more humility. But people who try to make Trump out to be some rich lazy slacker are barking up the wrong tree.

3) Stop the currency hedging madness! Vanguard has a wonderful piece of research out on currency hedging (see here). Their conclusion – it’s just more fees cloaked in complexity. They conclude:

For us, hedging equity exposure isn’t worth the added costs in those strategies that still have considerably less than half their assets in international equities and that have broader investment objectives than controlling volatility.

This makes a lot of sense to me. If you’re using a passive long-term vehicle like an index fund then why would you layer on a short-term zero sum trading vehicle on top of it? This is a total contradiction of strategies! Low fee indexing and currency hedging are not synonymous. After all, when you hedge currencies you are essentially timing a zero sum relative market. Over long periods of time we should expect that currencies will generate a negative real, real return because they are zero sum relative markets. It makes no sense to layer on a currency hedge if you’re adhering to a low fee indexing strategy.

I’ve noticed a lot of these currency hedging products coming on the market lately. They’re very likely just high fee versions of index funds that come with a slick marketing campaign and little more.