Share the post "3 Big Flaws in “The Market” Portfolio"I get a lot of emails about the Global Financial Asset Portfolio, which is the only true “passive index” of the world’s outstanding financial assets (you can see a basic depiction of it here using 4 Vanguard funds). This is a fine portfolio, but I always like to emphasize that the thing I find most interesting about the GFAP is its flaws. As it turns out, “the market” portfolio isn’t necessarily the ideal portfolio which is a pretty interesting finding for anyone who’s an indexing purist or an Efficient Market junky (this is a sickness you should have treated immediately).In this two part piece from 2014 I went into some detail on this, but I want to emphasize this again due to the overwhelming number of people who seem to think that I believe this is the ideal portfolio when in fact I think it has its own flaws (though, in fairness, you could do a lot worse than this low fee diversified global allocation!). Here were the three big flaws I highlighted:1 – A True GFAP is Impossible to Replicate Perfectly. The biggest problem with the GFAP is that there’s a good bit of guesswork that goes into its construction.

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Share the post "3 Big Flaws in “The Market” Portfolio"

I get a lot of emails about the Global Financial Asset Portfolio, which is the only true “passive index” of the world’s outstanding financial assets (you can see a basic depiction of it here using 4 Vanguard funds). This is a fine portfolio, but I always like to emphasize that the thing I find most interesting about the GFAP is its flaws. As it turns out, “the market” portfolio isn’t necessarily the ideal portfolio which is a pretty interesting finding for anyone who’s an indexing purist or an Efficient Market junky (this is a sickness you should have treated immediately).

In this two part piece from 2014 I went into some detail on this, but I want to emphasize this again due to the overwhelming number of people who seem to think that I believe this is the ideal portfolio when in fact I think it has its own flaws (though, in fairness, you could do a lot worse than this low fee diversified global allocation!). Here were the three big flaws I highlighted:

1 – A True GFAP is Impossible to Replicate Perfectly. The biggest problem with the GFAP is that there’s a good bit of guesswork that goes into its construction. When I broke down the original Global Multi-Asset Market Index from the well known Doeswijk 2014 paper, I altered the portfolio a bit because it would be nearly impossible for the average investor to simply reconstruct such a complex portfolio. Items like private equity make this portfolio nearly impossible to replicate in an accurate manner so there’s some guesswork that goes into it in the first place. I used stocks and bonds for simplicity and that results in some approximation in terms of recreating the actual allocation.

A further problem in this framework is the after tax impact of the portfolios in different countries which was outlined nicely by a recent commenter in the forum. The GFAP is a very complex portfolio and probably too complex for anyone to realistically reconstruct in a manner that would fully reflect its many components and investor specific differences.

2 – The GFAP is an Ex-Post Snapshot. The GFAP is a market cap weighted portfolio which means that you’ll initiate the portfolio, but it will have to be recalibrated over time due to new issues and other factors including readjustment for point 1. If we purchase the current weighting of US stocks in our GFAP we’ll have to update it every year to account for new issues since most index funds don’t adjust automatically for new IPOs and issues. This won’t result in huge intra-year swings, but in the long-term it could results in big changes to the portfolio which means you actually end up having to be more active than is ideal in an indexing strategy whose whole goal is to reflect the market and nothing more.

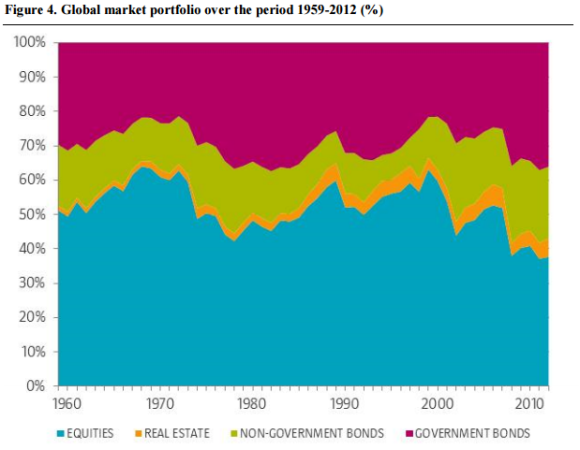

3 – The GFAP is Often Wrong at Crucial Points in the Market Cycle. This is the biggest flaw in the GFAP. One of the key reasons that I am a huge advocate of Counteryclical Indexing™ is because the GFAP is just flat out wrong at many crucial turning points. Because it’s a market cap weighted portfolio you often end up being overweight the riskiest assets at the riskiest times. Here’s the rough historical weighting from the Doeswijk paper:

So, for instance, starting in 1970 you would have been about 60% stocks and 40%, but the most interesting aspect there is that you would have generated much better risk adjusted returns had you done the exact opposite weighting over the next 45 years. Further, you’ll notice that this portfolio also leaves you overweight stocks in periods like 1999, 2007 and then underweight stocks coming out of the financial crisis. This is due to the fact that the market cap weighting of stocks is shrinking relative to bonds during these big equity market swings thereby leaving you taking more risk late in a market cycle (when you should be taking less risk) and taking less equity risk early in a cycle (when you should be taking more equity risk). Following “the market” portfolio leaves you blindly following the market and taking inappropriate equity risk at the most inopportune times when in fact you should be weighting AGAINST the market’s current allocation.

Anyhow, that’s a short summary of my general view of the GFAP. As I said before, you could do much worse than this portfolio of low fee globally diversified funds, but that doesn’t mean it’s an idea approach to asset allocation.

Share the post "3 Big Flaws in “The Market” Portfolio"