Share the post "“There are no Good Gold Analysts”" Joe Weisenthal recently asked for a recommendation for a good gold analyst to interview on Bloomberg. I said: @TheStalwart There are no good gold analysts. — Cullen Roche (@cullenroche) April 21, 2016 I was sort of kidding, but let me explain. Gold is one of the most interesting assets because it is viewed by many people and even central banks as a form of “money”. As a result of this it tends to have a uniquely special place in the financial system since it is viewed not only as a medium of exchange, but insurance in the case of fiat money collapse. And this doesn’t even touch on gold’s properties as a useful commodity. So, what’s interesting about all of this is that gold’s price has earned a huge premium over the CRB Commodity Index in the last 40 years: I have referred to this price premium as a “faith put” due to the belief that gold is a form of money and insurance. But to be honest, I really don’t have a good explanation for this premium other than that. There have been other good attempts to explain gold’s pricing (Barsky and Summers on the Gibson Paradox is very good, for example), but I can’t say that I find many of them to be all that convincing.¹ Based on my knowledge of the monetary system and the capital markets I tend to agree with Warren Buffett here.

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Joe Weisenthal recently asked for a recommendation for a good gold analyst to interview on Bloomberg. I said:

@TheStalwart There are no good gold analysts.

— Cullen Roche (@cullenroche) April 21, 2016

I was sort of kidding, but let me explain.

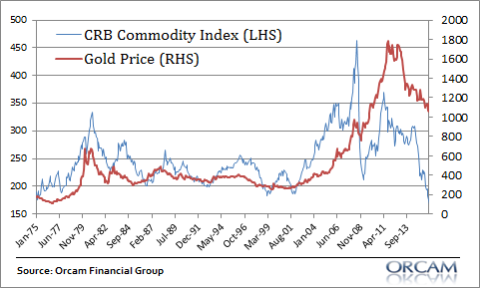

Gold is one of the most interesting assets because it is viewed by many people and even central banks as a form of “money”. As a result of this it tends to have a uniquely special place in the financial system since it is viewed not only as a medium of exchange, but insurance in the case of fiat money collapse. And this doesn’t even touch on gold’s properties as a useful commodity. So, what’s interesting about all of this is that gold’s price has earned a huge premium over the CRB Commodity Index in the last 40 years:

I have referred to this price premium as a “faith put” due to the belief that gold is a form of money and insurance. But to be honest, I really don’t have a good explanation for this premium other than that. There have been other good attempts to explain gold’s pricing (Barsky and Summers on the Gibson Paradox is very good, for example), but I can’t say that I find many of them to be all that convincing.¹

Based on my knowledge of the monetary system and the capital markets I tend to agree with Warren Buffett here.² In essence, gold is a cost input in the capital structure and does not, in and of itself, generate anything productive. This means it is little more than another commodity and should not earn much of a premium in the long-term outside of its productive use. Further, I have argued that while gold is money, it is not a very good form of money since it is such an inconvenient medium of exchange. And I would further add, in addition to being an inferior inflation hedge versus stocks, gold doesn’t serve as a very reliable fiat currency hedge since, if the fiat currency system goes away you’ll wish you’d invested in lead and not gold.

Of course, my opinions are just one among many and the obvious consensus is that many many people believe gold is a valuable asset above and beyond its use as a commodity. So, either I am the very worst gold analyst or I am the very best gold analyst who’s just very early to the trade.³

¹ – See, Gibsons’s Paradox and the Gold Standard

² – See Warren Buffet in Fortune, Why Stocks Beat Gold and Bonds

³ – Remember, there are no good gold analysts, especially not me.

Related reading:

Did you have a comment or question about this post, finance, economics or your love life? Feel free to use the discussion forum here to continue the discussion.*

*We take no responsibility for bad relationship advice.