Share the post "The Biggest Risk of a Clinton Presidency"Hillary Clinton will be a one term President. The reason I say this is because I suspect that her economic plan will not be very stimulative and I think that four more years of weak economic growth will be intolerable. And the main driver of my thinking here is deeply rooted in Bill Clinton’s presidency.Back in the late 90’s the US government ran a brief budget surplus. It was heralded as an act of “fiscal responsibility” at the time. Of course, when the economy tanked immediately following the surplus the government was driven back in the red as tax receipts cratered and automatic spending jumped.So, was the surplus, followed so closely by a sharp recession, just a coincidence? I suspect not. As Wynne Godley outlined back in the late 1990s, the fiscal position was never all that sustainable because, as a current account deficit country the flows were unsustainable. As I outlined in my popular paper, Understanding the Modern Monetary System, some sector of the economy has to be expanding its balance sheet in order for the economy to grow. If the private sector isn’t expanding its balance sheet (usually through borrowing) then the economy needs to make up for this drag via a government expansion in the deficit OR an expansion from the foreign sector.

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Share the post "The Biggest Risk of a Clinton Presidency"

Hillary Clinton will be a one term President. The reason I say this is because I suspect that her economic plan will not be very stimulative and I think that four more years of weak economic growth will be intolerable. And the main driver of my thinking here is deeply rooted in Bill Clinton’s presidency.

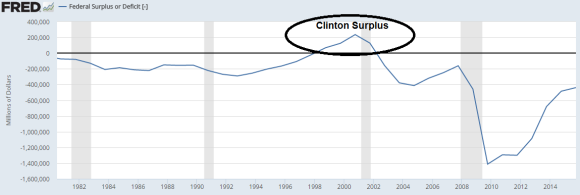

Back in the late 90’s the US government ran a brief budget surplus. It was heralded as an act of “fiscal responsibility” at the time. Of course, when the economy tanked immediately following the surplus the government was driven back in the red as tax receipts cratered and automatic spending jumped.

So, was the surplus, followed so closely by a sharp recession, just a coincidence? I suspect not. As Wynne Godley outlined back in the late 1990s, the fiscal position was never all that sustainable because, as a current account deficit country the flows were unsustainable. As I outlined in my popular paper, Understanding the Modern Monetary System, some sector of the economy has to be expanding its balance sheet in order for the economy to grow. If the private sector isn’t expanding its balance sheet (usually through borrowing) then the economy needs to make up for this drag via a government expansion in the deficit OR an expansion from the foreign sector. Since the foreign sector was a negative drag in the 90’s the US economy relied heavily on private borrowing for expansion. The federal budget surplus made this borrowing even more important as the surplus acted as another spending drag on the aggregate economy. And when the tech bubble burst the corporate borrowing binge collapsed and the economy and financial markets collapsed with it. It didn’t stabilize again until the government position moved back into deficit and private borrowing stabilized.

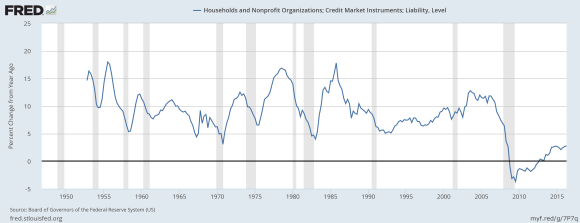

The current environment is worrisome because we’re still climbing out of a very deep economic hole. The foreign sector is still acting as a drag on growth and the deficit has declined sharply as the private sector has recovered. But the private sector is still weak. In fact, household debt growth is still at levels consistent with past recessionary periods:

With private balance sheets still on the mend and inflation remaining extremely low the private markets are essentially begging the government to expand its supply of safe financial assets via a larger deficit. I’ve been explaining this matter for 8 years consistently saying that monetary policy was not enough and that concerns over the government’s debts were unfounded. It’s something I wish I had been wrong about, but here we are with a weak economy because the unwarranted fears and myths about monetary policy dominated public policy decision.

The thinking here is simple – with more safe financial assets private sector balance sheets can further improve and government spending can bolster the confidence of a still fragile private sector. An expansion in the deficit would help offset weak private sector borrowing and the negative drag from the foreign sector. But Hillary Clinton’s economic plans could unravel the recovery as her dreams of the glory days of the 90’s and the Clinton budget surplus risk reducing aggregate economic spending and drive an already weak economy into an even weaker spot.

Unsurprisingly, Clinton’s fiscal prudence is being heralded as a big positive. It’s as if we’ve learned nothing from the last 8 years as we’re still worried about the government’s debt and the risk it poses to the solvency of the USA and the economy. And as I’ve long described, this is all wrong. The way most people think about government debt and deficits is incomplete if not completely wrong. And we now know, for a fact, that it was wrong 8 years ago when Republicans were worried that high debt would cause hyperinflation, higher interest rates and a crashing dollar. And it’s wrong today for Democrats to applaud the fiscal responsibility that Clinton is proposing. That “fiscal responsibility” might in fact turn out to be highly irresponsible as it could suffocate growth and risks actually driving government debt higher as growth remains weak and the risk of recession poses the threat of another huge automatic increase in the deficit thanks to a potential decline in tax receipts and increase in automatic spending.

It looks as if Hillary Clinton will be our next President. But if she passes her fiscal plan I suspect she won’t be President for long.

Share the post "The Biggest Risk of a Clinton Presidency"